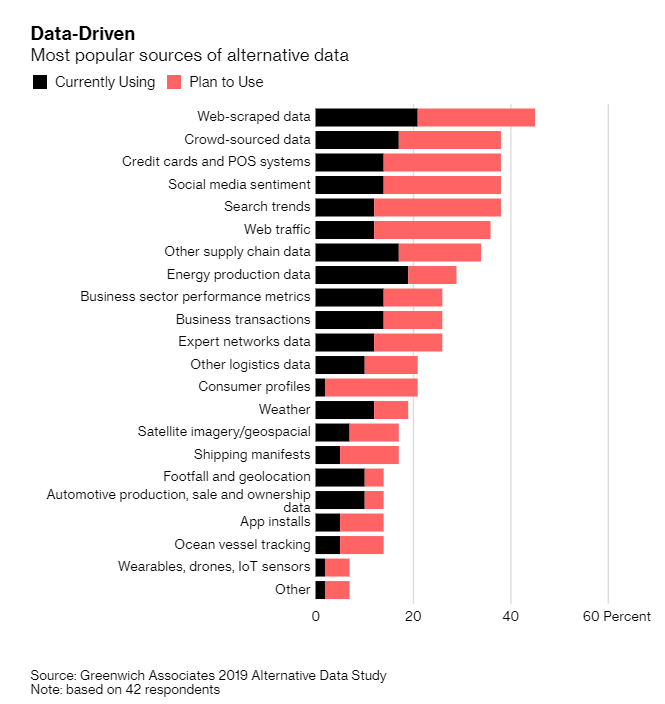

Hedge fund managers continue to mine all sorts of “alternative data” in order to try and gain trading edges. This now includes seeking out consumer habits from devices like Fitbits, Rokus and Teslas, according to Bloomberg.

As we have reported on before, alternative data is being bought hand over fist by hedge funds like Steve Cohen’s Point72 Asset Management and Ken Griffith’s Citadel. Many are even paying large sums for it.

Michael Marrale, chief executive officer of M Science said:

“There is not one major hedge fund or asset manager that doesn’t have data initiatives underway or that are not using alternative data in some way.”

Spotting trends in consumer habits is a big business and JP Morgan estimates that the market for big data could reach more than $200 billion by next year. Even then, the data needs to be analyzed, scrubbed, organized and aggregated to be of use.

There has been “incredible demand” for this data, according to Marrale.

So what exactly are hedge funds looking at?

First, they are looking at Wi-Fi and Bluetooth connections, which have both become so ubiquitous that they are often taken for granted. Capturing the signals that these networks emit can show “when and where new things appear in the world,” said Hugh O’Connor, director of data sourcing and partnerships at Eagle Alpha.

This can help firms keep tabs on the number of video streaming devices or fitness trackers being used, the length of time consumers spend on them and their locations. Data providers can also capture when your new ride is hitting the road if you have bought a Tesla Model 3 and use its Bluetooth enabled media.

Location tracking data can also be pulled from mobile phones and show the number of people carrying devices at a particular location. This can help distinguish how many people are frequenting retailers, supermarkets or fast food joints. Alternative data firms can also monitor app downloads to see how popular they are, where they are occurring and when they are being used to make purchases.

Hedge funds also are scraping the internet for data, sifting through sites to create bespoke collections of public data. They look at things like pricing trends on flights and hotels and inventory figures for products sold on sites like Amazon.

Twitter sentiment is also being watched: hedge funds track key words or phrases on social media sites to gauge what consumers are thinking about the newest products from companies like Apple and Nike. This can be mapped to companies and provide clues about popularity of products or services.

Credit card data is also being used to track what and how much people charge and which sites accept online payment services. This data has immense potential, so it can be more expensive than other alternative data.

aniel Goldberg, founder of Alternative Data Analytics said:

“Credit card data can range from $150,000 to over a million dollars a year, depending on certain characteristics such as the level of granularity.”

Firms also collect information on job postings, changes in salary and employee reviews of companies from sites like Glassdoor. From this material, they can see if a tech giant starts seeking new talent from a different industry, which may suggest a new product or service. They can also check for the removal of job postings, which can sometimes signal corporate distress.

via ZeroHedge News https://ift.tt/2Y7yNT1 Tyler Durden