Authored by Richard Breslow via Bloomberg,

The next in a long line of moments of truth for the ECB will soon be upon us. And in typical fashion the market is gearing up to have a last-minute debate about whether they will stick to consensus expectations or surprise with a move this month rather than teeing one up for September. Traders love to drive themselves crazy. To make matters more fun, there isn’t even agreement on what sooner rather than later, bigger rather than less, will mean for the currency. Such is the extent of dollar bearishness.

Getting in under the wire, lest anyone be under the misapprehension that rate cutting is anything but a global phenomenon, are dovish comments by officials at several other central banks. They aren’t scheduled to imminently do anything, but seemingly want to make sure everyone knows they are on the case. This non-currency war gets more interesting by the week.

RBA’s Christopher Kent could have been speaking for a lot of his global peers when he said, that, in response to their recent rate cuts, the exchange-rate transmission mechanism has been working as one would expect. Adding, with what seems like great candor, without the rate cuts “the Aussie dollar might have been higher.” And I’m sure EUR/JPY being within shouting distance of the post-flash crash year-to-date lows wasn’t lost on BOJ’s Haruhiko Kuroda. The RBNZ just admitted to taking a new look at potential unconventional monetary policy should it be needed. So much for any breakout for the kiwi above $0.6815. Not to be outdone, Bank of Korea Governor Lee Ju-yeol assured parliament that he’s also ready to act if needed.

It has been quite a day on the monetary-policy front. No wonder so many of the world’s equity indexes are having a happy day.

It’s a testimony to just how ubiquitous are the promises and hints at further liquidity infusions, that PBOC Governor Yi Gang sounded positively hawkish when he said earlier Tuesday that China’s interest rates are at an appropriate level. More importantly, given all the allusions to “global headwinds”, he said the bank will set interest rate policy “based on its own situation.” Cue the next round of trade talks.

But the most important remarks came from the Bank of England’s Michael Saunders. He said, in a Bloomberg interview, that Brexit “vulnerabilities“ could prevent any rate hike even if their forecasts imply a need to do so. Talk about known unknowns.

Once again, a central bank is inching closer to market pricing rather than the other way around. When I read this, I couldn’t help but think back to a comment made in 2012 by then Dallas Fed President Richard Fisher. In what at the time seemed like sacrilege, he said:

“I would caution, again, that at best, the economic forecasts and interest-rate projections of the FOMC are ultimately pure guesses.”

Boy was he right.

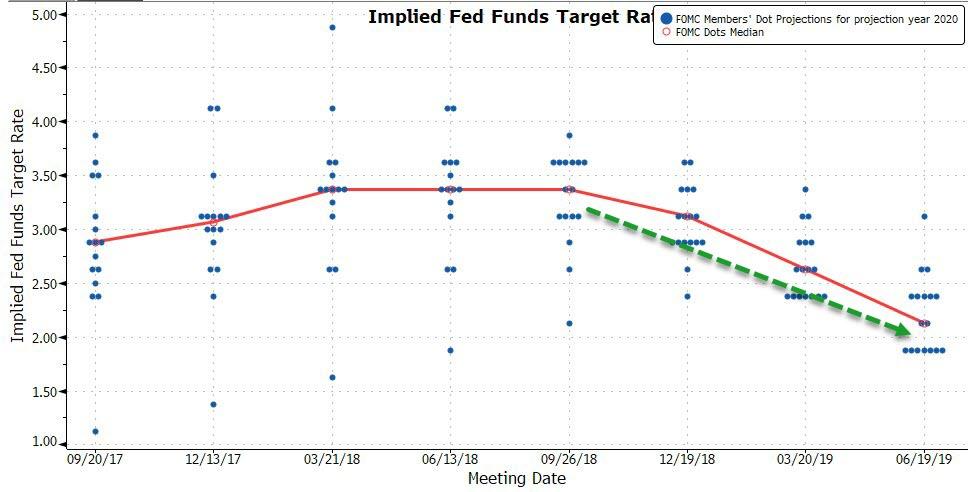

Yet it is a truth the market still struggles with as they continue to parse with great intensity the latest staff projections, dots and comments. Traders knew, or should have, what to do when forward guidance was having its hay day. When trying to discern policy-maker reaction functions, they hung on every word uttered in speeches. Comforted in the knowledge that everyone agreed that no surprises was the order of the day. During the period when data-dependence was purported to be the key, investors were told which numbers mattered most and went from there. We may now be entering a period of educated guessing.

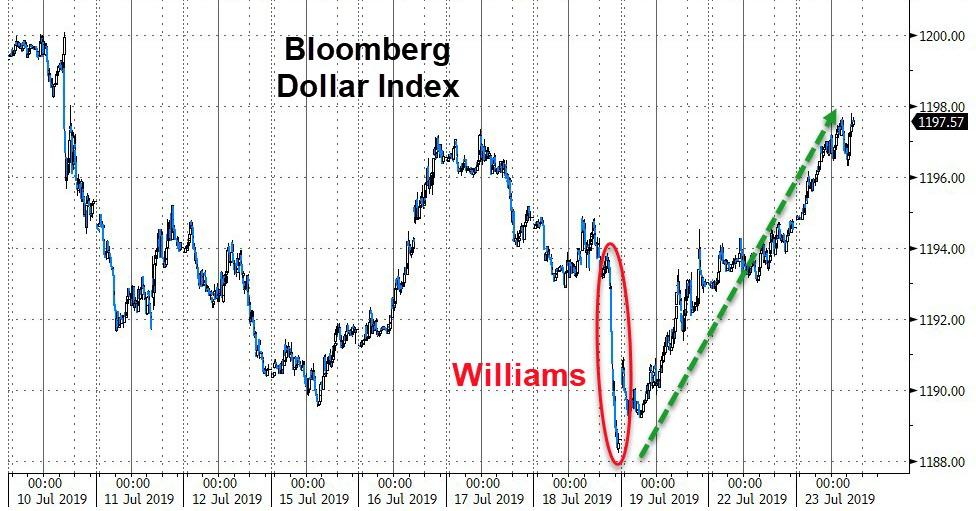

NY Fed President John Williams’ comments got the lion share of last week’s attention. But it was actually Governor Richard Clarida’s comments that will have lasting import. He made it quite clear that the Committee is willing to make rate decisions based on forecasts. Gone are the “whites of their eyes” notion. And it’s going to make it harder to handicap what they are likely to do. You have to be impressed with their self-confidence.

The dollar, unsurprisingly, is having a good day. But both the Dollar and Bloomberg Dollar Indexes have risen right into resistance. Now it gets really interesting. Trading wise and, perhaps, politically.

via ZeroHedge News https://ift.tt/2OfdNVX Tyler Durden