S&P futures reversed a two-day rally, dropping alongside European stocks, led by the tech sector after the DOJ announced it was launching a broad, anti-trust review of the mega-tech (FANG) names, while weaker-than-expected composite PMIs in the Eurozone weighed on equities and sent bond yields to new all time lows, with manufacturing readings in Germany and France standing out. The dollar slumped while cable spiked one day after BoJo was elected as the next prime minister.

Weaker-than-expected composite PMIs in Germany and France weighed on equities and lifted bond prices, with manufacturing readings in Germany and France standing out, as the recession in Germany’s manufacturing sector worsened in July with the performance of goods producers dropping to the lowest level in seven years while French business growth slowed unexpectedly, the latest PMIs showed.

Trade tensions, weaker demand abroad and the travails of the car industry have built up over the past year to take a toll on the engine of Europe’s economy. They’ve dragged manufacturing into its deepest slump in seven years, and some of the nation’s biggest corporate names from BASF SE to Daimler AG and Continental AG have had to come to terms with a new reality for business. As one of the world’s biggest exporters, Germany is paying a high price for the the slowdown in global trade. The economy is forecast to grow the least in six years in 2019, the Bundesbank sees no sign of an export recovery and some are even saying there’s a risk of recession.

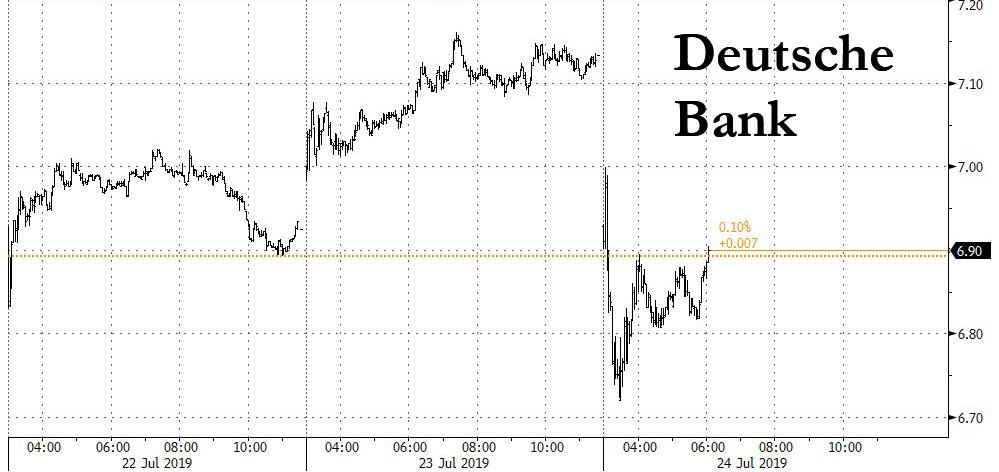

Beyond manufacturing, Germany’s image has also been dented by the troubles at Deutsche Bank AG, which is cutting thousands of jobs, and warned Wednesday that its trading slump deepened sending its stock sharply lower.

Downbeat earnings as well as the weaker-than-expected Eurozone manufacturing surveys took European shares and the euro a leg lower, with the single currency hitting two-month lows. Following strentgh in Asia, MSCI’S All-Country World index extended its previous day’s gains by a whisker, rising 0.02%. Sentiment was boosted by a Bloomberg report that U.S. Trade Representative Robert Lighthizer would travel to Shanghai next week for meetings with Chinese officials.

“While the resumption of trade talks appears to mitigate any near-term deterioration in US-China tensions, prudent investors will not get carried away, seeing as a meaningful deal still seems a long way off,” said Han Tan, market analyst at FXTM.

Asian stocks climbed for a second day, led by communications firms, as U.S. officials prepare to travel to China next week for trade negotiations. Markets in the region were mixed, with China and Australia advancing and India retreating. The Shanghai Composite Index rose 0.8% for its biggest gain in three weeks, as large insurers and banks offered strong support. The Topix added 0.4%, driven by Toyota Motor and Sony. SoftBank gained 1% following a report that it’s close to announcing the launch of a new technology investment vehicle modeled on its giant $100 billion Vision Fund. The Bank of Japan may lower its inflation forecast for this fiscal year and downgrade some of its economic growth projections. India’s Sensex slipped 0.2%, with Reliance Industries and Larsen & Toubro among the biggest drags, as investors judged bad debt risks at some financial companies.

