Authored by EconomicPrism’s MN Gordon, annotated by Acting-Man’s Pater Tenebrarum,

Tending Towards Maximum Perversity

According to Finagle’s corollary to Murphy’s law, “Anything that can go wrong, will — at the worst possible moment.” Taken a degree further, per O’Toole’s corollary of Finagle’s law, and the second law of thermodynamics, “The perversity of the Universe tends towards a maximum.”

Murphy’s law in action… not even Murphy himself was safe from it. [PT]

No doubt, the perverse effect of central planning on the economy is tending towards a maximum. This tendency can be traced back well over a century, with the advent of the Fed and the federal income tax in 1913. Our purpose today, however, is to look back a mere decade. This offers an adequate sampling of O’Toole’s corollary of Finagle’s law in action.

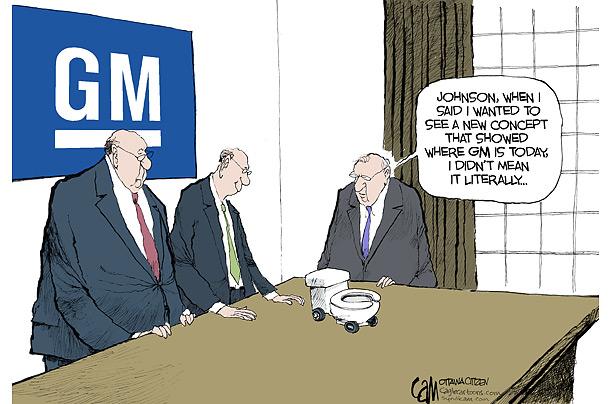

For example, on June 1, 2009, General Motors filed for Chapter 11 bankruptcy protection; the fourth largest bankruptcy in U.S. history. Of course, GM didn’t vanish from the face of the earth. Instead, Washington took 60 percent ownership and nationalized the company with a $50 billion taxpayer bailout. President Obama remarked at the time:

“We are acting as reluctant shareholders because that is the only way to help GM succeed.”

In other words, we must destroy capitalism to save it.

At this juncture GM discovered it would need a bailout… [PT]

The truth is, real free market capitalism disappeared from American shores long before the GM bailout. Nonetheless, this event marked a significant milestone in America’s transformation to a more centrally planned economy. The last 10 years have borne out the consequences.

You see, June 1, 2009, also marked another significant economic event. At the precise moment GM was filing for bankruptcy, America was commencing a record economic expansion. Now, at 121+ months, it is the longest period of uninterrupted growth of the post-WWII era.

But what type of expansion is this, really? After a decade of growth, shouldn’t the rising wealth tide have lifted all boats? That is typically how an economic expansion works.

Over the last decade, however, only the luxury yachts were lifted by the rising tide of cheap credit. The sloops, schooners, and practically every other boat, slipped beneath the surface. But that’s not all…

A Big Fat Goose Egg

The typical working stiff has seen the workplace become inordinately intolerable over the last decade. At a time of supposed record unemployment, employees commonly perform multiple job functions. All the while, their pay has stagnated.

There is also little remaining workplace stability or job security. And because of the connectivity of email and smartphones, the workday never ends. It follows workers home and invades their private lives at the family dinner table. Calls, emails, text messages; the expectation is that you’re wired in at all hours.

Without question, the longest economic expansion in modern U.S. history has been a big fat goose egg. A decade of extreme fiscal intervention through massive deficits year in and year out and heavy handed monetary policy did little to benefit anyone but the crème de la crème. For everyone else, they have little to show for their labors.

Central planning, like the GM bailout and the big bank bailouts via AIG, are what got us into this mess to start with. But that does not mean the President, the Fed, and the Treasury won’t try to keep the bogus expansion going with more of the same failed policies. Not when the alternative is to let an avalanche of debt cascade down in final destruction.

Over the last two weeks, the Fed has telegraphed it will cut rates at the FOMC meeting on July 30-31. Financial markets have already run ahead based on the rumor. Clearly, money and markets have gone insane.

The difference between now and September 2007, the last time the Fed started a rate cutting cycle, is the Fed will be easing from a place that is already highly accommodative.

Assets held by the Fed and the Federal Funds rate, then and now. The Fed finds itself at a very different starting point compared to 2007, when the previous business cycle ended. Given the vast expansion of credit market debt since then, we should expect even more massive central bank intervention when the current bubble bursts (yes, when, not if). [PT]

Remember, for the 15 months leading up to September 2007, the federal funds rate was 5.25 percent and the Fed’s balance sheet was at $900 billion. Still, zero interest rate policy (ZIRP) and quantitative easing (QE) didn’t prevent the S&P 500 from getting lopped in half.

Now the federal funds rate is close to 2.5 percent and Fed’s balance sheet is about $3.8 trillion. Heading into the next recession, the Fed has much less room to maneuver. A future QE program could take the Fed’s balance sheet to $10 trillion or more. Plus, with the federal funds rate at just 2.5 percent, the Fed will likely have to push rates below zero – into negative territory – to bail out financial markets.

Tending Towards Maximum Perversity

Massive monetary stimulus injections of QE and negative interest rate policy (NIRP) will take an economy and financial markets that are already grossly distorted and will disfigure them beyond all recognition. But that is just the half of it. The central planners at the U.S. Treasury are also behind the eight ball.

U.S. Treasury Secretary Steven Mnuchin – a Goldman guy – is running out of time to broker a debt ceiling budget deal with House Speaker Nancy Pelosi and her cohorts in Congress. If an agreement isn’t reached by next week, House Representatives will be AWOL until September 9. By then, without a debt ceiling increase, Mnuchin will have run out of the fake money he needs to keep the nation’s lights on.

Lettuce not dwell on the nation’s debt too much… that will only be prone to invite ulcers, and who needs an ulcer? [PT]

At $22.5 trillion, the national debt is well past the point of no return. There is no way to repay it outright. Thus, an implied default through currency debasement is bound to be the government’s preferred option.

However, to keep up with exploding debt levels, new and extreme methods of currency debasement will need to be employed. After QE and NIRP fail to do the trick, the promise of Modern Monetary Theory (MMT) will be put to the acid test.

Per the tenets of MMT, U.S. government debt is not debt at all. Rather, it is money the government has spent that hasn’t yet been used to pay taxes. Therefore, the U.S. government can print all the money it needs to amplify the economy without care nor worry about debts and deficits.

The federal debtberg in all its terrible glory. MMT (a.k.a. warmed-over Chartalism) suggests that there is no limit to the growth of this pile that could possibly invite untoward consequences. This is precisely what the board of the German Reichsbank under Rudolf von Havenstein thought as well as it proceeded to monetize both treasury bills and commercial paper by the wagon-load after WW I. The eventual outcome of this policy was rather less salubrious than had been hoped. This excellent example of the triumph of hope over experience ultimately left the entire nation in abject poverty and wretched misery (of course modern-day MMT proponents will know how to “do it better”). [PT]

Should such overt dollar debasement lead to price inflation, MMT has just the solution. Raise taxes and issue bonds to remove the excess money from circulation. Taxes, you see, are not for funding government spending. They are for throttling back the money supply to attain the magical balance of growth and inflation.

If this sounds like maximum perversity to you, it’s because it is. What a delight to be tending towards it more and more each and every day.

via ZeroHedge News https://ift.tt/32QEqn4 Tyler Durden