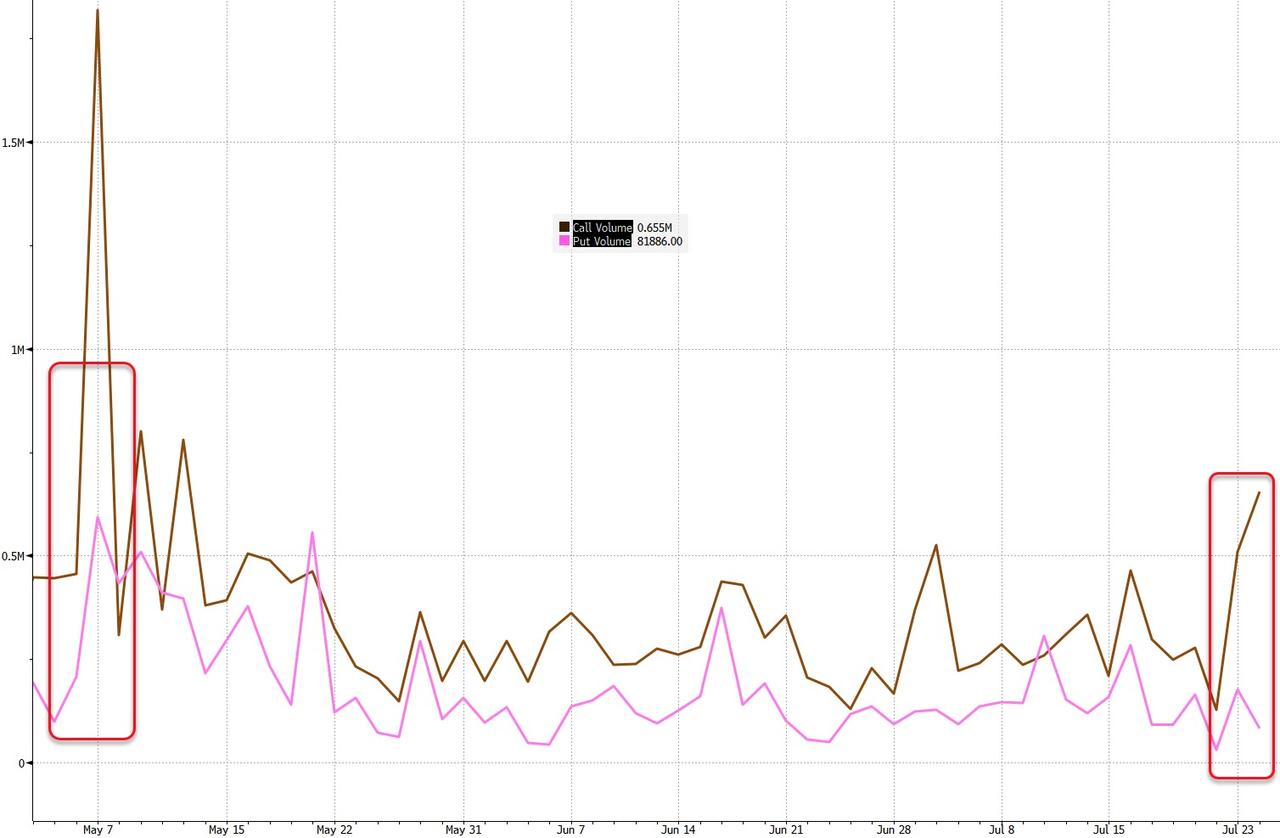

In the last two days, someone, or more than one, has been aggressively buying VIX Calls (bearish market bets that gains as risk re-emerges) relative to puts (bullish bets)…

