On Monday, investors in mainland China finally got a taste of what it would be like to trade in a market that isn’t tightly controlled by Chinese economic authorities. And what a day it was.

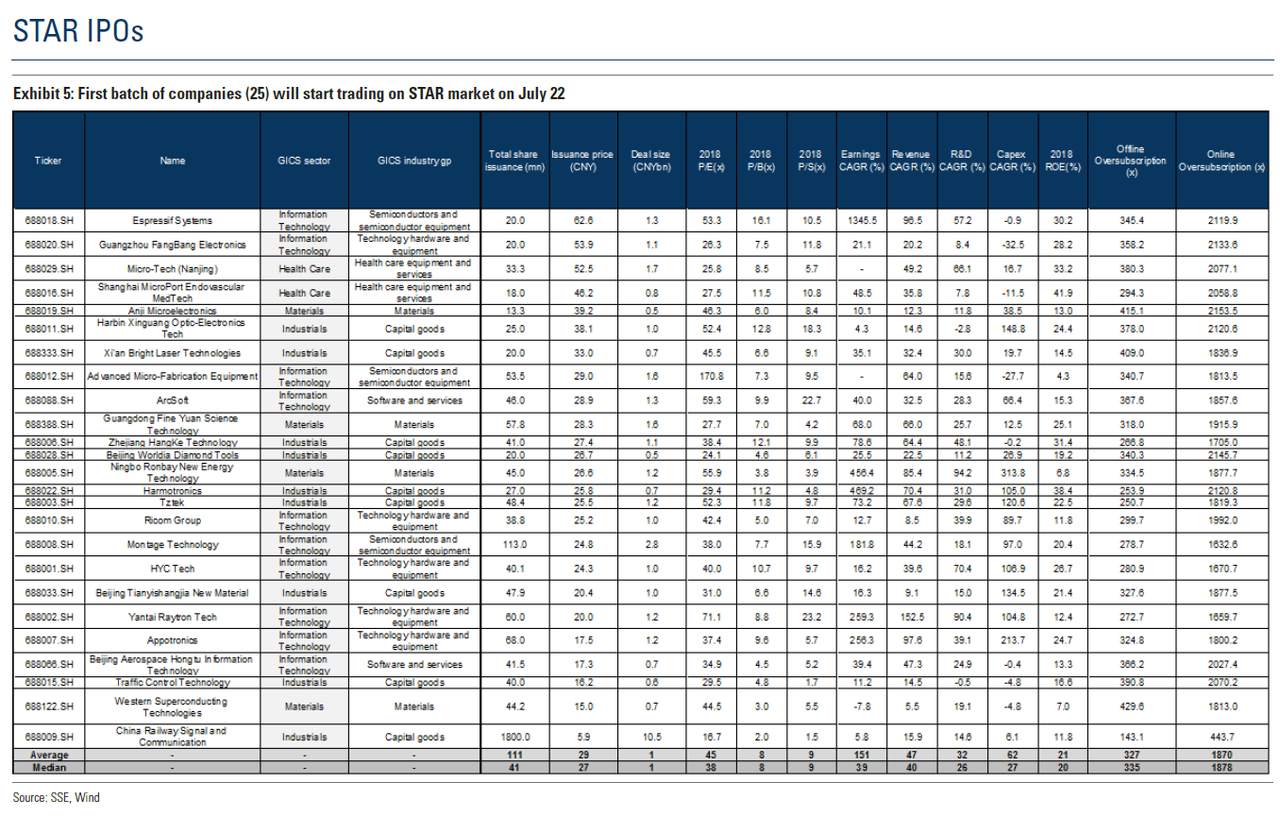

During the opening day of trading on China’s new Nasdaq-style STAR Market, volatility was so intense that the average move among the 25 stocks listed on the exchange was a 140%+ increase. Some stocks climbed more than 500%.

But unfortunately for the bulls, the euphoria couldn’t last, and on Tuesday, investors started taking profits, causing STAR’s five biggest individual shareholders to lose a combined $1 billion (that’s after STAR added $44 billion to market cap). All but four companies of the 25 stocks listed on the market fell on Tuesday, erasing about 9% of the total market cap, Reuters reports.

To be sure, the size of the pullback on day two wasn’t nearly as large as the rally on opening day, but many suspect that this is only the beginning.

The biggest loser on Tuesday was China Railway Signal & Communication Corp., which sank 18.4%, the sharpest drop of the day. But even after that, CRSC shares were 71% higher than their initial public offer price.

The market opened on Monday, less than a year after President Xi first announced his plans to build an exchange that would entice China’s top tech firms to list at home, rather than looking to Hong Kong or the US. Investors swapped more than $7 billion of the shares – equivalent to about 13% of turnover in the rest of the market – as the surge minted three new billionaires, according to Bloomberg.

But with all the excitement surrounding the new exchange, one investment management executive said it was hardly surprising to see such wild swings.

“We’ve never been in a market with no trading limits so it’s going to be a bit of a chaos in the early days of trading,” said Sun Jianbo, president of China Vision Capital Management in Beijing. “The high volumes suggest that many investors that won subscription in share offering have dumped shares.”

Unsurprisingly, margin loans helped power trading on Monday, according to data from the Shanghai Stock Exchange. Investors borrowed a total $219.38 million to bolster their buying power.

An index tracking the shares trading on the exchange will launch in the next few weeks, shortly after the exchange gains its 30th listed stock in about two weeks.

Most expect valuations to shrink to more “reasonable” levels in the coming weeks and months. One investor said he expects to see “a tug of war” between speculators and the market as more try to lock in profits.

Investors have three more days to enjoy unrestricted trading on STAR. After that, shares will be subject to daily limits of 20% in either direction. That’s still double the rate from the Shanghai Stock Exchange.

via ZeroHedge News https://ift.tt/2K4vKkO Tyler Durden