Authored by Sven Henrich via NorthmanTrader.com,

Greatest economy ever according to the presidential talking points, new market highs in July, free money just around the corner with every central bank looking to cut rates because greatest economy ever. Welcome to the age of conflicting signals. But the main message sent to investors: You can’t lose, guaranteed gains await you. Don’t you know?

Then why are small caps acting like crap? Where’s the rush to partake in the free money party?

I ask:

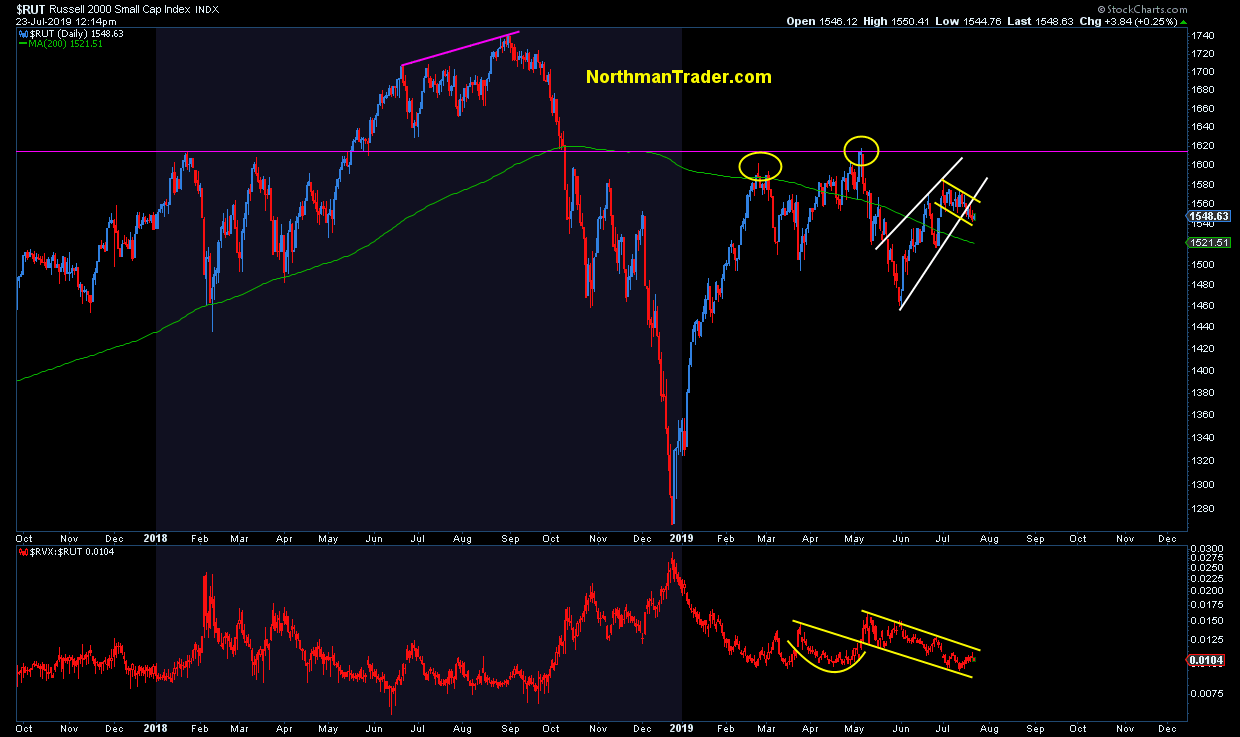

While solid up on the year following last year’s disastrous drubbing small caps haven’t gone anywhere in months.