With the latest PMIs confirming Europe is on the edge of recession, the ECB is thought likely to at least offer a nod to easier policy at its meeting on Thursday. Meanwhile, in the US, futures remain 100% priced for a rate cut of 25 basis points from the Federal Reserve next week, and even imply an 18% chance of 50 basis points. The prospect of widespread central bank largesse helped take the sting out of a downgrade to the IMF’s global growth forecasts.

“There are two conflicting catalysts for stock traders right now: on one hand, central banks around the world are about to embark on an easing initiative…,” said Konstantinos Anthis, head of research at ADSS. “On the other though, the slowdown in growth on a global scale and various geopolitical factors keep weighing down on corporate profitability, asking questions on whether equities have peaked.”

In FX, the euro declined for a fourth day after manufacturing gauges in Europe came in weaker than forecast. The common currency hit a two-month lows at $1.1127, falling further after the weak PMIs. It also hit a near seven-month trough against the yen at 120.19 though it recovered from a two-year low versus the Swiss franc. The Australian dollar tumbled after a domestic bank that has correctly called previous policy decisions flagged two more rate cuts. The pound reversed losses before Boris Johnson was set to be appointed U.K. prime minister, with a cabinet reshuffle expected later Wednesday, with investors unclear as to whether he will lead the country to a no-deal EU exit or find a compromise.

“We believe that in the short term the market is overstating the risk of a no deal,” said Mark Haefele, chief investment officer at UBS Global Wealth Management. “While a no-deal Brexit remains possible over the longer term, our view is that the most likely path in the short term is for a further extension to the UK’s 31 October exit day, either due to a change in stance from PM Johnson, or in the case of a general election.”

In rates, fears of a European recession sent investors toward the safety of German bunds, with Treasury and gilt yields also sliding lower in unison. European bond yields lower across the curves, also dragging down UST yields, with BTPs and Bonos outperforming.

Expected data include PMI readings, mortgage applications and new home sales. AT&T, Boeing, Caterpillar, UPS, Facebook, Ford, and Tesla are among companies reporting earnings

Market Snapshot

- S&P 500 futures down 0.3% to 2,998.25

- STOXX Europe 600 down 0.1% to 391.14

- MXAP up 0.2% to 160.97

- MXAPJ down 0.03% to 528.60

- Nikkei up 0.4% to 21,709.57

- Topix up 0.4% to 1,575.09

- Hang Seng Index up 0.2% to 28,524.04

- Shanghai Composite up 0.8% to 2,923.28

- Sensex down 0.3% to 37,881.58

- Australia S&P/ASX 200 up 0.8% to 6,776.67

- Kospi down 0.9% to 2,082.30

- German 10Y yield fell 2.6 bps to -0.381%

- Euro down 0.1% to $1.1137

- Italian 10Y yield fell 5.0 bps to 1.25%

- Spanish 10Y yield fell 3.1 bps to 0.363%

- Brent futures up 0.4% to $64.11/bbl

- Gold spot up 0.4% to $1,423.97

- U.S. Dollar Index little changed at 97.71

Top Overnight News from Bloomberg

- European Central Bank policy makers have plenty of reasons to wait until September before committing to more stimulus; in the run-up to their meeting, Governing Council members have said that additional support measures are available, if needed, to boost the euro zone’s ailing economy

- U.S. Trade Representative Robert Lighthizer and senior U.S. officials are set to travel to China next Monday for the first high-level, face-to-face trade negotiations between the world’s two biggest economies since talks broke down in May

- Boris Johnson will formally take office as U.K. prime minister Wednesday and seek to build a government that will bring his Conservative Party together and deliver Brexit The new leader will give hardline Brexiteer Priti Patel a cabinet role and promote politicians of all stripes to try to reflect modern Britain, according to a person familiar with his plans