Sending the Call/Put ratio soaring…

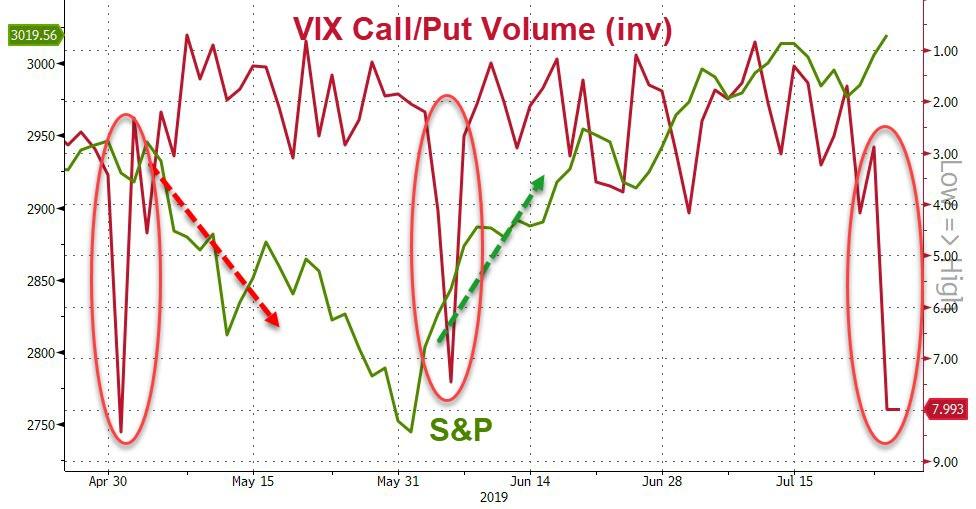

It seems these notable spikes in VIX Call buying coincide with severe market turning points. Major build up of large VIX bullish (market bearish or hedging) bets…

As Bloomberg’s Luke Kawa points out, the activity is similar to moves by the infamous volatility buyer known as “50 Cent,” so dubbed for the practice of purchasing protection priced at half-a-dollar a piece in considerable size. This player was active throughout 2017, the most tranquil year for U.S. stocks in over 50 years, yet was finally able to reap a massive payday on the trade to the biggest one-day jump in implied equity volatility in history on Feb. 5, 2018. But this type of buying behavior has been seen only sparingly since then.

“The large VIX call buying over the past two days is a definite change of character in the VIX options market in an otherwise sleepy tape,’’ said Patrick Hennessy, head trader at IPS Strategic Capital.

“There hasn’t been many of these chunky 50,000-plus contract prints in the VIX space this year, which was a theme that dominated the VIX options market back in 2017 when ‘50 Cent’ was present.’’

“Over the past few days we’ve seen big buyers of VIX call options,’’ said Pravit Chintawongvanich, Wells Fargo’s equity derivatives strategist.

“It’s especially notable since hedging with VIX call options had kind of gone out of fashion since the 2018 VIX blowup.’’

The VIX Whale – we tend to agree that is is likely ’50-cent’ or a generic model of him – among various other big VIX players, are not alone, as NorthmanTrader.com’s Sven Henrich notes the recent VIX collapse won’t end well.

A bestiary of the big players in the Vix and S&P 500 options, according to @Pravit_C pic.twitter.com/mjYhlrn7Cc

