Authored by Mike Shedlock via MishTalk,

The widely discussed “everything bubble” is, in reality, a corporate junk bond bubble on steroids sponsored by the Fed…

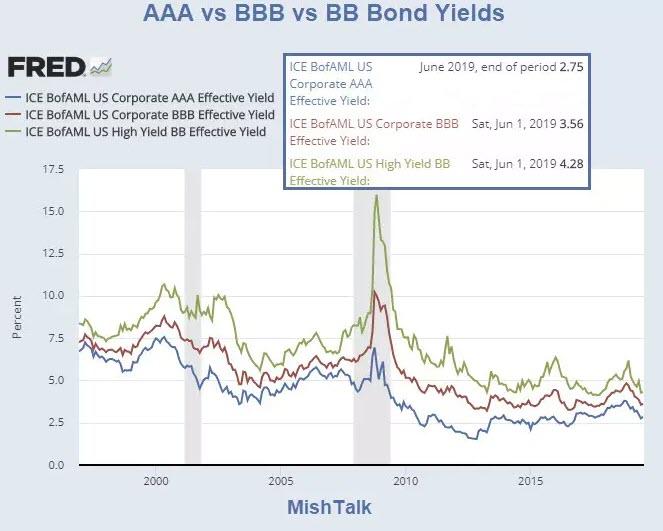

The highest grade AAA corporate bonds yield 2.75%. BBB-rated corporate bonds, just one step above junk, 3.5%. BB-rated bonds yield just 4.28%.

Corporate Bond Spreads

The spread between Prime AAA bonds and lower-medium grade bonds (see chart below) is just 0.77 percentage points.

The spread between BBB lower-medium grade bonds and non-investment grade, speculative BB-rated bonds is just 0.69 percentage points.

The spread between BBB and BB-rated bonds hit six percentage points in the great recession.

Bond Rating Steps

Chart from Wikipedia’s Bond Credit Ratings.

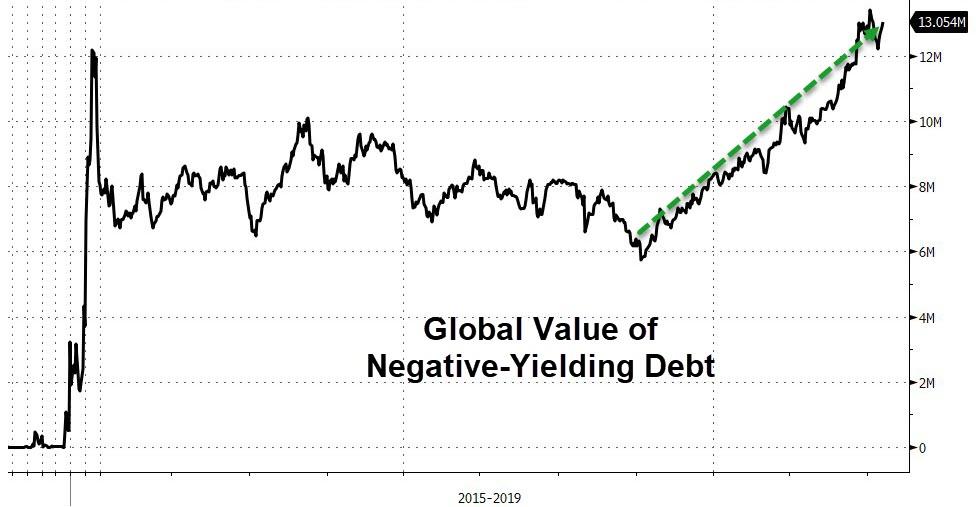

Volume of Negative-Yielding Debt Rises Sharply

In the real world, yields would never be negative. In the Central Banks’ bubble-blowing world, the Volume of Negative-Yielding Debt Rises Sharply.

-

From a low last October of just under USD 6 trillions the value of the Bloomberg Barclays Global Aggregate Negative-Yielding Debt Index has more than doubled, increasing in value by over USD 7 trillions over the last 8 months to establish an all-time record of USD 13.2 trillions earlier in late June.

-

The current situation is a manifestation of the inability of global financial markets to emerge from the era of ultra-low bond yields that central banks engineered in the wake of the global financial crisis.

-

Non-conventional policies pursued by central banks in recent years have lead neither to a rise in sluggish rates of economic growth nor to an end in the disinflationary trends within the global economy.

