There’s good news, bad news, and goldillocks news from today’s IMF report.

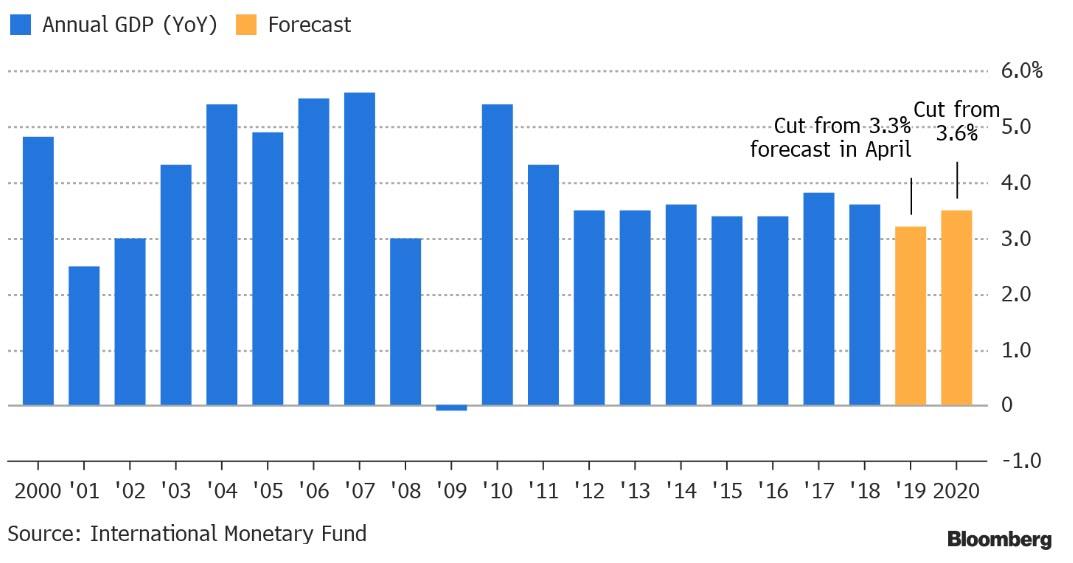

Bad News: For the fourth time in a row, The International Monetary Fund is downgrading its outlook for the world economy because of simmering international trade tensions.

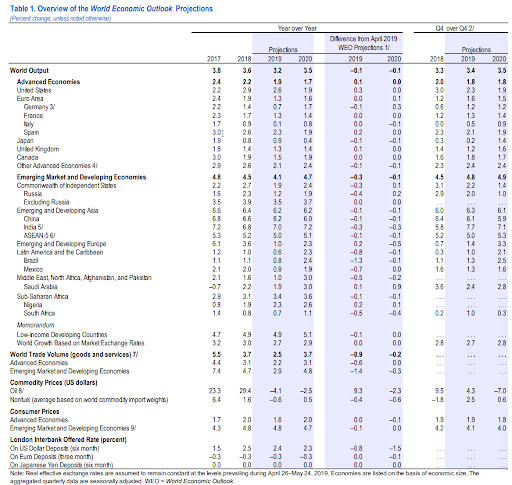

The IMF expects the global economy to expand by a “sluggish” 3.2% in 2019, down from 3.6% in 2018 and from the 3.3% growth it forecast for this year back in April.

“The projected growth pickup in 2020 is precarious, presuming stabilization in currently stressed emerging market and developing economies and progress toward resolving trade policy differences,” the IMF said.

“The principal risk factor to the global economy is that adverse developments — including further U.S.-China tariffs, U.S. auto tariffs, or a no-deal Brexit — sap confidence, weaken investment, dislocate global supply chains, and severely slow global growth below the baseline,” the IMF said.

It forecasts 6.2% growth for the Chinese economy, slowest since 1990 when China faced sanctions following the brutal crackdown on pro-democracy demonstrations in Beijing’s Tiananmen Square.

Good News: The IMF boosts its forecast for the U.S. economy this year, citing expectations that the Federal Reserve will cut interest rates.

The fund now expects the U.S. economy to grow 2.6% in 2019, down from 2.9% last year but up from the 2.3% it forecast in April.

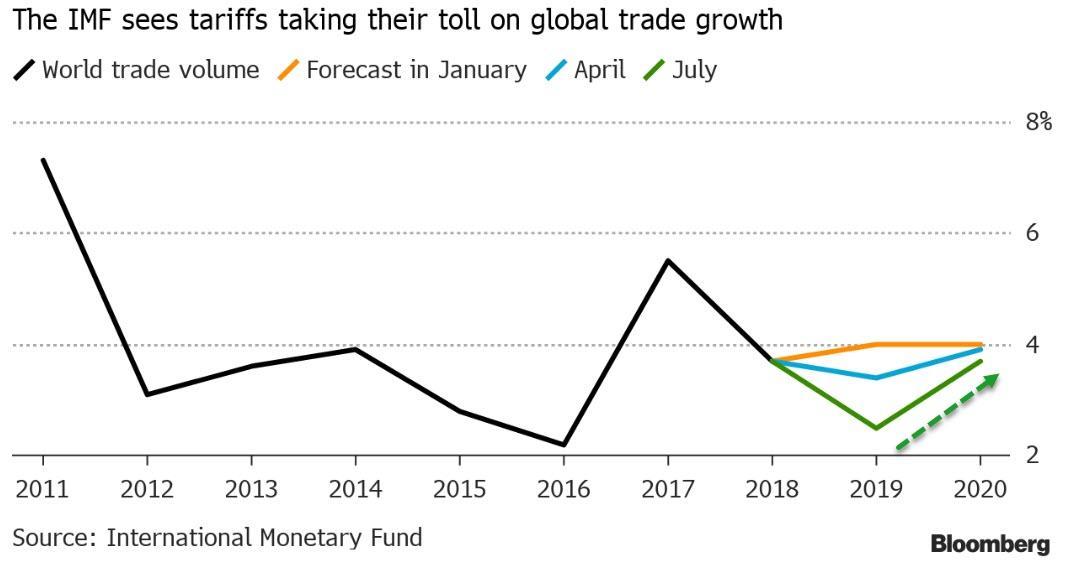

Goldilocks News: While the IMF saw global trade slowing this year more significantly as a result of the trade tensions, it predicted a bounce back to 3.7% growth in volumes in 2020, the same pace as 2018.

“It’s absolutely urgent to end these trade wars as soon as possible, to not escalate, and also to roll back the tariffs in place,” Chief Economist Gita Gopinath said in an interview with Bloomberg’s Tom Keene ahead of Tuesday’s report.

“That will have a big boost to business sentiment that will raise investment and be good for the global economy.”

Watch the press conference here:

via ZeroHedge News https://ift.tt/30Syybs credittrader