- U.K. businesses urges Johnson to soften “hugely worrying” Brexit stance

- China’s central bank governor said the country’s current interest rates are at an appropriate level, and policy will reflect domestic considerations

- Bank of Japan will probably lower its inflation forecast for this fiscal year and may also downgrade some of its economic growth projections at its meeting next week, according to people familiar

- Oil rallied as plans for a meeting between the U.S. and China offered a hint of progress in the trade war dividing the world’s two biggest economies

- Speaker Nancy Pelosi says the House will have the votes to pass the budget, debt limit deal

Asian equity markets traded mostly higher with sentiment lifted by US-China trade hopes after reports US Trade Representative Lighthizer will lead a small team of negotiators to China next Monday for trade discussions. This underpinned major indices on Wall St. with outperformance seen in the trade sensitive sectors such as materials and industrials, although futures pared some of the gains after-market on news the DoJ is to open a broad antitrust review on the large tech firms. Nonetheless, ASX 200 (+0.8%) and Nikkei 225 (+0.4%) were higher with broad strength seen in Australia aside from the mining sector, while gains in Tokyo were capped amid a downturn among JPY-crosses. Hang Seng (+0.3%) and Shanghai Comp. (+0.8%) showed a strong performance on the trade optimism which was also helped by US Commerce Secretary Ross who said he will deal with Huawei waiver applications within the next few weeks, while China was also said to be looking to make more agricultural purchases as a goodwill gesture. Finally, 10yr JGBs were uneventful with demand sapped following similar uninspiring trade in USTs amid the positive risk tone and with the BoJ also absent from the market today.

Top Asian News

- World’s Top Toymaker Joins Companies Leaving China’s Factories

- Japan May Soon Gain A Powerful Trade Weapon Against South Korea

- Hong Kong’s NWS Is Said to Mull Sale of Public Transport Assets

- Malaysia’s PE Fund Said to Weigh Options for Oil Tanker Operator

Major European bourses are marginally lower [Eurostoxx 50 -0.2%] following on from a relatively flat open as overall downbeat flash PMIs from Europe weighted on the region. UK’s FTSE 100 (-1.0%) lags its peers amid unfavourable currency action coupled with underperformance in heavyweight mining names following a barrage of broker downgrades. As such, Rio Tinto (-4.0%), BHP (-3.4%) and Anglo American (-3.1%) all rest at the foot of the index. Sectors are mixed with defensive sectors supported due to the current cautious risk tone. In terms of individual movers, ASM (+7.3%), ITV (+6.1%) and Akzo Nobel (+4.1%) shares are all fuelled by earnings and trade at the top of the Stoxx 600. On the flip side, Deutsche Bank (-3.7%) shares plumbed the depths post-earning after the German lender reported a larger than expected net loss and cut its FY 19 revenue guidance.

Top European News

- Euro Area’s Economic Struggles Persist as Industry Slump Deepens

- Dovish ECB Renders More Czech Rate Hikes Pointless for Michl

- Paris Scorches in Historic Drought as Heatwave Fries Europe

- Repsol Announces Buyback Plan as Oil Earnings Kick Off

In FX, dollar bulls have gleaned even more encouragement from unfolding US-China trade developments given that face-to-face talks look set to resume early next week, and Beijing offers to buy more agricultural goods as a good will gesture in response. Moreover, the Dollar continues to proffer from the demise of others and increasingly constructive technical impulses with the DXY eclipsing a Fib retracement level and inching closer towards the psychological 98.000 mark.

- AUD/NZD – The Aussie has given up 0.7000+ status and is now threatening to slide below 0.6975 in wake of slowdowns in all CBA PMI readings overnight and yet another dovish RBA policy call looking for 2 further cuts in the OCR (Westpac this time eyeing moves in October and February 2020). All this ahead of comments from RBA Lowe in the early hours on Thursday and in contrast to the Kiwi that is keeping in contact with 0.6700 after a wider than forecast NZ trade balance, albeit due to a bigger miss on the import side vs exports.

