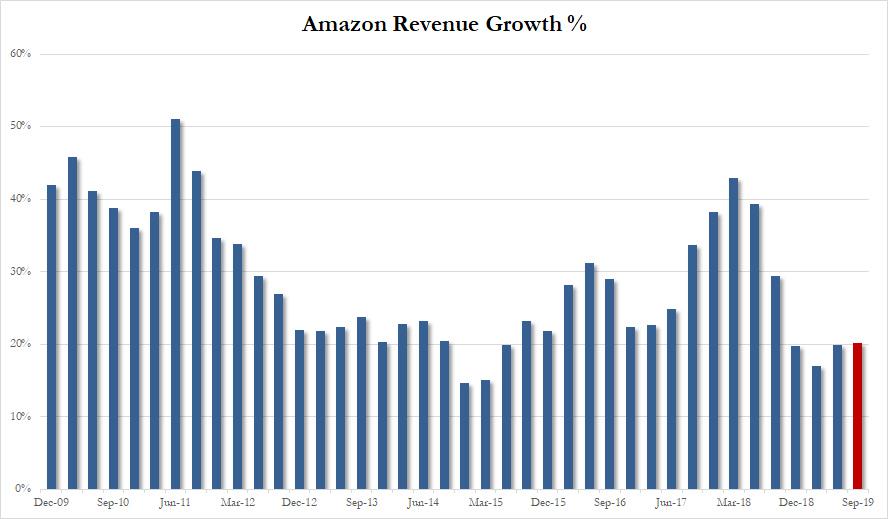

Last quarter, when Amazon reported otherwise respectable earnings, the market hammered the stock after AWS growth slowed again and Amazon guided to the lowest revenue growth since 2001, despite broadly higher margins. And, as the company reported moments ago, while its guidance may have been slightly downbeat, it wasn’t too far off as Amazon reported Q1 net sales of $63.4BN, above the $62.46BN consensus estimate, while generating $5.22 in Q2 EPS, missing the $5.56 expected.

Here are the summary Q2 highlights:

- Earnings per share of 5.22$, missing expectations of 5.56, but up from $5.07 in 2Q 2018

- Sales of $63.4 billion, above expectations of $62.4 billion, and also up 20% YoY from $52.8 billion

- Operating income of $3.08 billion, missing expectations of $3.7 billion, and just up from $2.9 billion

- AWS sales of $8.381 billion, also missing the $8.5 billion expected, but up from $6.1 billion

While AMZN missed on most of Q2 metrics, the good news here is that Q2 revenue did come in higher than sellside expectations, rising 20% in Q1, and looking ahead, the recent top line slowdown is expected to moderate, as the company now expects Q3 net sales between of $66BN and $70N, with the midpoint of $68BN ,coming in just above the Wall Street consensus estimate of $67.22BN. If revenue comes in right on the midpoint, it would represent another modest rebound from recent lows, rising 20.2% in Q3.

But if the company’s top line guidance was the good news, its profit outlook was not, as Amazon’s guidance for Q3 profit came in well below analyst expectations with the company expecting to make just $2.1 billion to $3.1 billion in operating income, well below the Wall Street analyst estimate of $4.3 billion.

More bad news: after the company’s profit margin nearly doubled to an impressive 7.4% in Q1 2019, largely thanks to the increasing contribution from AWS, in Q2 profit slumped again, and the profit margin of 4.9% was the lowest going back to Q1 2018.

Another negative: after the company’s international loss shrank to just $90MM in Q1 2019, it once again swelled, rising to $601 million in Q2.

Meanwhile, the all important Amazon Web Services was once again responsible for more than half of Amazon’s entire profit, with the division generating $8.381BN in revenue (below the $8.5BN expected), and up from $7.7BN in Q1, generating $2.12 BN in operating income, a 25.3% operating margin, down from $2.22BN in operating income in Q1, and sharply lower from the 28.9% margin reported last quarter. Even so it was responsible for 69% of the company’s total operating income of $3.08BN.

But even more concerning was the slowdown in AWS revenue, which rose just 37%, down from 49% a year ago and down from 42% last quarter. As Bloomberg puts it, AWS’s growth rate of 37% continues to slow as the business grows, “but it’s still a cash machine.”

To summarize, AWS revenue growth:

- Q1 2018: 48%

- Q2 2018: 49%

- Q3 2018: 46%

- Q4 2018: 46%

- Q1 2019: 42%

- Q2 2019: 37%

And AWS operating margin:

- Q1 2018: 25.7%

- Q2 2018: 26.9%

- Q3 2018: 31.1%

- Q4 2018: 29.3%

- Q1 2019: 28.9%

- Q2 2019: 25.3%

Looking at the rest of Amazon’s business, Q2 marked two years since Amazon announced it was buying Whole Foods Market. Alas, as Bloomberg notes, the read on how the grocer is performing under Amazon remains murky. Whole Foods accounts for almost all of the sales in Amazon’s “physical stores” segment. That was $4.33 billion, barely changed from $4.31 billion a year ago, with razor thin margins. “Complicating matters, that total does not include online orders from the dozens of markets where Whole Foods stores serve as grocery delivery depots.”

And while Amazon reported strong revenue and an impressive sales outlook, the reason why the stock is sharply lower is due to the disappointing profit outlook, suggesting continue big spending on delivery which pressures margins, and the ongoing slowdown in AWS.

Perhaps realizing that it needs to focus much more carefully on costs, Amazon announced labor initiatives, pledging to upskill 100,000 of its employees across the U.S. by 2025, dedicating over $700 million to provide employees across its corporate offices, tech hubs, fulfillment centers, retail stores, and transportation network with access to training programs that will help them move into more highly-skilled roles within or outside of the company.

The stock, for those who don’t have a screen in front of them, tumbled as much as $100 to $1,900 after hours, before recovering some losses.

via ZeroHedge News https://ift.tt/2YuaspG Tyler Durden