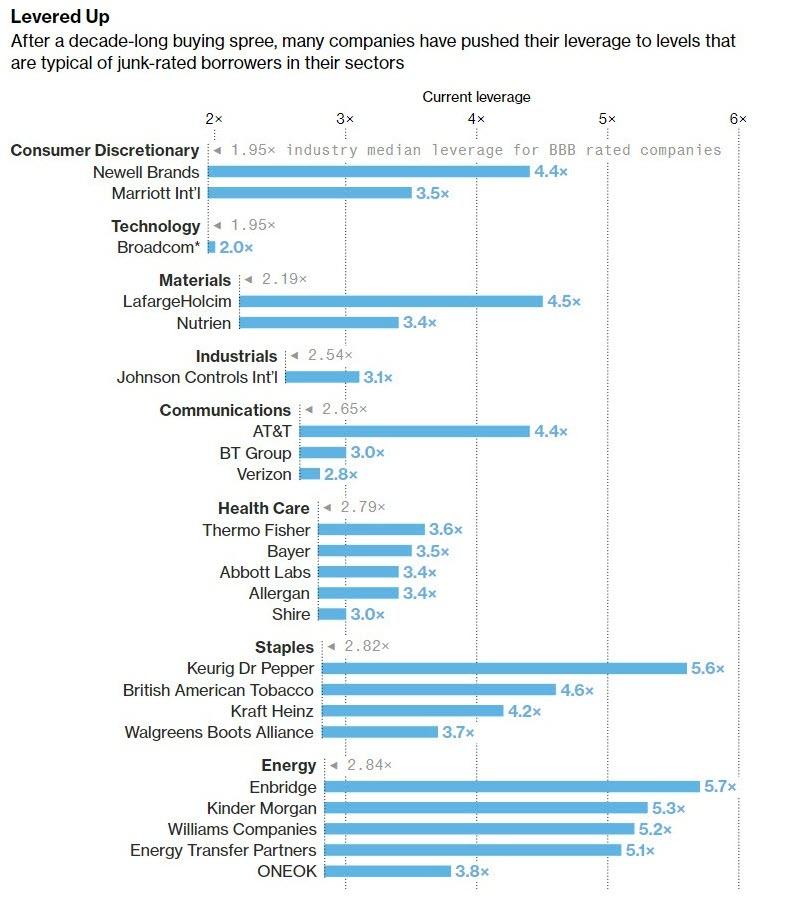

Leverage on the Rise

Also, please note a $1 Trillion Powder Keg Threatens the Corporate Bond Market

Levered Up

-

After a decade-long buying spree, many companies have pushed their leverage to levels that are typical of junk-rated borrowers in their sectors.

-

Bloomberg News delved into 50 of the biggest corporate acquisitions over the last five years, and found more than half of the acquiring companies pushed their leverage to levels typical of junk-rated peers. But those companies, which have almost $1 trillion of debt, have been allowed to maintain investment-grade ratings by Moody’s Investors Service and S&P Global Ratings.

-

This M&A-fueled leveraging of corporate balance sheets contributed to a surge in debt rated in the bottom investment-grade tier and now represents almost half of the outstanding market, Bloomberg Barclays index data show.

The above article and chart is from October 11, 2018. The leverage (and bubble) is bigger today.

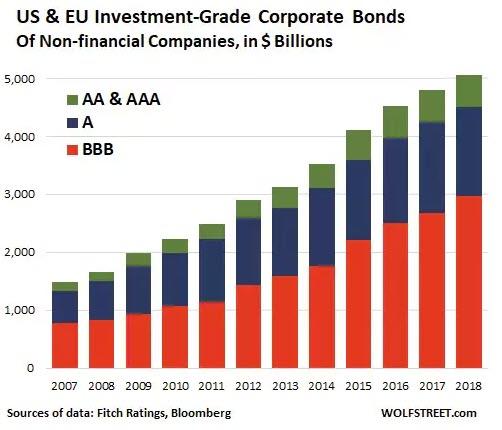

BBB-Share Keeps Expanding

Wolf Richter explains What Happens When BBB-Rated Companies Try to Dodge a Downgrade to “Junk”.

In the next downturn, many bonds in the BBB-category will transition to junk, and many junk bonds but also some investment-grade bonds – if the past is any guide – will transition to default. Two-notch downgrades are not uncommon: one day you wake up, and your “BBB” investment-grade bond is a “BB+” junk bond.

To avoid a downgrade to junk, companies will try to shore up their balance sheet. This means curtailing or stopping share buybacks and slashing dividends.

