Seemed appropriate…

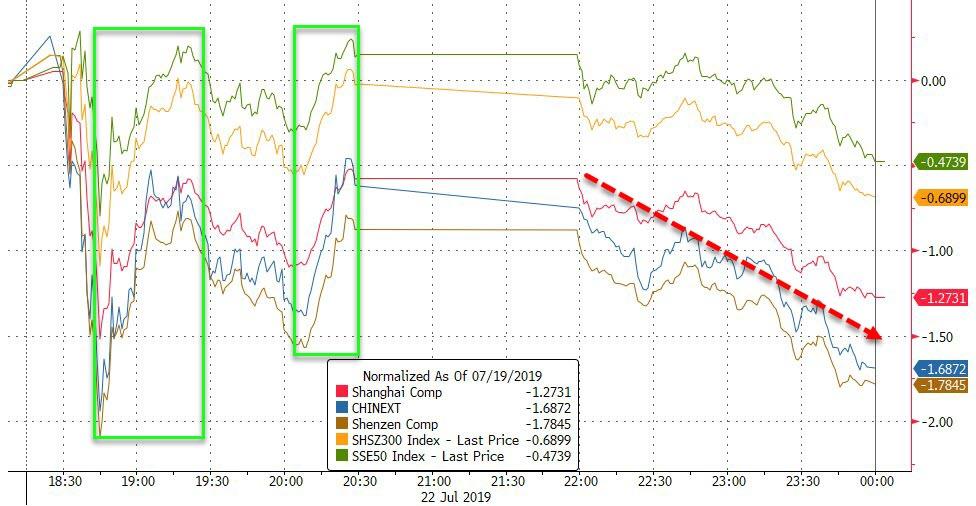

Chinese stocks were not pretty. Despite STAR soaring, ChiNext tumbled along with Shenzhen as it appears liquidity moved to the new index…

European markets (except Spain) managed to cling to gains on the day thanks to 4 notable impulses…

Nasdaq dramatically outperformed led by semis. Small Caps were the biggest losers. Dow ended unchanged (Boeing down vs Apple up)

NOTE – Trannies and Small Caps notably decoupled at around 1400ET only to see a mysteriously large buy program strike at 1500ET

Small Caps continue to dramatically diverge from big caps (and mega cap tech)…

Small Caps also closed below their 100DMA…

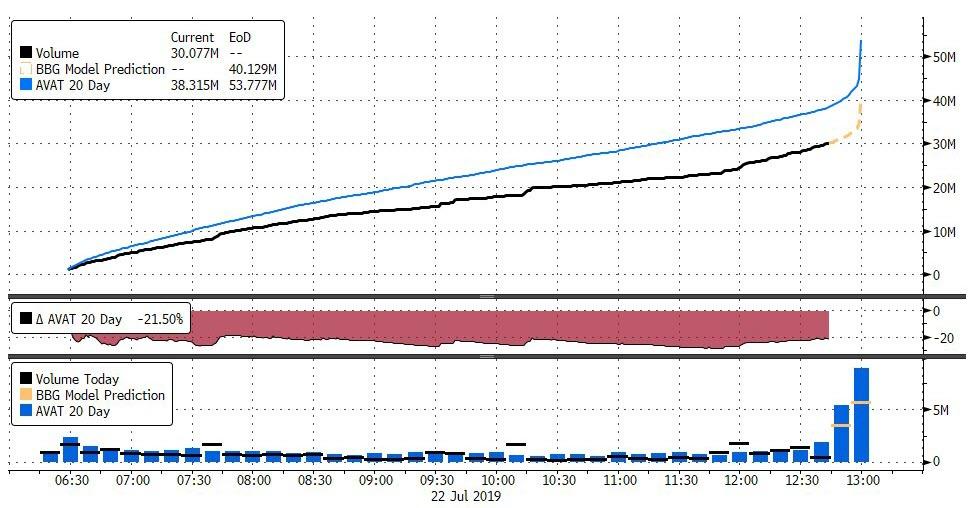

Volume was low – around 20% below average…

There were two ‘failed’ attempts at yet another short-squeeze today…

Semis soared on the day following Goldman’s upgrade on Micron…

But while Semis spiked, FANG stocks were flat…

Bonds and stocks remain in their own – buy all the things – worlds…

Treasury yields traded in a narrow range today, with yields down across the curve led by the belly…

