Last August, several of Bank of America’s more skeptical analysts including Michael Hartnett and chief economist Ethan Harris wrote a piece on the law of large numbers, arguing that an ever-expanding list of uncertainties would likely undercut the markets going into year-end. At the time, the main concerns were the trade war, a hawkish Fed, Brexit, Quitaly and Iran oil sanctions. And now, Bank of America once again warns that this fall, a similar set of concerns could come to a head and halt the current rally in global equity markets.

As always, the trade war is at the top of the list.

While BofA’s economists are hopeful for a partial de-escalation between the US and China in the next few months, they are are becoming increasingly concerned that the current tariffs are permanent. With the US and China facing off across a demilitarized zone, a number of other battle fronts could emerge. The deadline for avoiding auto tariffs is mid-November. Additionally, there is a steady drift toward some kind of currency war: in the form of either countervailing duties or outright intervention. Countries that benefit from production shifting out of China, including Vietnam and other ASEAN countries, could face at least a serious threat of US tariffs. Meanwhile, the list of foreign firms facing unfair trade investigations by the US Commerce Department continues to grow. Elsewhere, Brexit, Middle East tensions, fraying Japan and Korea relations, and Washington DC policy missteps all loom as risk factors.

However, the list of global risks doesn’t end with trade. The next deadline for Brexit is 31 October, and there is a significant risk of a “no deal” exit either then or after another election. The oil market seems able to handle Iran oil sanctions, but it may face a bigger challenge if military conflict emerges in the Middle East. On the other side of the world, relations between Japan and Korea have frayed and there is a risk of a regional tech trade war in the coming months.

Finally, dysfunctional US politics are increasingly becoming a focal point.

Not to be outdone, the US Congress and the Trump Administration have created a massive to-do list this fall. Here they are, in order of priority.

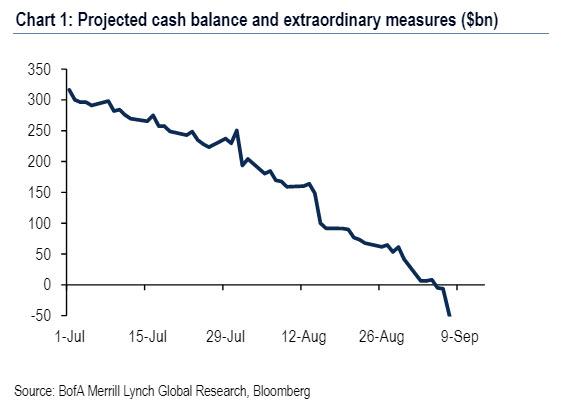

- Debt limit: The most urgent issue facing Congress right now is the debt limit. Breaching the debt limit and running out of cash is much worse than a government shutdown. The latter closes a limited range of activities; the former means immediately balancing the budget on a daily basis and a high risk of defaulting on a debt payment. Last week, Treasury Secretary Mnuchin sent a letter to House Leader Pelosi that the Treasury could run out of extraordinary measures by early-September, meaning that there is less than two months until the “x-date”.

With Congress scheduled to be on break until 9th September, consensus expects Congress to raise the debt limit before going on break. There is bipartisan support to tie the debt limit to a new budget deal but if talks stall, a short-term increase could be in the works. Ultimately, the final agreement will likely lift the debt ceiling beyond the 2020 presidential election. - Budget deal: The previous two-year budget deal is set to expire at the end of September and a new deal will be needed to avoid across-the-board spending cuts. Press reports early Thursday suggest that Congress and the Trump administration have a tentative deal to increase the spending caps and raise the debt limit. Details remain scant but higher spending caps would translate into a modest tailwind for growth and wider budget deficits in 2020 and 2021.

- USMCA: The passage of USMCA remains in limbo in the US with the Democrat-led House looking for stricter enforcement provisions on labor laws and environmental protections as well as other changes in the trade agreement. Negotiations are ongoing between USTR Lighthizer and House Democrats. We think USMCA will ultimately be ratified by the US later in the year (the fall at the earliest).

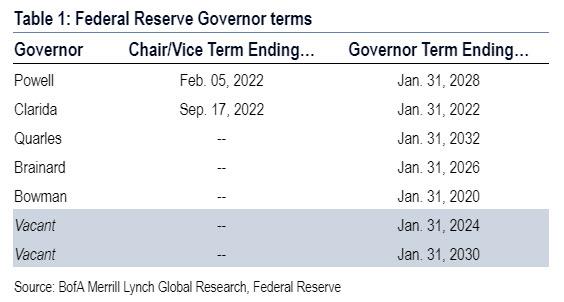

- Fed nominations: President Trump announced that he will nominate Judy Shelton and Chris Waller to the Federal Reserve Board. Chris Waller is a relatively conventional choice for the Board. Judy Shelton is not: in 2009, she argued that easy monetary and fiscal policy would create “ruinous inflation”; today, with the economy fully recovered from the Great Recession, she favors quickly cutting rates. Given that the nominations are not official yet and other pressing matters remain, we think the confirmation process is likely to bleed into late-fall/early-winter. If they are confirmed to the Fed, the two nominees will fill seats expiring in 2024 and 2030 (Table 1). Note that only the Senate will need to confirm their nominations with a simple majority.

- Bipartisan wish list: Other policy proposals (eg, middle-income tax cuts, infrastructure and immigration reform) remain on the backburner. Given the political climate and split Congress, these policies are unlikely to get a look until after the 2020 elections.

That said, there are two important silver linings in these dark clouds according to BofA.

First, the Trump Administration is very reluctant to impose broad-based consumer tariffs. This makes across-the-board China, autos and Vietnamese tariffs less likely.

Second, since last fall, the Fed has done a 180-degree turn from steady tightening to pre-emptive easing. This not only helps cushion the trade shock in the US, but has also created space for many emerging market central banks to ease as well. The problem is that the market is already pricing in more rate cuts than many banks – certainly Bank of America – believe the Fed is likely to deliver. The markets expect about 110bp in cuts by the end of next year, while BofA has penciled in only 75bp, while Goldman goes so far as to expect the Fed to resume rate hikes in 2020. At some point, the Fed has to disappoint very high expectations.

The bottom line is that, according to Bank of America’s top economists, for now investors can continue to bask in the glow of Fed-fueled financial markets. However, “once that burns out and the rains arrive, the picture could look a lot different.”

via ZeroHedge News https://ift.tt/2Lyw3r0 Tyler Durden