- EUR/CHF/CAD – The single currency has also been undermined by PMI surveys, and in particular the manufacturing prints showing France on the 50 threshold and Germany sinking deeper into contraction. With Eurozone M3 also softer than expected, rate cut odds have now tipped in favour of 10 bp for tomorrow’s ECB meeting and Eur/Usd is losing sight of decent option expiry interest at 1.1150 (1 bn) as a result, but holding above the ytd base and 1.1100 where big barriers lie. Meanwhile, the Franc has retreated further vs the Buck within a 0.9850-75 band, but remains above 1.1000 against the Euro pending Thursday’s ECB policy pronouncements and the SNB’s response, but the Loonie has clawed back some lost ground vs its US counterpart to meander between 1.3129-47 compared to 1.3164 or so at one stage on Tuesday.

- GBP/JPY – Relative outperformers and bucking the overall trend, as the Pound maintains its recovery momentum following confirmation that Boris Johnson will take over the reins from Theresa May as Tory Party head. Cable has extended its rebound from near 1.2400 to 1.2480+ awaiting the official unveiling of the new PM and his Cabinet line up, with Eur/Gbp down towards 0.8925 and early July mtd lows. Similarly, the Yen is still displaying resilience in the face of overall Usd strength and upbeat risk sentiment despite ongoing geopolitical tensions, with a reluctance to stray too far from 108.00 where massive expiries roll off (4.3 bn) and technical resistance capping the upside (108.31 Fib).

- EM – The Rand remains in the spotlight amidst comments from SARB Governor Kganyago underlining post-rate cut guidance for limited additional monetary stimulus and CPI data that was slightly firmer than anticipated in m/m terms. Usd/Zar is hovering just below 13.9500 as the Central Bank head highlights the fact that neutral rates have risen due to risk premia of late and this makes it tougher for further easing.

In commodities, WTI and Brent futures are taking a breather from last night’s geopolitical-induced gains in which the benchmarks reclaimed USD 57/bbl and USD 64/bbl to the upside on reports that UK approached EU nations to join a European-led mission for safe shipping via the Strait of Hormuz. Furthermore, reports of a US delegation heading to China on Monday exacerbated upside in the complex on sentiment. Meanwhile, the mammoth drawdown in API crude stocks (-10.96mln vs. Exp. -4.0mln) added further fuel to the upside for oil, although the immediate jolt was quickly faded due to bearish components of the release including a surprise build in gasoline inventories, it’s worth noting that this week’s inventory data also captures the late effects of Storm Barry. Elsewhere, spot gold in is crawling higher as the yellow metal consolidates following its recent decline from 6yr highs. Copper prices are marginally lower amid the cautious risk tone, albeit remain above USD 2.70/lb, while Dalian Iron ore extended losses amid slowing demand in the wake of output restrictions on steel producers in China’s top steel-making city Tangshan.

US Event Calendar

- 7am: MBA Mortgage Applications, prior -1.1%

- 9:45am: Markit US Manufacturing PMI, est. 51, prior 50.6; Services PMI, est. 51.8, prior 51.5

- 10am: New Home Sales, est. 658,000, prior 626,000; est. 5.11%, prior -7.8%

DB’s Jim Reid concludes the overnight wrap

I’ve been promised the hottest night of my life this week. For the avoidance of doubt, meteorologists have suggested that this week will likely see the hottest overnight temperatures on record here in the UK and the hottest July day on record and possibly a new overall record. I must admit the more I read about climate change the more worried I get. However all I will say is that since we moved house three months ago we must have eaten outside in the evening 90% of the time I’ve been around. It’s been absolutely fantastic. Not even a swarm of flying ants could stop us last night. The only thing missing was a glass of Rose. Interestingly flying ants have been so prevalent over the last week in the South of England that they’ve appeared on weather radars and some forecasters initially mistook them for a band of rain!

