Authored by Steve Englander, Head, Global G10 FX Research and North America Macro Strategy at Standard Chartered Bank

The US government may find FX intervention irresistible; we are less enthusiastic. If US policy makers judge that foreign counterparts are artificially weakening their currencies, they might feel justified in doing the equal and opposite. And, there may be some substance to the Treasury’s complaints about currency manipulation. For example, we suspect that most private-sector analysts would see a weaker EUR as the major, and perhaps only, stimulus from further European Central Bank (ECB) easing. Still, implementing effective intervention is harder and more expensive than it looks, and would probably deliver less than expected even if successful.

Our expectations if the US were to intervene:

- The US would be on its own – other countries would not join

- The first intervention, even if small, would shock and weaken the USD by 2% or more

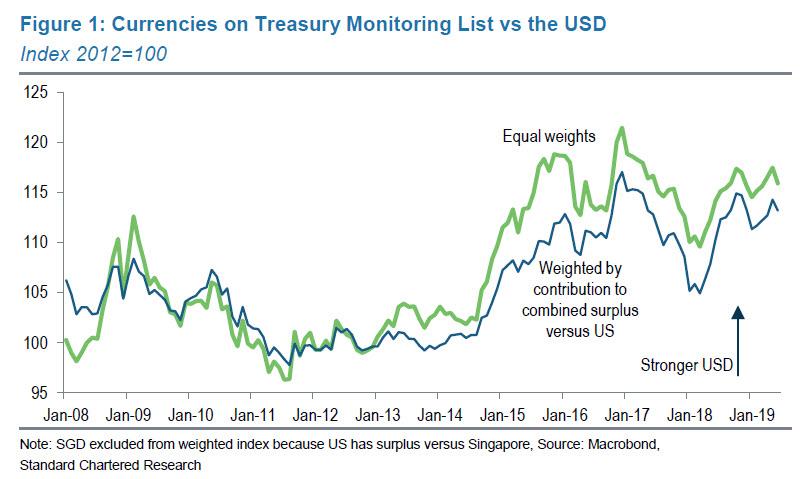

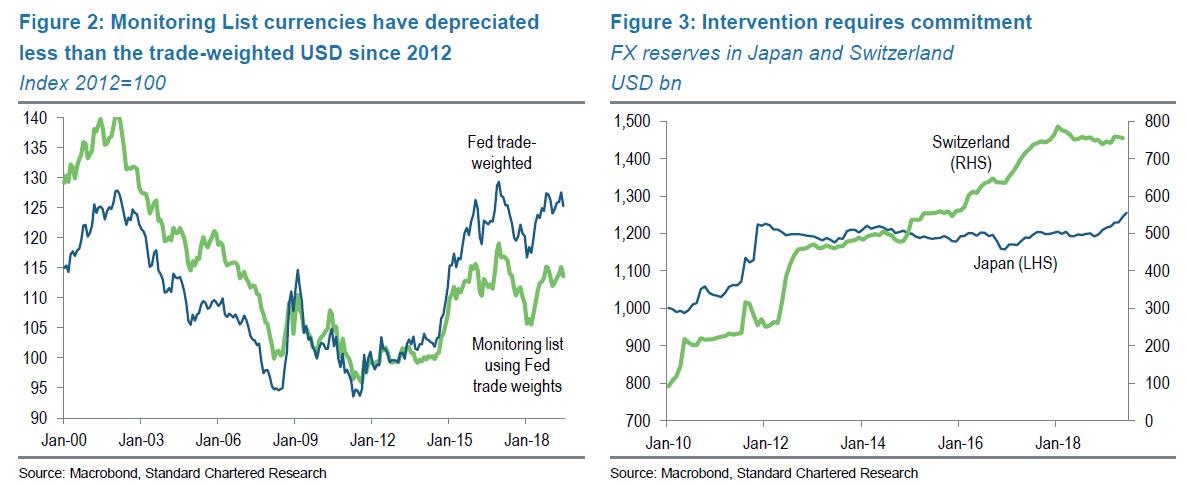

- Of the seven currencies on the Treasury’s Monitoring List – the CNY, EUR, JPY, KRW, MYR, VND and SGD – intervention would be most likely in the EUR and JPY, the most liquid and freely traded; as a group, these currencies have depreciated about 15% since 2012 (Figure 1), but less than the currencies not on the Monitoring List (Figure 2)

- Impact of small, sterilised intervention would diminish rapidly

- A sustained FX effect would require a commitment of USD 200-400bn

- Other central banks would push back, increasing the needed intervention size and diminishing the exchange rate effects

- The administration’s harsh criticism of policies in these countries would make it hard to justify amassing a large portfolio of their currencies

Intervention is rare but doable

ESF has enough to start

The US has foreign exchange reserves of about USD 127bn, and the Exchange Stabilization Fund (ESF) has about USD 95bn. The intervention mechanism is creaky, as there has been no large-scale intervention in decades. There were small interventions selling JPY on behalf of the Bank of Japan (BoJ) in the early part of this decade and buying EUR in the early 2000s. The ESF would probably need to be augmented to avoid the perception that there is a limit to intervention; otherwise intervention could lose credibility quickly. As Fed officials have frequently acknowledged, the Treasury directs policy on exchange rates.

The debate in the policy and academic literature continues as to whether sterilised intervention – the US sells USD in the FX market but withdraws reserves domestically – is effective. There is a consensus that unsterilised intervention is more powerful than sterilised intervention because unsterilised intervention increases the supply of the currency being sold, whereas sterilised intervention does not alter the overall supply. Some argue, however, that the signalling effect of sterilised intervention gives such intervention some potency. If the Fed is as dovish as Chair Powell has conveyed, there is a case for unsterilised intervention. This would increase the impact of intervention by increasing the global supply of USD versus non-USD assets. The Treasury may prefer unsterilised intervention, but the norm has been for the Fed to sterilise interventions.

