If one ever needed evidence that such a thing as bank karma exists, look no further than Deutsche Bank, which after manipulating and rigging every market it traded in, violating virtually every regulation and anti-money laundering rule in existence, and quietly witnessing the bizarre, unexplained suicide by more than one senior official, has been caught in a downward spiral of spectacular collapse which culminated recently with the biggest corporate restructuring and mass layoff announced by a major bank. And then there are the earnings.

On Wednesday, the bank that is set to layoff over 20% of its workforce, reported a dramatic decline in trading revenue resulting in a far bigger than expected €3.16 billion net loss, a far cry from the €361MM profit a year ago. While the revenue of €6.2 billion was in line with the preliminary release from July 7, the bank warned that 2019 group revenue would be lower than 2018, blaming lower interest rates on increasing pressure on revenue after trading slump deepened in the second quarter, adding urgency to Chief Executive Officer Christian Sewing’s overhaul plans.

As many expected – largely since it is now firing front-line traders – the bank again underperformed Wall Street peers in trading, with income from buying and selling securities slumping 12%, led by a decline of about a third in the now defunct equities business. While Q2 FICC sales & trading revenue of €1.32 billion was a fraction better than the company-compiled estimate EU1.31 billion, equities sales & trading revenue €369 million badly missed the estimate of €480 million. Fixed income trading declined 11% when adjusting for the TradeWeb IPO. While Sewing is keeping that business, he is reducing the amount of capital it uses.

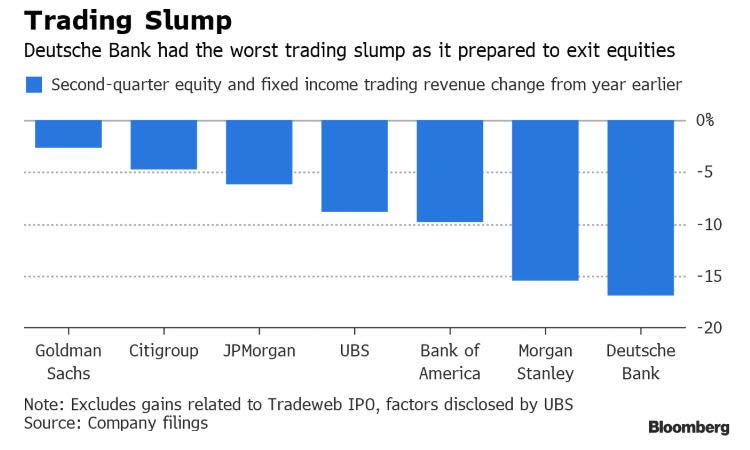

The resulting total Q2 trading revenue of €1.69 billion not only missed the average estimate of €1.79 billion, but the 17% decline in trading revenue was the worst of all major Wall Street peers.

Deutsche Bank’s dismal trading Q2 results compared with a decline of around 8% at the five biggest Wall Street banks. UBS Group on Tuesday reported a 9% slump in equities trading and 7% lower revenue from fixed income, which however was better than expected and lifted DBK shares sharply higher. Oops.

Deutsche Bank said it started losing business during the quarter as it became clear it would exit equities trading. Sergio Ermotti, the UBS CEO, said Tuesday that some of the balances from the German lender’s business are coming to his bank’s prime brokerage unit; as a reminder, last week we reported that Deutsche was seeing a whopping €1 billion in daily outflows, as part of its exit from equities, in which the German lender had agreed to transfer some 150 billion euros of balances linked to hedge funds to French rival BNP Paribas SA. Additionally, Deutsche Bank is planning to auction its equity derivatives portfolio and kick off the process in the coming weeks, Bloomberg reports.

At the global transaction bank, which CEO Sewing is separating from the investment bank to make it the centerpiece of a new corporate bank division headed by Stefan Hoops, revenue was essentially flat when adjusting for a one-time gain a year earlier.

Elsewhere, Q2 Private & Commercial Bank revenue of €2.49 billion was in line with the company-compiled estimate EU2.49 billion; meanwhile Asset Management revenue €593 million was slightly ahead of estimates.

But wait, there’s more: after warning of about a €2.8 billion charge just a few weeks back, Deutsche decided to make Q2 into yet another kitchen sink quarter, as the bottom line result also included a bigger than expected €3.4 billion restructuring charge. How DB found an additional several hundred million in “one-time expenses” to lump into the charges in under a month is somewhat perplexing, yet traders would have likely let it slide… if only such “kitchen sinking” wasn’t now a regular, quarterly event at Deutsche Bank.