This is a process GE went through. After blowing nearly $14 billion on share buybacks in the four years through 2017 to prop up its shares, GE stopped on a dime and transitioned to dismembering itself to pay down debts. The share buybacks stopped cold. Then it slashed its dividends to near-zero. And its shares have plunged.

GE now sports a credit rating of “BBB+” with negative outlook, three notches from junk, after getting hit by a round of two-notch downgrades late last year. Despite having already cut off some major limbs to reduce its debts, GE still has $97 billion in long-term debt. And GE is still trying hard to dodge further downgrades.

Richter’s article is from April 9, so again the situation is worse now than as-reported then.

Ultimate Oxymoron Alert

The Wall Street Journal provides the Ultimate Oxymoron Alert: Some ‘High Yield’ Bonds Go Negative

In the latest sign of financial markets going into uncharted territory, more than a dozen junk bonds, which usually carry high yields, now trade in Europe with a negative yield.

It is a stark illustration of how ultraloose monetary policies have turned debt investing into a choice about how to lose the least amount of money.

There are about 14 companies with junk bonds worth more than €3 billion ($3.38 billion) that are trading with negative yields, according to Bank of America Merrill Lynch. They include telecom giant Altice Europe NV and tech-equipment company Nokia Corp.

Everything Bubble

-

Stocks

-

Bonds

-

Consumer Confidence

-

Buybacks

-

Faith in Central Banks

The “everything bubble” has at its roots central bank policy of yield suppression.

Central banks made it easy for corporations to borrow money for leverage buyouts, to buy back shares, and for zombie corporations to get enough funding to stay alive.

Investors (speculators actually), especially retiring boomers, are as optimistic as they were in 2007 when they viewed their own house as a retirement vehicle, not a place to live.

Investor Faith

Investor faith in central banks has never been higher.

At the individual level, baby boomers see the stock market is up so they buy a car and have a nice vacation.

Corporations borrow money to buy back their own shares or to make insanely leveraged buyouts.

Hedge funds buy low-yielding junk bonds in belief yields will get even more ridiculous.

Deflation Coming

The Fed is hell bent on producing inflation. The sad part is they do not now how to measure it. Inflation is all around us: In junk bonds, in equities, and in home prices.

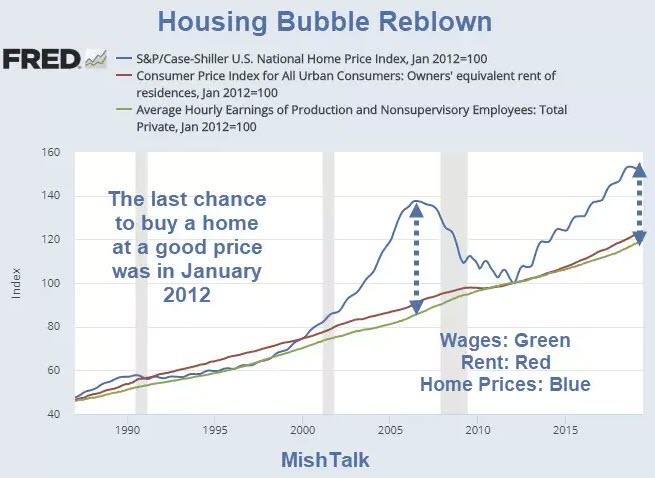

The Last Chance for a Good Price Was 7 Years Ago

The Fed re-blew the housing bubble.

Those who fail to spot inflation in the above chart are clueless about inflation.

Bubbles B Goode

“Maybe some day, your name will be in lights, saying Powell cut rates tonight.”

Bubbles B. Goode: Musical Tribute to the Fed – MISH PRODUCED VIDEOhttps://t.co/fFT1wtxAdI

— Mike Mish Shedlock (@MishGEA) June 6, 2019

Equity Bubble Will Burst

The equity bubble will burst. I can even tell you when.

Unfortunately, my answer is useless: The equity bubble will pop when the junk bond bubble pops.

When is that? I don’t know.

Several years ago I thought we were in the 9th-inning. If we we were, then it’s the 12th inning now with all eyes on Powell.

But what Powell does now is irrelevant. The bubbles will pop and one rate cut or even four will not make a damn bit of difference.

Another very destructive asset bubble deflationary collapse is baked in cake.

via ZeroHedge News https://ift.tt/2M2s5GD Tyler Durden