Authored by Lance Roberts via RealInvestmentAdvice.com,

Over the last couple of weeks, I have laid out the bull and bear case for the S&P 500 rising to 3300, and the case for the Fed to cut rates. In summary, the basic driver of the “bull market thesis” has essentially come down to Central Bank policy.

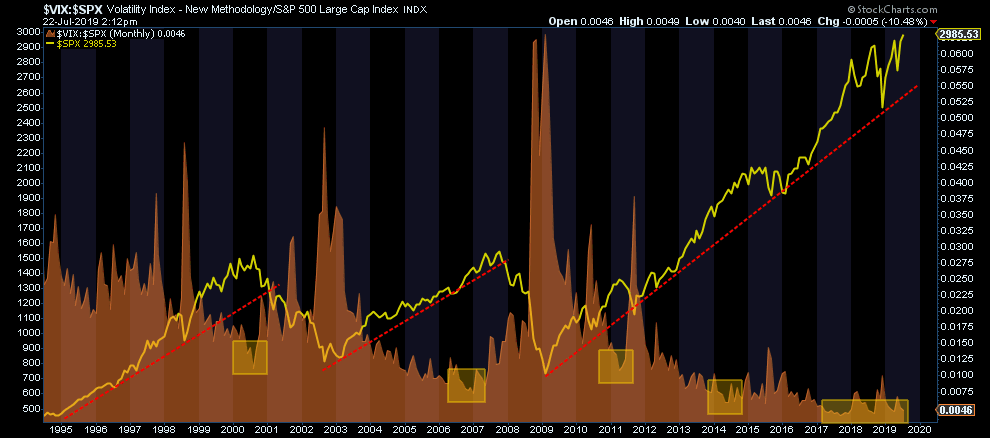

This reliance on the Fed has led to a marked rise in “complacency” by investors in recent weeks despite a burgeoning list of issues. As shown in the chart below, the ratio of the “volatility index” as compared to the S&P 500 index is near it’s lowest level on record going back to 1995.

Combine that with investors now completely back in the market, and you have the ingredients for a decent short-term correction in the weeks ahead.

In other words, investors are “all in” based on hopes the Fed will cut rates. However, rate cuts are unlikely to reverse the macro pressures facing the markets currently. Such as:

-

The global economy IS slowing.

-

Interest rates have turned lower with nearly 1/3 of Sovereign bonds now sporting negative yields.

-

China, representing 30% of global GDP growth, has slowed markedly.

-

Domestic GDP is expected to rise by only 1.50% in the second quarter, which is a sharp reversal from last year.

-

The trade war with China, and to a lesser degree Europe, has not been resolved and could accelerate on a Tweet.

-

Not surprisingly, ten years into an expansion, markets at record highs, unemployment near 50-year lows, and inflation is near the Fed’s target. Yet, the Fed is talking about cutting rates at the end of the month. What does the Fed know that we do not?

-

The potential for a hard Brexit is still prevalent.

-

Earnings expectations have fallen markedly along with actual earnings and revenues.

There is much more, but you get the idea.

Investors are currently betting very heavily on a “weak” hand as they ignore the “risk.”

What Is Risk?

The word “RISK” is not normally associated with positive outcomes. For example:

-

Walking a tightrope without a safety net.

-

Driving with a blindfold on.

-

Hanging off the edge of skyscrapers

Yes, professionals do these things and survive. But for the average person, it could mean serious injury or even death.

The same idea of “risk” applies to investing.

Many individuals convince themselves that in order to make more money, they need to take on more “risk.” The correlation, over the short-term, may indeed seem positive when markets are trending higher.

However, the reality is quite different. “Risk” in a portfolio can be directly correlated to the amount of loss (destruction of capital) which occurs when something inevitably goes wrong.

The Poker Analogy

Last week, I was visiting with a new client who had just transferred over from one of the “big box” financial firms. Of course, as usual, she began to regurgitate the media-driven myths of how she was a “long term”investor, how she was diversified, and since she was an “aggressive” investor with a “high risk tolerance,”she was willing to ride out the “wiggles” in the market.

It only takes a couple of questions to derail these myths.

-

What did you do in 2001-2002 and/or 2008?

-

How did you feel?

-

Are you willing to do that again?

Since the “dot.com” bust, when I began asking those questions, I have NEVER had anyone tell me:

-

I sold near the top and bought near the bottom. (Sell High/Buy Low)

-

It was a truly terrific experience watching half of my money disappear.

-

Absolutely, just tell me when so I can get some popcorn.

In this particular case, she happened to be an avid “poker player” and enjoyed going to Las Vegas for a “few hands” at the tables. Poker is a straightforward comparison to investing as the general rules of risk management apply to both. The conversation was quick.

“Do you go ‘all in’ on every hand you are dealt?”

“Of course, not” she responded.

“Why not?”

“Because I will lose all my money,” she said.

“You say that with certainty. Why?”

“Well, I am not going to win every hand, so if I bet everything, I will certainly lose everything” she stated.

“Correct. So why do you invest that way?”

“………….Silence………………….”