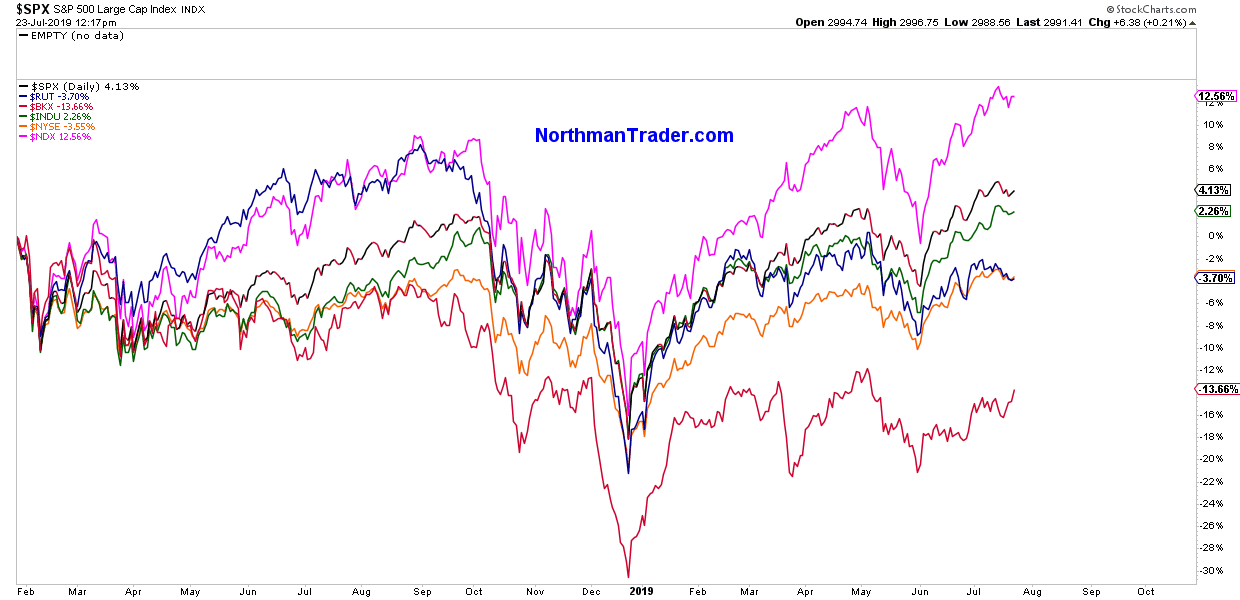

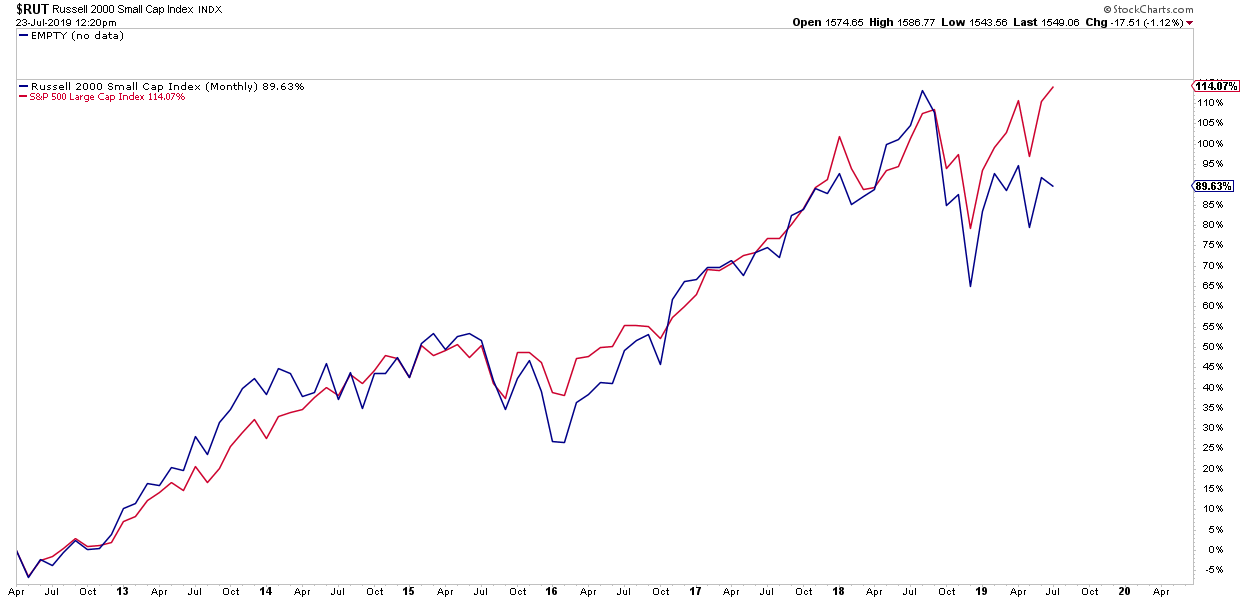

In fact they haven’t gone anywhere since January 2018 while select tech again is leading advance in 2019.