— Robin Wigglesworth (@RobinWigg) December 13, 2017

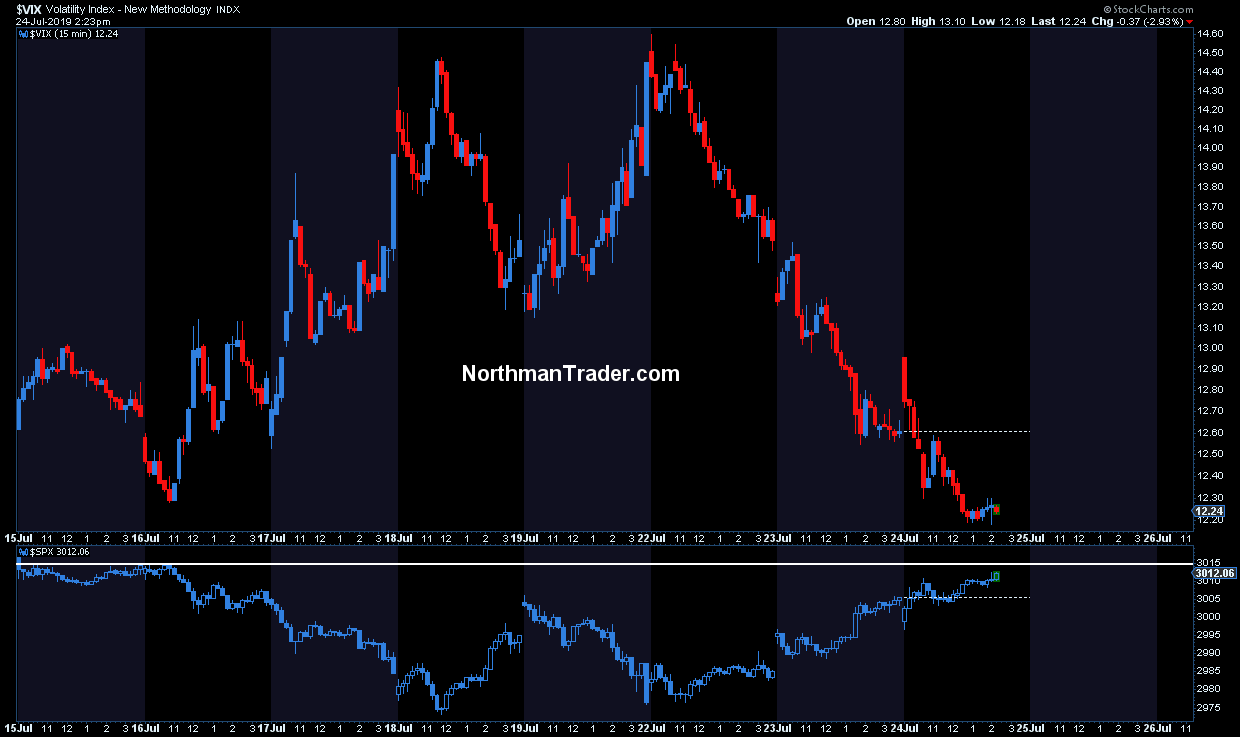

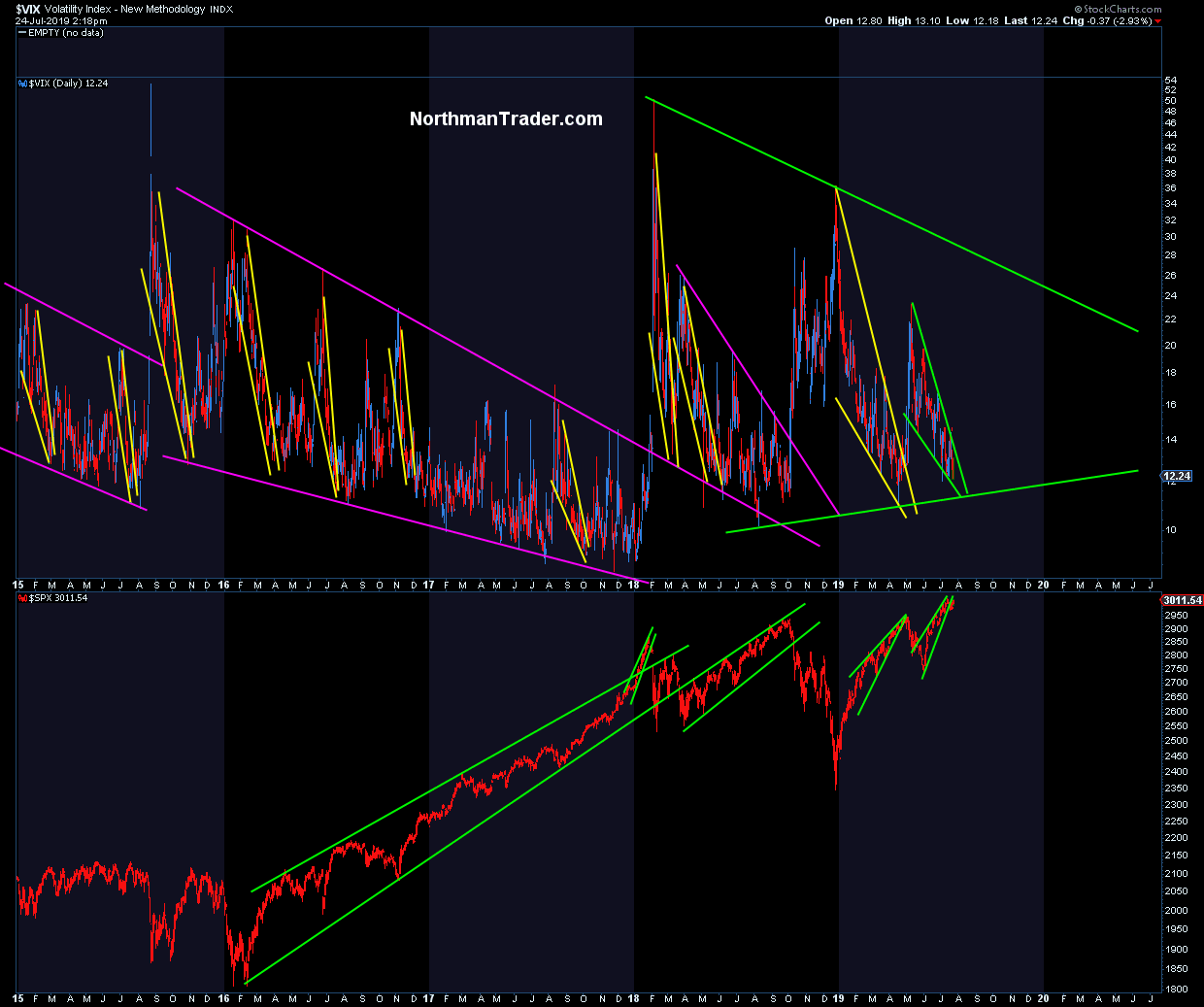

In the new normal world in which we live – of QEternity across the globe – no wonder the $VIX gets crushed in mechanical fashion this week:

That’s a lot of $VIX crushing for very little marginal gains I would argue, but nevertheless there it is.

