0, 25, or 50bps next week? Will Draghi leave Lagarde a rate-cut gift (or start buying stocks)? Those are the questions the market is asking and judging by the markets’ response, it’s moar of whatever hasn’t worked til now…

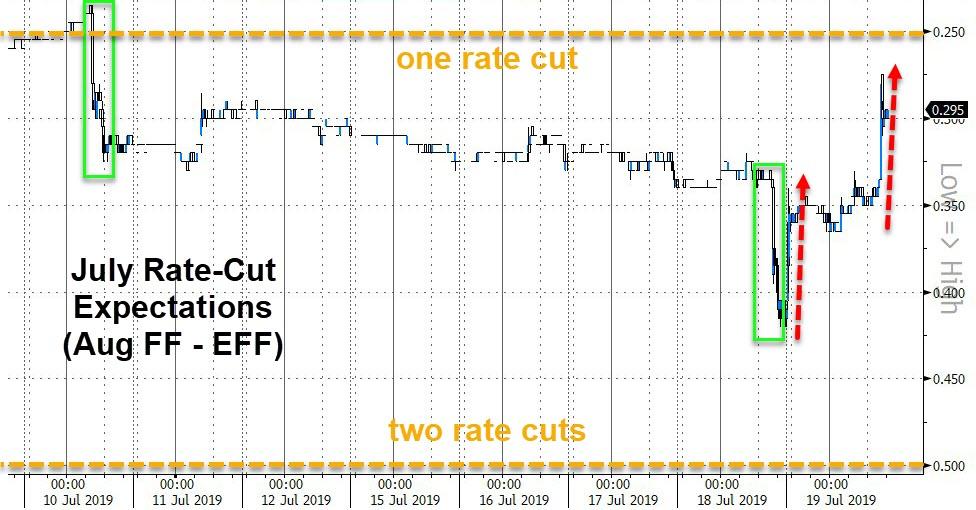

And the short-end is implying a 20% chance of 50bps next week (down from over 71% just after Williams spoke)…

But, despite the desperate jawboning last last week, to rescue market expectations back from Williams’ “academic” warnings, former fund manager and FX trader Richard Breslow notes that now that rate cuts and dovish talk are firmly on the agenda, it’s hard to think of anything, at this point, that might derail the ECB or the Fed. And we certainly know the mindset of the PBOC and the BOJ.

Which raises the question of whether economic data releases mean anything or not? With momentum having stalled in several major asset prices, it’s easy to conclude that they don’t. But they do.

Via Bloomberg,

Is the Fed cutting rates based on U.S. economy trends or because of the ubiquitous global headwinds? Are these forces anything monetary policy can do something about? Foreign-exchange traders certainly want to know the answer. And, given the dispersion of economist forecasts for this week’s numbers, a lot of other people are curious and confused as well.

Whether it’s one-and-done or the start of the march back toward zero will obviously affect what investors do for the rest of the year. Quite a few assets are at crossroads and where they go from here will depend on the answer. Oddly enough, there seems to be far more debate about what the Fed will do rather than how much the ECB will cut. And yet we know Europe unambiguously can use some additional stimulus.

Unfortunately, they’re going to provide the dubious kind in the form of more deeply negative rates, rather than the fiscal boost they need. Yet, for reasons that escape me, there seems to be more optimism about the efficacy of what the Europeans will do than the “insurance cut” from the FOMC. Despite some of last week’s comments, the Fed should do as little cutting as they can. Twenty-years of academic research or not. And the ECB will be wasting everyone’s time by not erring on the aggressive side.

Analysts, by and large, hate the dollar. They’ve been remarkably consistent in holding that view, even though the Dollar Index has done nothing all year but range back and forth. Such is the staging of currency-war wrangling more than a demonstration of the relative attractiveness of the dollar versus the rest of the G-10.

Equity markets have also lost their upward momentum. Given the waning technical picture and the geopolitical backdrop, it’s tempting to get intrigued about testing the downside. But markets aren’t here because of a fantastic global economy, rather courtesy of share buybacks and quantitative easing. Which we are getting more, not less, of. The market can certainly go down, but, at this point, there is nothing to suggest it shouldn’t be treated as a correction rather than a sea change. Keep a weathered eye on consumer spending. Not to mention all of the support levels below.

Business investment won’t pick up without trade talk progress. But even at these lofty prices, any constructive news will still be market positive. With central banks once again very much on the case, it’s worth remembering the many examples of traders feeling able to ignore geopolitical news courtesy of monetary-policy generosity.

As far as bonds are concerned, they continue to act like every setback is a buying opportunity. Gold’s good to have. Lots of people feel safer with yen or francs on the books. But bonds remain the ultimate haven to be parted with begrudgingly. Fixed-income traders can be happy with any economic number that’s an outlier. Rightly or wrongly, they’re happy to enjoy what has been a heads-they-win, tails-they-win environment.

via ZeroHedge News https://ift.tt/2Lz7EBJ Tyler Durden