One may argue that small caps are heavily influenced by the drag in the banking sector as many financials are found in the small cap sector.

This performance divergence is very notable as small caps were leaders in 2018 when rates were rising, but due to the collapse in yields in 2019 the performance dynamic has clearly shifted:

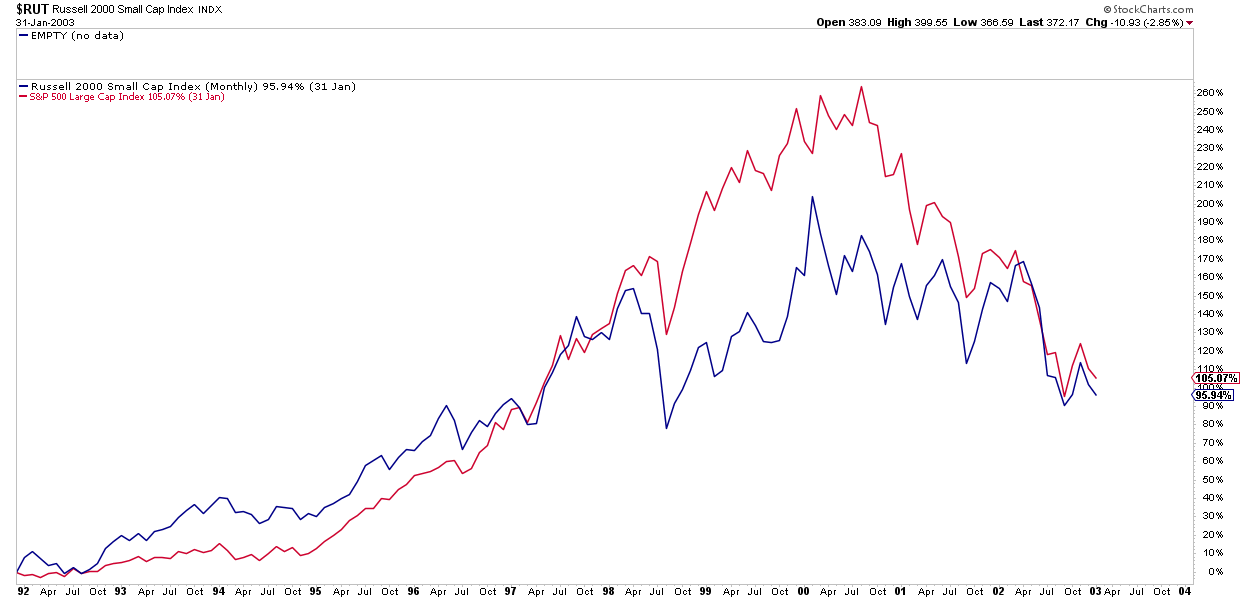

It’s not the first time such a shift in performance has taken place. One notable such event, the lead up to the 2000 market top:

The potential good news for bulls here: That underperformance lasted for 2 years before it mattered and the indices then realigned in performance as the recession unfolded despite the Fed cutting rates. But realign they did.