As well as potentially being the hottest day ever tomorrow, it’s possible we’ll also start the latest round of global monetary stimulus or at least get new dovish forward guidance from the ECB. Given we’re on the eve of such an event and given that we have seen a big rally in global assets as a prelude, I found it interesting to read DB’s Binky Chadha’s latest asset allocation piece yesterday (see link here). In it he showed that since the 1950s, the Fed has embarked on 19 easing cycles, including the unconventional easing measures adopted during the course of this economic recovery. However of these, 9 or almost half, saw the economy eventually slip into recession. The episodes that ended in recession saw the ISM continue to weaken, eventually bottoming – 8 months after the Fed began cutting – at low levels (median 36). In these recession episodes, the S&P 500 saw a full bear market, typically falling -27% from peak to trough, with a bulk of the decline occurring after the Fed had started easing. Indeed, on average, the S&P 500 did not bottom until 5 months after the Fed started cutting. The distinguishing characteristic of the episodes that did not end in recessions was that after a moderate further decline in growth (to a median ISM 48), on average within 2-3 months after the Fed began easing, growth rebounded quickly. The equity market typically fell -7% after the Fed began easing, but bottomed quickly with growth. The S&P 500 ended above the pre-easing level within 6 months each and every time, rising a robust 12% on average. So my take on this is that history suggests a much higher probability of an imminent recession than markets do and also that we’re at quite a binary moment for markets as the Fed (and other central banks) embark on a fresh easing cycle. See the piece for much more detail.

In terms of markets yesterday, the focus was a further rally for equities across the world, with the S&P 500 closing +0.69% higher and above the 3000 level for only the fourth time in history. Elsewhere, the DOW and NASDAQ advanced +0.65% and +0.58%. After US markets closed, the Justice Department said it is investigating tech firms for antitrust violations, which caused the Nasdaq to retrace a bit more than half of its gains from yesterday, with futures down -0.18% overnight. Shares of Amazon (-0.95%), Alphabet (-0.96%) and Facebook (-1.54%) declined c.1% in after-hours trading. Prior to that, indexes were supported by strong earnings reports, as well as positive news on the trade front after Europe went home. USTR Lighthizer and other senior officials will reportedly travel to China on Monday for face-to-face talks, likely staying through Wednesday. European equities rallied as well before this news, with the STOXX 600 up +0.98% and the DAX trading +1.64%.

The positive trade news has also supported the Asian session overnight with Chinese markets leading advances – the CSI (+1.03%), Shanghai Comp (+1.01%) and Shenzhen Comp (+1.39%) are all up over 1%. The Nikkei (+0.46%) and Hang Seng (+0.93%) are also up while the Kospi is down -0.25%. Elsewhere, futures on the S&P 500 are trading largely unchanged while crude oil prices (WTI +0.41%, Brent +0.27%) are up for the fourth day in a row on a report from the American Petroleum Institute which showed a 10.96 million barrel decline in US crude stockpiles last week. In terms of overnight data releases Japan’s preliminary July manufacturing PMI came in at 49.6 (vs. 49.3 last month) while the services PMI stood at +52.3 (vs. 51.9 last month) bringing the composite PMI print to 51.2 (vs. 50.8 last month).

Ahead of tomorrow’s ECB meeting the next test will be the rest of today’s flash global PMIs. The last few months have seen some stabilisation in the data with the manufacturing PMI for the Euro Area hitting 47.6 in June (vs. 47.7, 47.9 and 47.5 in the three months prior). The consensus expects a 47.7 reading for July. As for the services reading the consensus expects a 53.3 print which compares to 53.6 last month. We should note that we’ll also get country level PMI data for Germany, France, and also the US.

Turning back to the earnings reports from yesterday, Coca-Cola (+6.07%) and United Technologies (+1.50%) led gains. Coca-Cola shares climbed to a record high after their results showed a strong increase in demand, with full-year revenue growth estimated to grow 5%, up 1pp from the previous guidance. Demand from China has been a key driver of that growth, with sales volumes up 7% in Asia’s largest economy. United Technologies also raised their guidance, citing strong jet engine sales. After hours, Texas Instruments (+7.01%) and Snap (+9.10%) rallied strongly, as the former raised its guidance and the latter increased its daily user count to 203 million, compared to consensus estimates for 192 million.

