WTF is going on!!

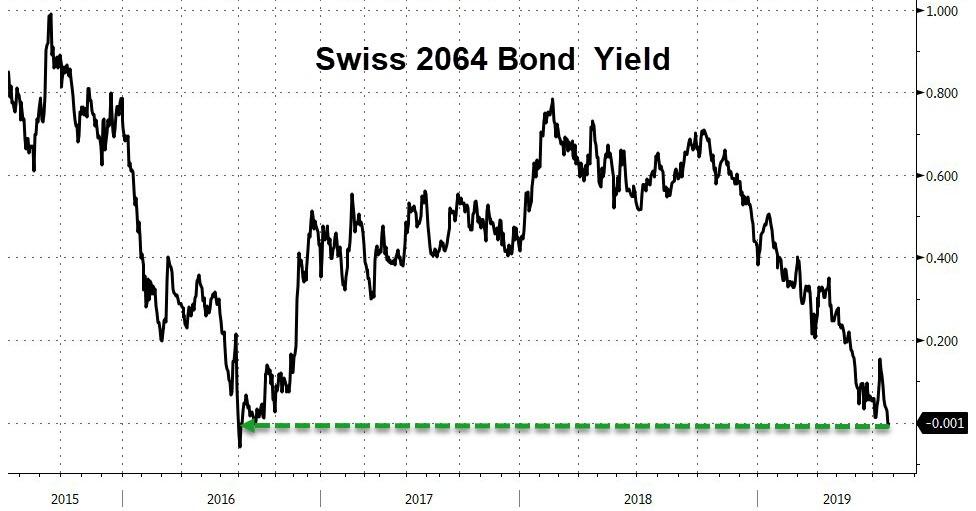

The yield on the 2064 securities fell for its 9th straight day, down 4bps to -0.019%.

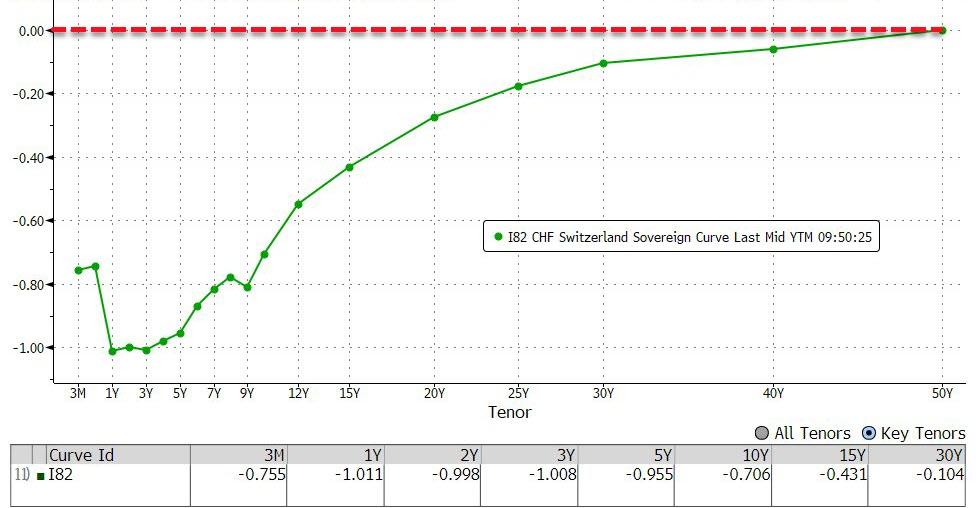

That leaves the entire Swiss yield curve (out to 50 years) below zero…

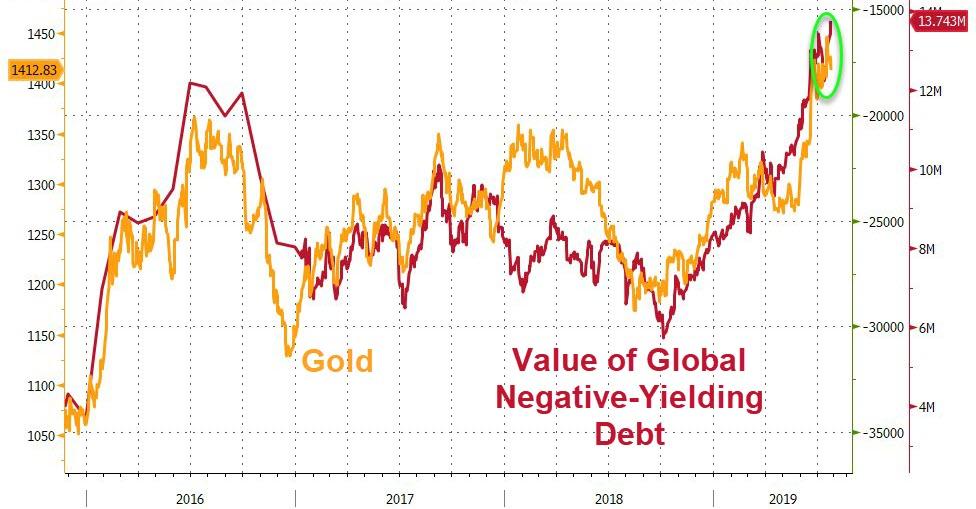

And has added to the new record high – over $13.7 trillion – in global negative-yielding debt…

(and that includes some junk European bonds!)

Time to buy some more gold?

“This is madness”

via ZeroHedge News https://ift.tt/2OfXUhL Tyler Durden