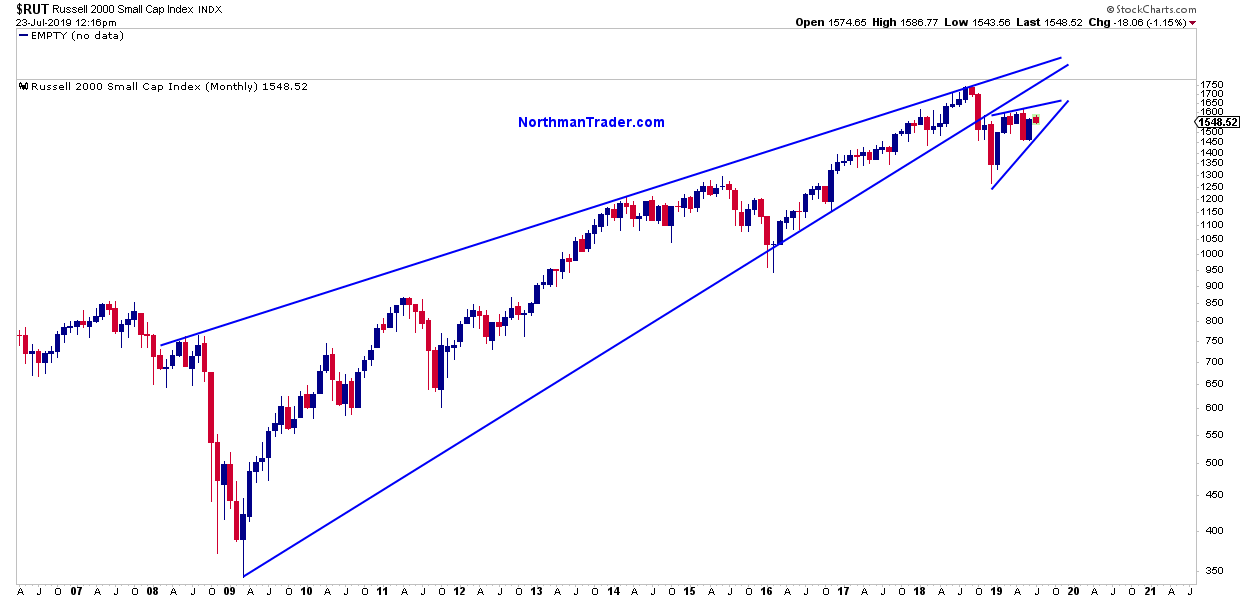

But by lagging in performance small caps have left a technical trail of craps:

A major broken wedge pattern and now a consolidation pattern that requires a break higher or risks a break lower which would target the December lows again.

Which one will win out?

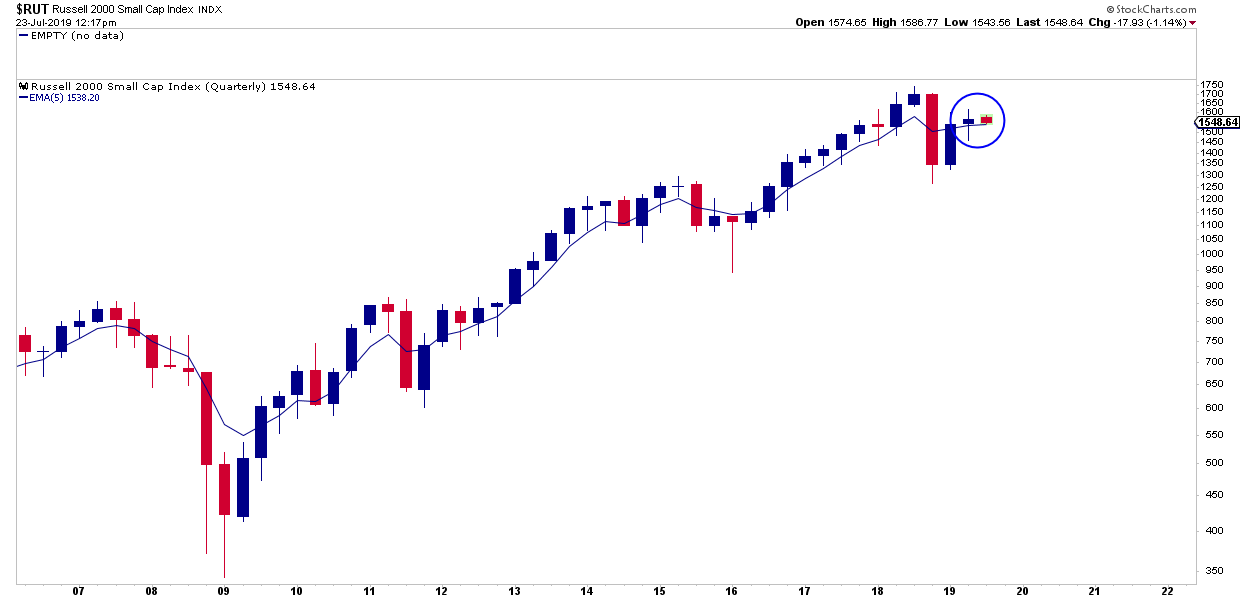

Perhaps look no further than the quarterly 5 EMA:

$RUT is hanging above it for now. Barely. A sustained break below the quarterly 5 EMA would suggest bears are gaining control and could break the consolidation pattern. Bulls need that line defended. Perhaps the Fed will offer that defense. Watch out if they don’t.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News https://ift.tt/2JMdn5e Tyler Durden