The pain was not over yet, as CFO James von Moltke had even more surprises in store, when he suggested the outlook for lower rates add further downside pressure on revenues: “Frankly it does represent a revenue pressure for us and all of the banks if rates from here go down further,” von Moltke said in an interview with Bloomberg Television. “It’s something that, as you say, is a significant risk to us.”

Von Moltke said earlier this month that the goal of lifting return on tangible equity to 8% in 2022 “is realistic given the interest rate environment we’re facing.” The bank wants to boost its annual revenue by 2 billion euros through 2022, helped by a “modest improvement” in rates.

“We provided a set of numbers,” von Moltke said on Wednesday. “As one always does, one has to make some planning assumptions, those happened to be at the end of May and we are very aware that the outlook deteriorated during June.”

The CFO also said he expected another €2 billion in second half charges, as he hopes to stabilize and grow revenue in the core bank. He also said that the bank would like to have job numbers in the high 80,000s by the end of the year, down from above 90,000 at present, and has given job notifications to about 900 equities staff.

Moltke said that if the European Central Bank does lower rates, he expects it to shield commercial banks from further harm through deposit tiering, in which some overnight deposits that banks park at the ECB are excluded or charged a less punitive rate. We explained last night why absent tiering, the ECB risked crushing Europe’s already suffering banks.

Attempts to put a favorable spin on the latest disastrous numbers fell far short alas, and as Thomas Hallett, bank analyst at Keefe, Bruyette & Woods in London, wrote, “client retention risks, an unfavorable interest rate environment and negative secular trends across divisions present material headwinds to management plans. These results do little to allay market concerns on the ability to deliver on those targets.”

Citi’s Andrew Coombs said he is “most cautious” on the ~€25b revenue assumption the bank has for its 2022 targets. The analyst estimates a greater risk of revenue attrition in the investment bank and believes the bank might need to factor in lower rates at its corporate and retail division

How DB will turnaround the ship with what is increasingly looking like a sub-skeleton crew of workers remains unknown: the German lender’s overhaul resulted in the departure of investment banking head Garth Ritchie. Sewing has taken over oversight over the division at the management board level while operational oversight has been split between Hoops; Mark Fedorcik, head of the investment bank; and Ram Nayak, in charge of fixed-income trading. Christiana Riley, who’s running the bank’s U.S. operations, will join the management board pending regulatory approval.

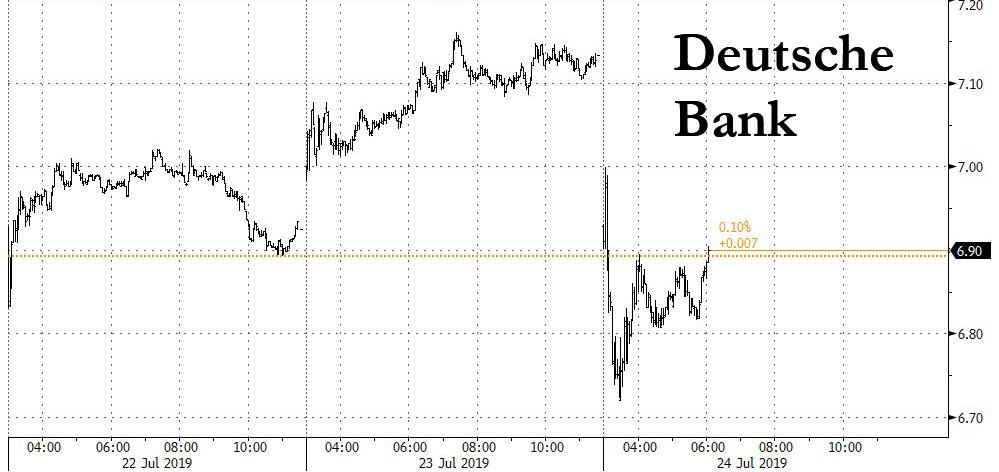

Deutsche Bank shares fall as much as 5.3% in early Frankfurt trading after the lender reported the disappointing results, and guided to even lower revenue. The move followed an odd gain of 3% on Tuesday after results from UBS and a lift in macro sentiment gave banking stocks a boost.

via ZeroHedge News https://ift.tt/2Yqqdhr Tyler Durden