Though you wouldn’t be able to tell from the price action in US stocks, which roared back into the green after John Williams offered some of the most dovish comments yet re: a July rate cut, only for his comms staff to walk them back hours later, the market is getting anxious about the prospects for a deal to raise the debt ceiling, which the White House has promised would be reached before the end of the summer.

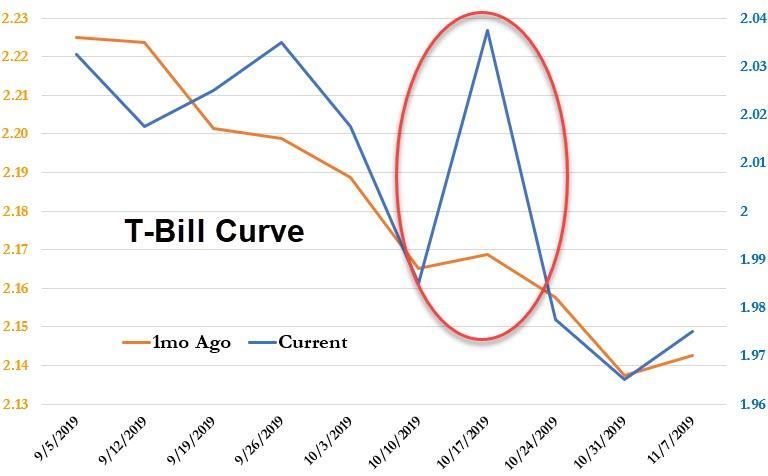

That anxiety has so far manifested in the T-bills curve around the October maturities, which is when the Treasury Department’s “extraordinary measures” are expected to run out, leaving the Treasury in danger on defaulting on supposedly “riskless” Treasuries.

But after the Trump administration and congressional leaders reportedly “reached an agreement” on overall spending levels in a two-year deal to raise budget caps – Congress wants a two-year budget agreement to accompany any deal to raise the debt ceiling – the difficult part of the negotiations is now at hand: That is, agreeing on the offsetting cuts that the White House is demanding (since the Trump administration won’t tolerate any tax increases).

The latest update on these negotiations has been brought to us by Bloomberg, which reported late Thursday that the White House has offered Pelosi a “menu” of spending cuts that would offset the budget-cap increases. In total, the ‘menu’ equals at least $574 billion, and the White House is seeking to pay for at least $150 billion of the cost for raising the caps via these cut, which Pelosi must now accept or reject.

Half of the proposals are cuts; the rest come from reforms, according to BBG’s anonymous administration sources. And one of the suggested reforms is the drug pricing plan from the White House’s 2020 budget, which would save $115 billion.

Alternatively, the offer also includes a proposal to extend budget caps by two more years, extending them through 2023 (under the current agreement, they would be set to expire in 2021). Extending the caps would save the government an additional $516 billion. Under current law, $126 billion in automatic cuts would take effect by the end of the calendar year if the caps are not raised.

Whatever she decides, it’s clear that Pelosi now has some decisions to make. Earlier on Thursday, she said she wants to file a bill this week to set up House votes next week on the package.

But, “nothing is agreed to until everything is agreed to, but we are on our way,” she told reporters at the Capitol this week. Though, “we have a path,” she insisted.

However, in an ironic twist, it might not be the Republicans who give Pelosi the most trouble on this issue. Indeed, the progressive Dems who are steadily gaining more influence in the House and already threatening to sabotage other pieces of party-leadership-backed legislation (like they tried to sabotage the border bill).

We wouldn’t be surprised to see AOC and her “squad” – who seem to have no respect, or even an understanding of, financial markets – push back against any proposed cuts, leaving Pelosi in an even more difficult position.

via ZeroHedge News https://ift.tt/2JDkInn Tyler Durden