The risk-on sentiment bled over into fixed income markets, where 10-year treasury yields rose +2.6bps. Two-year yields rose +2.5bps, leaving the 2y10y curve roughly flat. Earlier in the session, European yields rallied with bund yields down -0.9bps to -0.355%. BTPs outperformed, gaining -5.1bps. In the UK, gilt yields fell -1.6bps and the Treasury sold new 10-year notes at their second lowest ever yield at 0.789%, above only the September 2016 auction. In credit, HY spreads tightened -3.6bps and -4.7bps in Europe and the US. This morning we have published an update of our analysis looking at relative value between the EUR and USD HY markets. EUR HY has generally outperformed since February and within the note we assess whether USD HY is now starting to look relatively more attractive ( link here).

As widely expected, Boris Johnson was elected the leader of the Conservative Party yesterday, and as such will become the new UK PM this afternoon. While journals stretching to the moon and back have been written on the Brexit implications, less has been written on the wider economic policy mix of the incoming government. DB’s Oli Harvey wrote on this yesterday (see link here) and thinks that if the new administration survives or wins an election we could have a sizeable departure from the post 2010 regime. Indications are that Borisnomics may represent a significant relaxing of fiscal policy leading to materially higher borrowing and hence issuance. At the same time, we think there is at least some possibility the Bank of England’s mandate could be adapted to provide the bank more flexibility over inflation. This policy move is likely to be more extreme in a hard Brexit scenario but fiscal policy is likely going to take the strain in all reasonable scenarios. Oli thinks the best trades are forward steepeners such as 2s10s 2 year forward. As I’ve repeatedly suggested the UK could start the helicopter money experiment (on a hard Brexit) that I think is likely across the globe in the years ahead.

Elsewhere in the UK, there was some attention paid to two BoE speakers, Saunders and Haldane, who both leaned dovishly. Saunders is possibly the biggest hawk on the MPC, but he said that the economy looks weak and “is clearly not overheating,” suggesting potential support for policy easing. Similarly, Haldane said that uncertainty is high and “the case for holding rates until the road becomes clearer is strong.” Considering that he had previously argued for higher rates before the June policy meeting, this was a decidedly dovish shift as well. At the same time, the UK’s CBI manufacturing orders index fell to -34, its lowest level in over 9 years and far worse than the expected -15. The cocktail of dovish signals and weak data pushed the pound -0.31% weaker versus the dollar.

Away from markets, the IMF updated its World Economic Outlook and cut its forecast for global growth by -0.1pp for both 2019 and 2020, to 3.2% and 3.5%, respectively. The update described growth as “sluggish” and “subdued” and also noted that risks are tilted to the downside, emphasizing trade tension uncertainties. Nevertheless, the forecast for the US rose +0.3pp to 2.6% for this year, while Europe’s stayed steady at 1.3%. The forecast for China was revised down -0.1pp, to 6.2%, while India’s was trimmed -0.3pp to 7.0%. The IMF also revised down its forecast for 2019’s growth in world trade volumes by c.1pp, to 2.5%.

To wrap up yesterday’s economic data, in the US it was mostly disappointing, with the Richmond Fed manufacturing index down to -12 versus expectations for a positive print of 5. That contrasts with the recent rebound in surveys from the Philadelphia and New York Feds, giving a cloudier picture ahead of today’s flash PMI. Existing home sales slowed further in June to 5.27mn, weaker than expected, while the FHFA house price index rose only 0.1%, the weakest pace since early 2017 and fourth weakest since 2012. In Europe, consumer confidence improved slightly to -6.6 from -7.2.

Turning to the day ahead, the July flash PMIs in Europe and the US will be the main data focus. Away from that, July confidence indicators are due in France, June M3 money supply data due for the Euro Area and June new home sales data due in the US. Earnings highlights include Boeing, Caterpillar, Ford, Facebook and AT&T. Former Special Counsel Mueller will testify before the House Judiciary and Intelligence committees on Russian election interference.

via ZeroHedge News https://ift.tt/2OdfNxR Tyler Durden