How much would it take?

The first time the US intervened – whether unsterilised or sterilised, the USD would probably move a long way, as occurred when the first verbal interventions by the Trump administration occurred. If subsequent interventions were small and isolated, they would likely become increasingly ineffective.

We do not know how big the cumulative interventions would have to be in order to be effective. Gross daily FX transactions were about USD 5tn in 2016, according to the Bank for International Settlements (BIS), and the USD was a leg on USD 4.4tn of these transactions. Such statistics are misleading, however, as most trading is not directional. Net demand for USD on a directional basis is relatively small on a daily basis. The US current account (C/A) deficit is about USD 520bn annually, so as a rough benchmark, there must be just over USD 2bn of USD net buying every business day to keep it steady.

It makes more sense to ask how much the USD would move if foreigners were willing to finance, for example, only 80% of the C/A deficit at current interest and exchange rates. We suspect the USD would weaken significantly if this were the case, but this would mean a USD 100bn shift in the net annual demand for US assets. Note that this is much closer conceptually to unsterilised than sterilised intervention, and such a shift in portfolio allocation among investors would probably reflect deeper concerns about relative asset-market performance than exchange rate valuation. Most likely, it would take a much higher level of sterilised intervention to have a major impact, and even an unsterilised move may not have the same effect as a private-sector capital allocation decision.

At the time of the 1985 Plaza Accord, the US C/A deficit was about USD 140bn and the USD was very vulnerable to intervention. Germany and Japan joined the US in intervention, investors were likely much longer USD after its extended sharp rise, and the USD was more overvalued than it is now. Estimates of total intervention then were about USD 10bn.

At present, the US C/A deficit is about USD 520bn annually, any US intervention is likely to be unilateral (if not opposed by other central banks), the overall FX market is at least 15 times larger, and USD positioning is not as overwhelming relative to the size of the market. These factors might increase the size of the intervention required.

If a commitment to extended intervention were made, we see a minimum of USD 100bn being required, and likely more than USD 200-400bn. Swiss reserves went up c.USD 400bn from the beginning of the euro-area debt crisis in 2010 to the collapse of the 1.20 peg in early 2015. Japanese reserves increased by USD 200bn from early 2010 to end-2011. These are rough ranges, but we do not think a few billion here and there will be enough to affect the USD substantially.

We draw a sharp distinction between short- and long-term intervention strategies. If the US Treasury called dealers to check prices, we would expect the USD to plummet… the first time. Selling a few billion USD for foreign currency would likely move the USD c.2% or more when it first occurred. If this were all that happened, the USD would likely bounce back.

If it looks as if the Treasury were trying to intervene on the cheap, selling a few billion USD here and there when investors leaned the wrong way, the likely market strategy would be to step aside during the immediate period of Treasury intervention and buy the USD back when the Treasury intervention stopped. Several interventions in Japan over 2010-11 exhibited this dynamic (Figure 4).

The day after

We come back to what we think is a poorly understood constraint on US intervention policy. The countries on the US Monitoring List for currency manipulation – China, Japan, Korea, Germany, Italy, Ireland, Singapore, Malaysia and Vietnam – have almost all been harshly criticised by the US for their economic, social and foreign policies. Allocating USD 200-400bn across these countries’ currencies would be no easy task.

The easiest currency in which to intervene would be the EUR, but the Trump administration has been lambasting euro-area economic and political policies non-stop. It would be a strange turnaround for an administration that has been so negative on Europe and its future to acquire a large exposure to the EUR. China and a few others have significant capital controls, so it is unclear how the Treasury would buy their currencies. It is also unclear how the US administration would feel about such exposure to China. Setting aside issues of practicality, intervention would mean being stuck with these currencies. Diversifying out of unwanted reserve currencies has been much harder than anticipated (see Reserve managers sell USD, private sector buys).

Most broadly, selling a strong currency to buy other countries’ weak currencies can push against private-sector capital flows. This administration would find it difficult to explain why acquiring a large portfolio of currencies belonging to political opponents is a good idea.

Small-scale maybe, large-scale tough

Given these considerations, we expect any Treasury intervention to be small but noisy. It would probably mostly in the EUR and JPY, counting on the other currencies to appreciate as part of a broader USD move.

We are not sure intervention will occur, and even less sure it would be a good idea. However, another round of USD strength – especially if driven by policy moves abroad that look as if they are driven primarily by currency considerations – could tip the scales. We doubt that large interventions leading to a big scaling-up of the reserve portfolio would occur.

Social Security Trust Fund in part a sovereign wealth fund?

The Social Security Trust Fund (SSTF) of around USD 3tn is wholly invested in US Treasuries. Portfolio theory suggests that the beneficiaries of Social Security are paying a very high premium for the security of US Treasuries, which in theory cannot default. Few private-sector portfolios hold only Treasuries; a well-designed portfolio would include both domestic and foreign non-Treasury assets.

Our modest proposal is that a portion of these assets could be explicitly managed as a retirement portfolio, similar to the Canada Pension Plan, the Petroleum Fund in Norway and other public retirement plans. These funds could be invested in foreign assets, and this capital outflow would tend to have a USD-softening effect. It would be difficult to argue that such a fund was a currency manipulation scheme, even if it had currency impact. It would have credibility in that its foreign assets would make sense on a risk-return basis, rather than consisting of a set of currencies bought in order to ‘punish’ trading partners. This credibility might mean that it would be more effective in driving down the USD than scattershot intervention.

via ZeroHedge News https://ift.tt/2y3jfAo Tyler Durden