With the Russian stock market fading from all-time highs, the Russian economic minister has warned about a severe economic downturn that could start by 2021 amid current declines in personal lending, reported The Moscow Times.

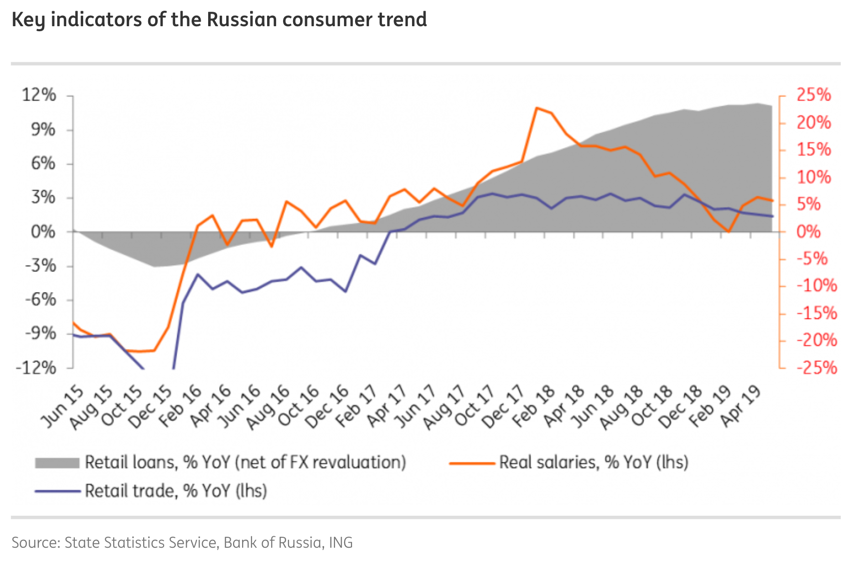

Consumer debt loads have exploded due to plunging real disposable incomes, an issue that President Vladimir Putin said could produce economic bubbles.

The Russian economy is expected to cycle down through 2H19, partly due to a plunge in retail spending.

Economic Development Minister Maxim Oreshkin told the Ekho Moskvy radio station Sunday that GDP is expected to drop by 3% in the next year and a half. Demand for consumer loans is also expected to decline, ushering in a default cycle that will de-lever heavily indebted consumers that can’t get new financing.

According to Oreshkin, many Russians are trapped in insurmountable debts. In the next crisis, he said, massive defaults on these loans will shock the economy.

Oreshkin noted that it would be difficult to get out of the next recession painlessly.

The economic minister said the government is developing mechanisms to cushion citizens if the economy crashes.

Natalia Orlova, a chief economist at Moscow-based Alfa Bank, told the Vedomosti business daily, that Oreshkin’s comments were a sign by consumers to take out new loans.

Moscow-based United Credit Bureau (OKB) reported that personal loans jumped by 46% compared to 2017, totaling $130 billion.

The Russia economy stalled in the last 4.5 years. From 2014 to 2018, GDP grew by an annual rate of 1.50%. During the same period, real disposable incomes fell by 10.7%, leaving 13% of all citizens living in poverty. In 2018, 600,000 Russian companies closed their doors.

Western countries could’ve sparked Russia’s demise through economic sanctions after Putin annexed Crimea in 2014. The sanctions contributed to capital flight, in excess of $317 billion from 2014 to 2018. Foreign direct investments also plunged. In the first three quarters of 2018, the volume of foreign direct investment was 11 times lower than during the same period in 2017.

The Russian ruble has fallen 45.5% against the US dollar since 2014, a trend that should have strengthened Russia’s export market, but it didn’t.

Residential construction, wholesale and retail trade, banking and insurance, personal services, lodging and restaurants, mobile telecoms, and web-based services are likely to come under pressure as an economic crisis in Russia is expected by 2021.

via ZeroHedge News https://ift.tt/2LF53Gg Tyler Durden