The issue of “risk,” as stated above, whether it is in the financial markets or a hand of poker, is the same. It is simply how much money you lose when the “bet” you made goes wrong.

In poker, most individuals can not calculate the odds of drawing a winning hand. However, while they may not know the odds of drawing a “full house” in a 7-card poker hand is just 2.6%, they do know the odds of “winning” with such a hand are fairly high. Therefore, they are comfortable betting heavier on that particular hand.

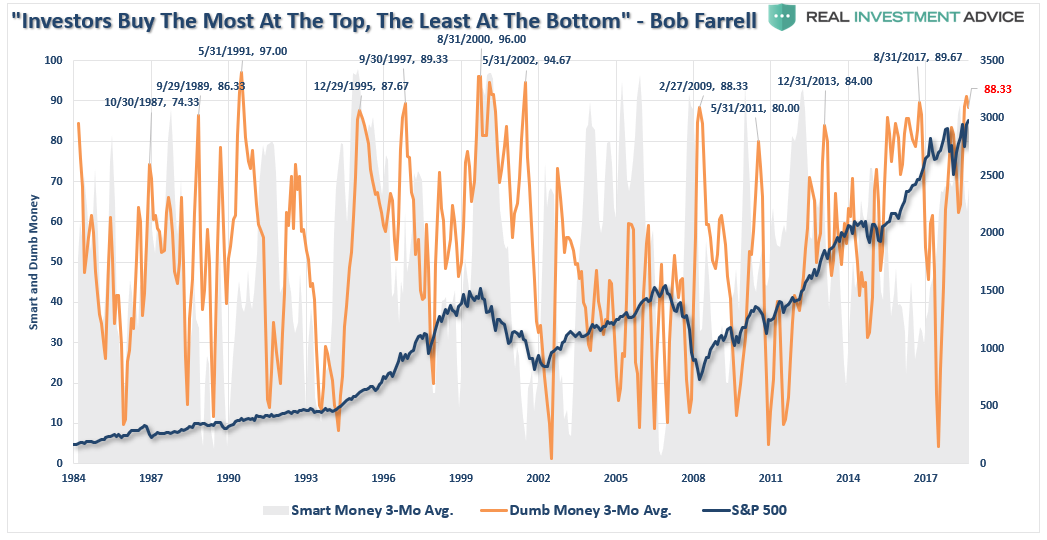

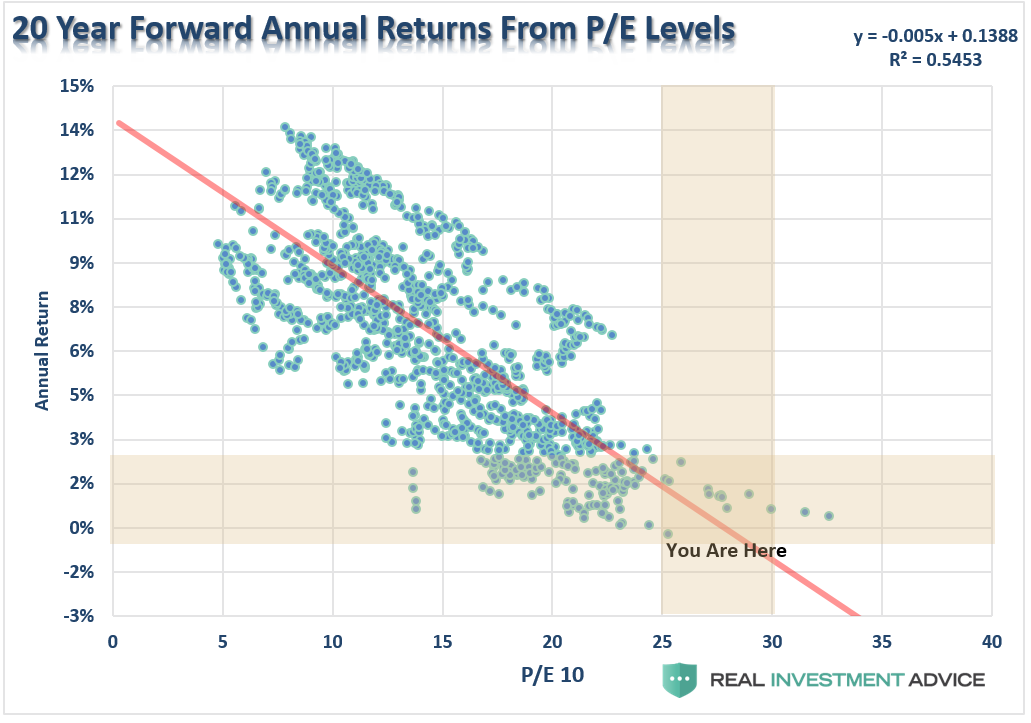

When it comes to investing, they are comfortable betting their retirement savings on a market which, at current valuation levels, has a long history of delivering less than optimal results. I have shown you the following chart before, and statistically speaking, the odds aren’t in your favor.

Despite this simple reality, investors continue to chase stocks as if future returns over the next 10-years will be as profitable as the last 10-years. This most likely will not be the case.

