A housing affordability crisis has been gaining momentum in Australia over the last several decades as the number of people outright owning a home has collapsed by a third as home prices soared 400%.

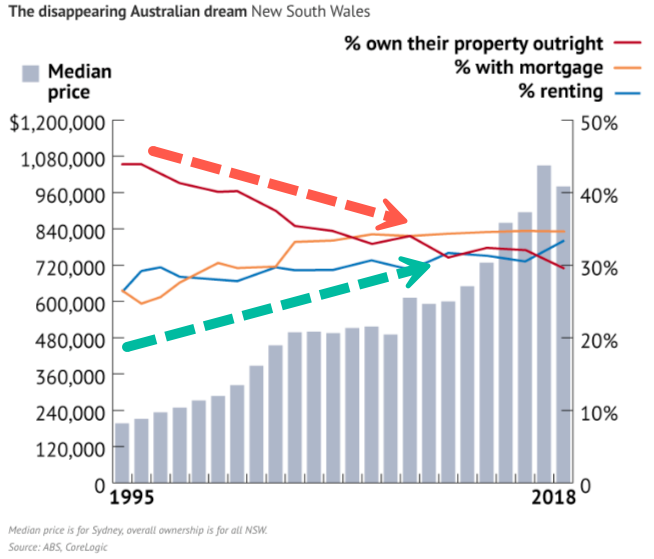

The Age, a daily newspaper in Melbourne and Victoria, Australia, reports that in the mid-1990s, nearly 44% of people living in New South Wales (NWS), a southeastern Australian state, outright owned their home, but according to new data published by the Australian Bureau of Statistics, this rate has now plummeted to just 29.7%.

So what happened over the last twenty years? Why have Australians resorted to hefty mortgages instead of buying homes in cash?

Well, the swing from outright ownership to financing has primarily been due to a 460% jump in the median house price in Sydney, approaching levels that are considered out of reach for many.

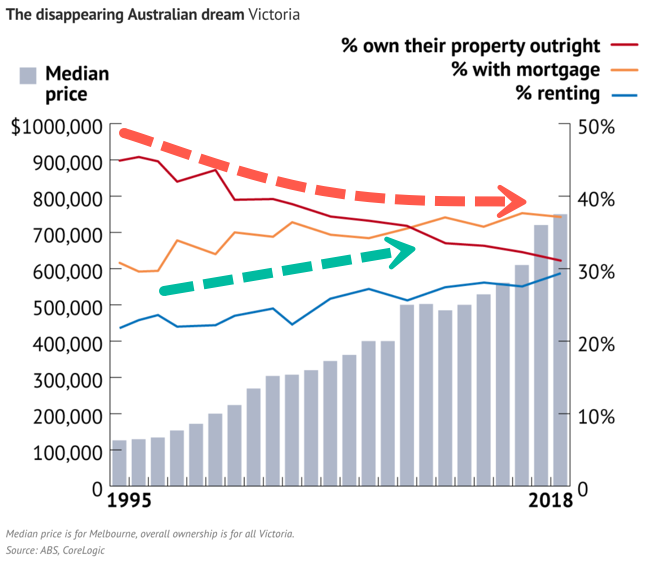

The Age reveals a similar crisis in Victoria, wherein the mid-1990s, more than 45% outright owned a home, but now that number has declined to just 31%.

Over the same period, the median house price in Melbourne has skyrocketed from $126,131 to $806,000, forcing homebuyers in the last decade to resort to mortgages more than ever.

The Northern Territory has the smallest population of people who own their home mortgage-free, at just 17%. Among the states, just 27% of residents in Queensland and Western Australia live without a mortgage or rental payments.

Despite a housing bubble that has shown cracks, the median outstanding mortgage in Western Australia is $315,000. The median mortgage in Victoria is $260,000 while it is $265,000 in NSW.

The single largest age group of new mortgages were those aged between 55 and 64, suggesting as the housing market falters – older adults will experience the most financial pain.

“There are more and more people who are getting into retirement with a mortgage over their heads,” said National Seniors chief advocate Ian Henschke.

“The number of people on Newstart aged between 55 and 64 is increasing sharply. These are people having to access their super to try and get on top of their mortgage because they don’t want to retire with such large debts.”

The affordability crisis has crushed low-income households. In the mid-1990s, the poorest of NSW resident spent 21% of their weekly income on housing; now they spend more than a third.

The low-income segment in Victoria is paying 25% of their income on rents or mortgages.

NAB senior economist Kieran Davies, in a recent note, warned that the newly created mortgage debt over the last several decades is mostly carried by older people.

“Gearing has increased sharply among older Australians, broadly reflecting the changing pattern of homeownership,” he said.

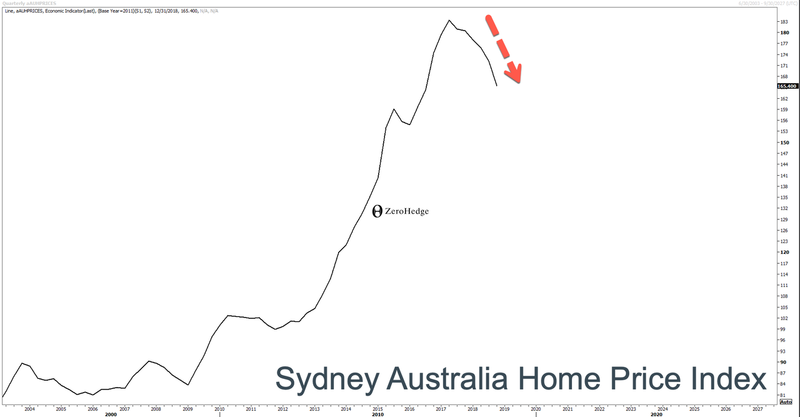

Earlier this week, the Reserve Bank of Australia said interest rate cuts were going to have little effect in boosting house prices.

“A decline in interest rates was unlikely to encourage an unwelcome material pick-up in borrowing by households that would add to medium-term risks in the economy,” it said.

With Australians saddled up with the most debt ever – many are soon going to discover that an era of cheap money will be the financial death of them as the housing market implodes.

via ZeroHedge News https://ift.tt/2Z1yiX5 Tyler Durden