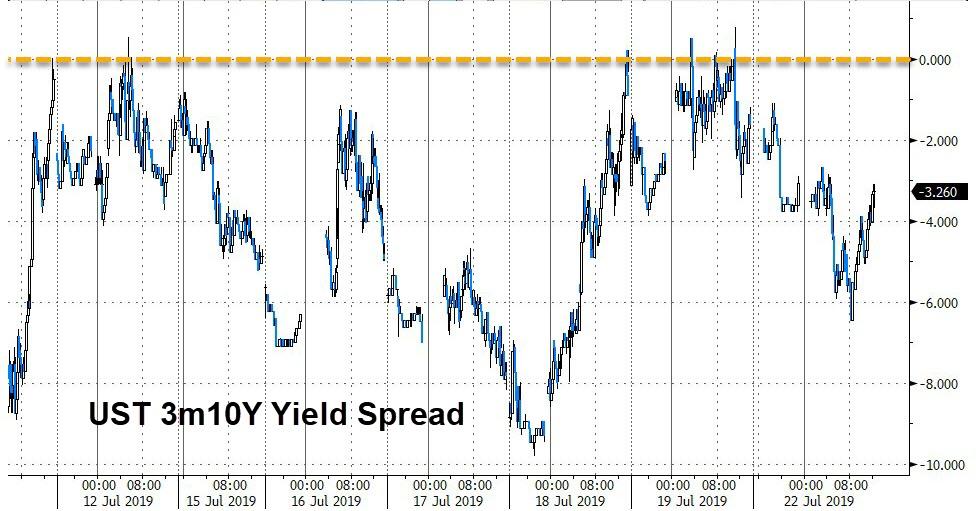

10Y Yield dropped to 2.02% intraday but the yield curve (3m10Y) remains inverted (41st day in a row)…

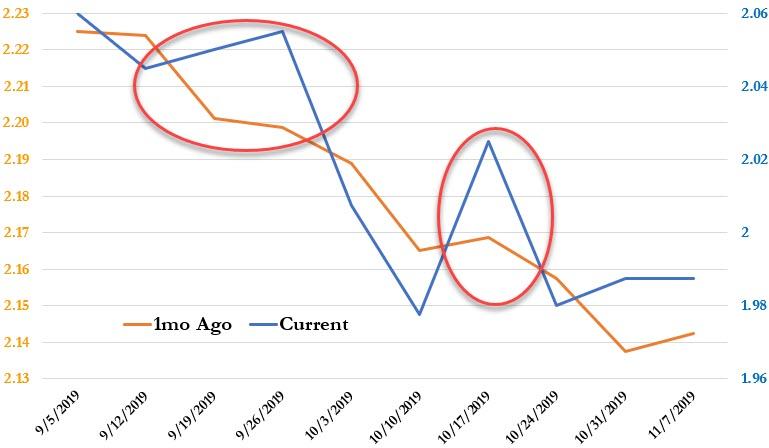

The T-Bill curve remains kinked around potential debt ceiling X-date…

The dollar index managed very modest gains, holding above last week’s Williams’ speech plunge levels..

Cryptos were mixed over the weekend with Bitcoin Cash holding gains but ETH and BTC lower after a leg lower this morning…

Bitcoin continues to hover between $10,000 and $11,000…

Dr.Copper is lagging as silver resurges…

Oil prices managed some gains today as Iran tensions resurfaced in the narratives…

Silver continues to rise…

Silver has outperformed gold for six straight days (longest streak since June 2018), erasing most of the relative gains for the year…

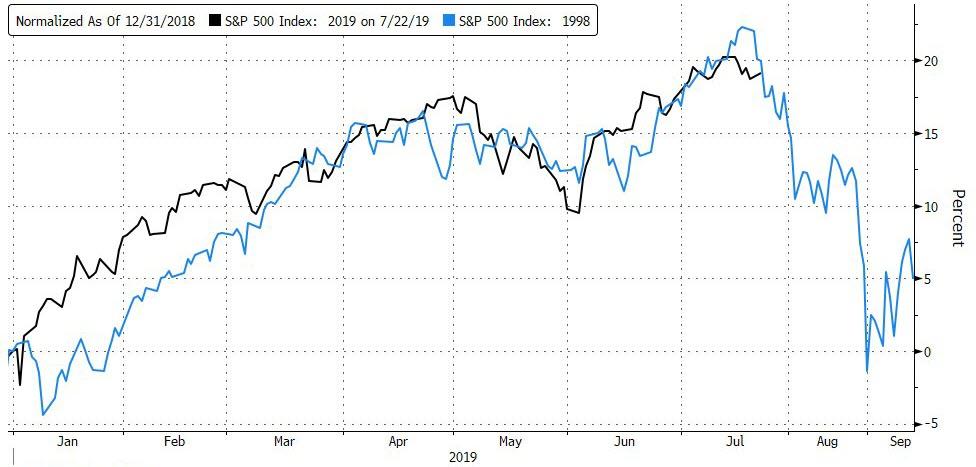

Finally, don’t forget, it’s different this time…

Except it’s all about liquidity, stupid…

via ZeroHedge News https://ift.tt/2JWq109 Tyler Durden