But what has been the pattern over the last 4 years? $VIX compression leading to $VIX breakouts:

I would argue what we’re seeing now is no different:

While not all index gaps fill, not the same can be said for $VIX: All $VIX gaps fill eventually.

And there is an open gap in the 24/25 area courtesy Jerome Powell when he delivered his ‘flexible’ speech in early January leading to the renewed compression phase we’re in now, a clearly defined descending wedge pattern again. Note the cute fake breakout earlier in the week.

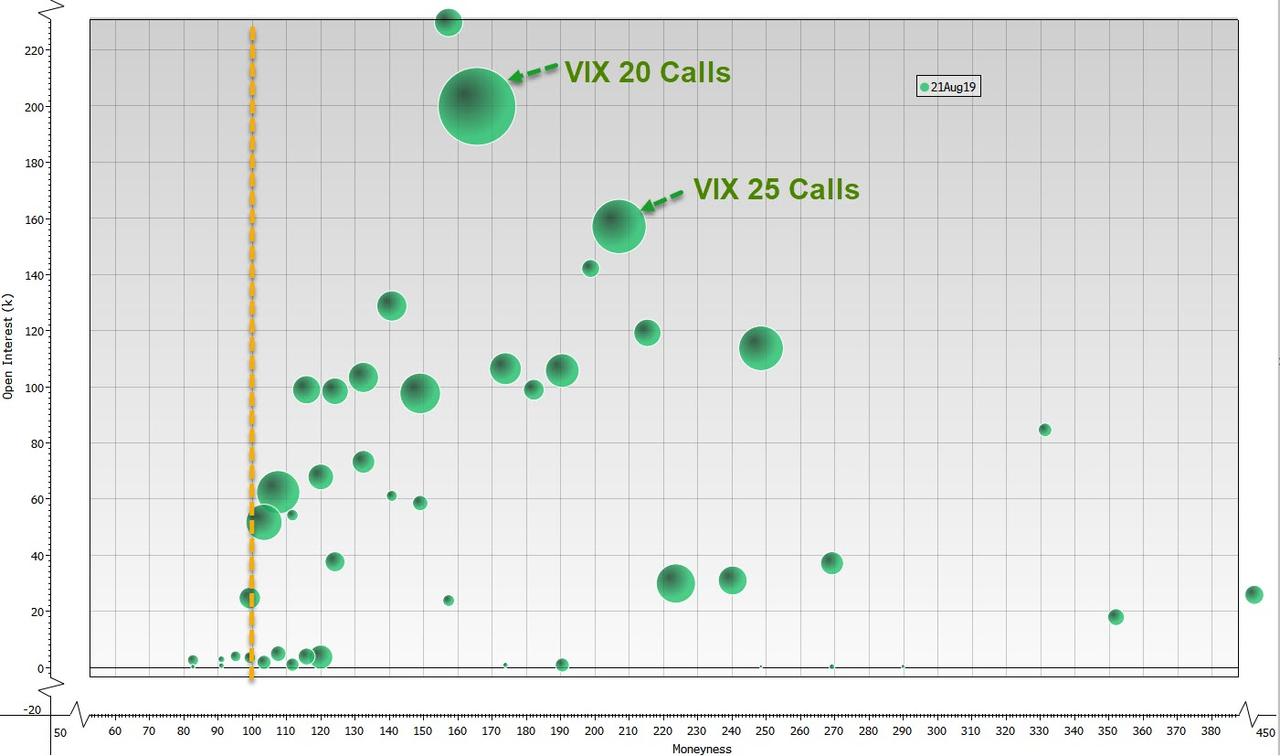

I may not be alone in the view that $VIX is setting up for another breakout this summer. Over 359,000 calls on the August 21 $20 $VIX strike were traded today easily dwarfing the put volume by 10:1.

$VIX may still drift lower to the lower trend line, but the pattern strongly suggest a VIXplosion is still to come this year, and perhaps not that far away.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News https://ift.tt/2GrN0iQ Tyler Durden