To make this clearer, let’s equate market fundamentals to poker hands.

If individuals were presented with the following “hand,” rather than media rhetoric, do you think they would quickly put all their retirement savings in the markets.?

Sure, one could absolutely win with a “high card hand” assuming everyone else at the table is in exactly the same position without an “Ace.” But what are the “odds” of that being the case?

However, this is the market as it exists today and the media is telling you to “be all in” as it is a “no lose”proposition.

Are you all in?

I’ll bet you are and your reasoning is completely logical – “The market is going up.”

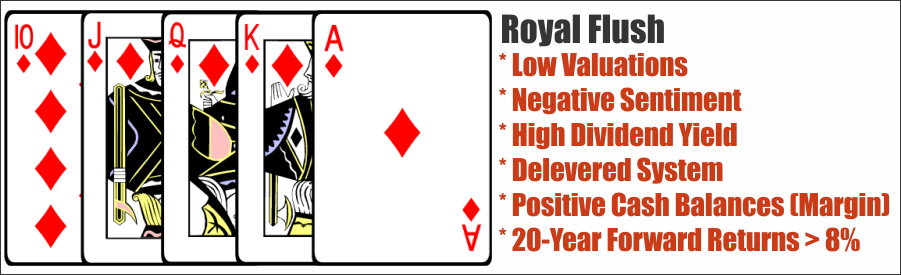

What if you were dealt the following hand?

Are you “all-in” now?

You should be, but you won’t be.

Why? Because this is what markets look like following major, mean reverting events. It is at this point individuals have learned the lesson of “risk,” and want nothing to do with the “financial markets ever again.”

If you were around in 2009, you remember.

The issue of understanding risk/reward is the single most valuable aspect of managing a portfolio. Chasing performance in the short-term can seem to be a profitable venture, just as if hitting a “hot streak” playing poker can seem to be a “no lose” proposition.

But in the end, the “house always wins” unless you play by the rules.

8-Rules Of Poker:

1) You need an edge

As Peter Lynch once stated:

“Investing without research is like playing stud poker and never looking at the cards.”

There is a clear parallel between how successful poker players operate and those who are generally less sober, more emotional, and less expert. The financial markets are nothing more than a very large poker table where your job is to take advantage of those who allow emotions to drive their decisions and those who “bet recklessly” based on “hope” and “intuition.”

2) Develop an expertise in more than one area

The difference between winning occasionally, and winning consistently, in the financial markets is to be able to adapt to the changing market environments. There is no one investment style that is in favor every single year – which is why those that chase last year’s “hot hands” are generally the least successful investors over a 10- and 20-year period.

As the great Wayne Gretzky once said:

“I skate where the puck is going to be, not where it has been.”

3) Figure out why people are betting against you.

“We know nothing for certain.” Managing a portfolio for “what we don’t know” is the hardest part of investing. With stocks, we must always remember that there is always someone on the other side of the trade. Every time some fund manager on television encourages you to “buy,” someone else has to be willing to sell those shares to you. Why are they selling? What do they know that you don’t?

3) Don’t assume you are the smartest person at the table.

When an investment meets your objectives, be willing to take some profits. When it begins to break down, hedge the risk. When your reasons for buying have changed, be willing to “call it a day and walk away from the table.”

4) It often pays to pass, and 5) Know when to quit and cash in your chips

Kenny Rogers summed this up best:

“You’ve got to know when to hold ’em. Know when to fold ’em. Know when to walk away. Know when to run.”

All great investors develop a risk management philosophy (a sell discipline) and combining that with a set of tools to implement that strategy. This increases the odds of success by removing the emotional biases that interfere with investment decisions. Just as a professional poker player is disciplined with his craft, a disciplined strategy allows for the successful navigation of a fluid investment landscape. A disciplined strategy no only tells you when you to “make a bet,” but also when to “walk away.”

6) Know your strengths AND your weaknesses & 7) When you can’t focus 100% on the task at hand – take a break.

Two-time World Series of Poker winner Doyle Brunson joked a bit about his book with which he had thrown around two alternative ideas for titles before going with “Super/System.” The first was “How I made over $1,000,000 Playing Poker,” and the second equally accurate idea was, ‘How I lost over $1,000,000 playing Golf.”

The larger point here is that invariably there will be things in life that you are good at, and there are things you are much better off paying someone else to do.

8) Be patient

Patience is hard. Most investors want immediate gratification when they make an investment. However, real investments can take years to produce their real results, sometimes, even decades. More importantly, as with playing poker, you are not going to win every hand and there are going to be times that nothing seems to be “going your way”. But that is the nature of investing; no investment discipline works ALL of the time. However, it is sticking with your discipline and remaining patient, provided it is a sound discipline to start with, that will ultimately lead to long-term success.

Those are the rules. Play by them and you have a better chance of winning. Don’t, and you will likely lose more than you can currently imagine. As the old saying goes:

“If you look around the poker table and can’t spot the pigeon, it’s probably you.”

via ZeroHedge News https://ift.tt/2Y1juuS Tyler Durden