Investors have a message for League leader Matteo Salvini: It’s time to make a decision, for better or worse.

BTPs sold off on Friday after one League official told reporters that Salvini – or “the Captain” as he’s known to his followers – had requested a meeting with Italian President Sergio Mattarella, a sign that the Deputy PM might finally be moving to withdraw from Italy’s ruling coalition and request new elections, only for another official to deny it.

Then Salvini himself affirmed that he’s still undecided about whether to call for new elections, as the League’s relationship with its coalition partner, the Five Star Movement, grow increasingly fraught.

Investors, and the Italian people, aren’t the only ones growing frustrated with Salvini’s indecisiveness. His closest aides are reportedly pushing him to make a decision about whether the League will withdraw from the ruling coalition, with one official saying on Friday that it’s becoming increasingly difficult to govern alongside the left-wing Five Star Movement.

Many senior officials would like to see Salvini kill the coalition and call for new elections, believing that – particularly after the League’s strong showing in the EU Parliamentary elections back in May – the League would be able to consolidate power and rule without a coalition partner, which would grant Salvini total control over increasingly fraught budget negotiations with Europe.

But for whatever reason, Salvini has been reluctant to stick the knife in the back of Luigi Di Maio, the leader of the Five Star Movement and Salvini’s fellow Deputy PM. On Friday, he insisted that it wasn’t Di Maio, but other senior M5S lawmakers, who have been sabotaging the government’s work.

But time is quickly running out. If Salvini chooses to pull out of the coalition now, new elections could be held by September, which would allow the League to assume total control over negotiations with the EU over what’s expected to be a contentious battle over Italy’s 2020 budget.

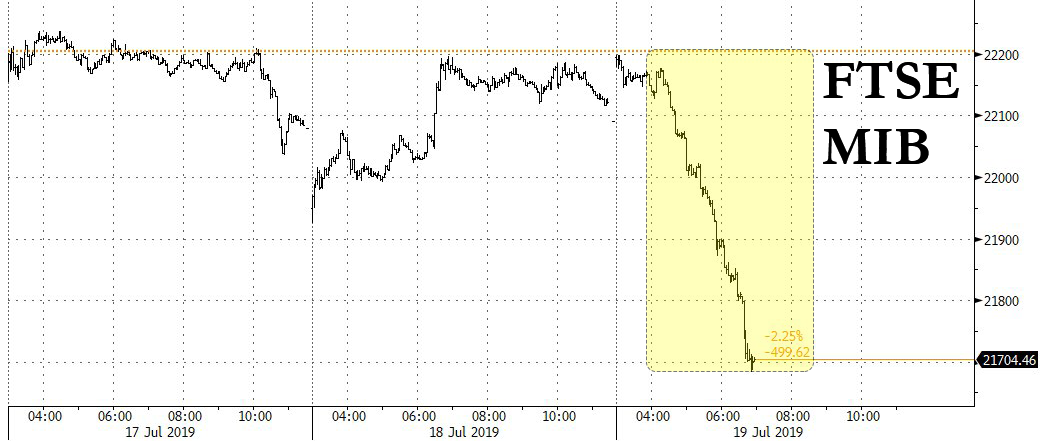

Investors are clearly dissatisfied with the uncertainty: the FTSE MIB slumped 1% intraday on Friday, the largest slump since June 3. Italian stocks dragged down the broader European market, causing the European Stoxx 600 to erase its prior gains intraday.

BTPs – Italian government bonds – also sold off, led by the 10-year, which saw yields climb four basis points to 1.6%, widening the spread with the 10-year German bund to 191 basis points, back toward the all-important 200 bp level.

The message is clear:

via ZeroHedge News https://ift.tt/30ITdOZ Tyler Durden