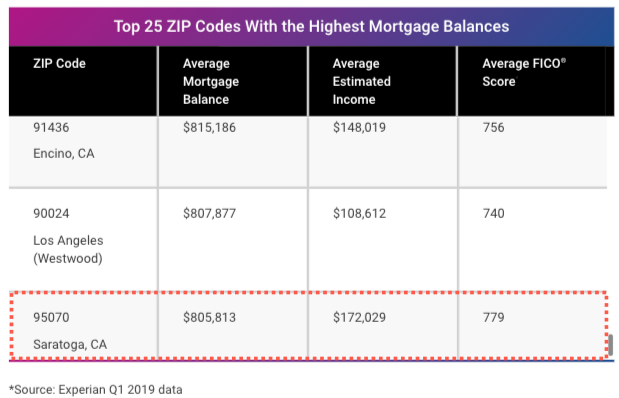

Experian, a consumer credit reporting company, has published a new study that determined the top 25 US Zip codes with the highest mortgage balances in 1Q19.

The study outlined how a bulk of the balances reside in California, with 17, and the remaining are evenly split between New York and Connecticut. New York City alone has four Zip codes with the highest mortgage balances in the nation.

Home prices in these areas are in bubble territory. And compared to the average cost of a new home in the US, approximately $377,200 in May 2019, each of these areas are sitting at price extremes that could revert to a more reasonable level when the next downturn strikes.

These areas have one advantage than the rest of the country: higher incomes. So when the credit crunch hits forced by the economic downturn, people with high mortgage balances can weather the storm to an extent but will eventually be overwhelmed and will have to liquidate homes at discounts which will drive downside momentum in prices.

The lowest income among these high net worth areas was $108k in 1Q19, more than $25,000 higher than the national average of $79,622.

The methodology behind the study is based on an Experian-created statistically relevant aggregate sampling of their consumer credit database.

The study determined ZIP code 90210, Beverly Hills, California, had the highest mortgage balance overall. The balance was $1,528,236, with an annual income average of $157,359 and an average credit score around 740.

Number 25, the lowest mortgage balance on the list, is ZIP code 95070, Saratoga, California, had a mortgage balance of $805,813, with an annual income of $172,029, and a credit score of around 780.

*chart

Experian’s data showed the average FICO Score among all top 25 ZIP codes with the highest mortgage balances in 1Q19 was 756, that’s about 53 points higher than the national average of 703.

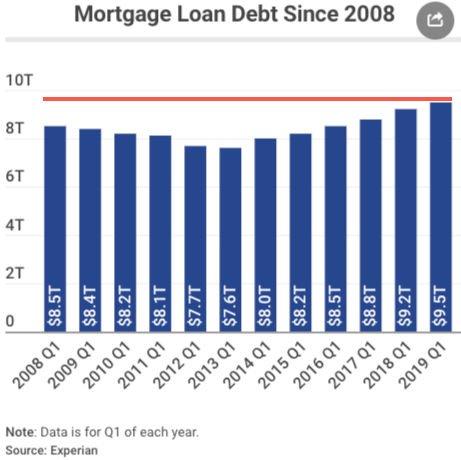

The data also showed outstanding mortgage balances have jumped in the last several years, now reaching $9.5 trillion.

US mortgage lending rates have been diving since November 2018, in anticipation of an economic slowdown. The 30-year mortgage interest rates went from 5.17% in November 2018 to 4.08% in July.

Even though rates have significantly declined in the past couple quarters, this has not translated into a rebound in housing markets across the top 25 Zip codes, nevertheless, the rest of the country. The housing market is stalling – be prepared for a possible top.

via ZeroHedge News https://ift.tt/2YfMWc5 Tyler Durden