Authored by Chetan Ahya, Morgan Stanley Chief economist and Global head of economics

Is the outlook, in the words of ECB President Mario Draghi, “getting worse and worse” or is there cause for optimism? Based on the evidence at hand and our assessment of the key drivers of the outlook, we think it is more the former than the latter, and we hold on to our base case prognosis of sub-par global growth.

Weaker fundamentals… Economic indicators around the world have been weakening, and the early data flow for July continues to paint a picture of softness. Sentiment surveys such as the flash PMI readings for the US and Europe, the German Ifo survey and the Japan manufacturing and non-manufacturing Tankan surveys, as well as Korean exports for the first 20 days of the month, have weakened further relative to June. All in all, global growth is now tracking at the 2015-16 cycle lows.

…meet stronger easing: Just like the data, central banks are moving back into the easing mode we last saw in 2015-16. The ECB has signalled it will cut rates and is assessing its options for QE (which we think will restart in 4Q19). Next week, we expect the Fed to cut by 50bp. Policy-makers in China will continue to implement their existing fiscal stimulus plans, and efforts to liberalise interest rates will likely result in a de facto reduction. Indeed, by year-end, we forecast that 21 central banks (out of the 34 we cover) will have eased monetary policy.

Can easing drive a strong recovery? A period of strong growth in 2017-1H18 followed the last easing cycle. Investors are asking whether we could be looking at a repeat performance. We’re sceptical. Easing helps to prevent financial conditions from tightening and avoids a non-linear market reaction that has a similar impact on growth. However, by itself, easing won’t suffice to power a strong recovery. As we learned from the 2012-16 experience, the key to reviving corporate confidence and growth lies in addressing the fundamental economic headwind of the day (deleveraging earlier in this cycle and trade tensions today).

Capex is key: A near-term revival in capex, which has been the key drag on growth, looks less likely. As things stand, trade tensions have seriously damaged corporate confidence globally, dampened the effectiveness of China’s tax cuts, weakened global demand and increased uncertainty as to the demand outlook. Capacity utilisation ratios are starting to fall, reducing the immediate need for investment.

What’s more, while companies may now need to alter their supply chains in light of trade tensions, we expect the increased capex from this channel to play out only over the medium term. Given China’s scale and efficiency advantages, at the moment no single-country alternative exists for its low-cost, high-scale and robust ecosystem. Hence, these decisions require a longer gestation period, with careful deliberation and planning.

Trade tensions: Small steps forward, but hurdles to a comprehensive deal remain: Investors cite developments on the trade tension front as another cause for optimism. Hopes for a resolution have been rekindled – trade talks will continue in Shanghai next week, China has approved a new guidance document on intellectual property rights law and is resuming purchases of US agricultural products, while the US is looking to loosen some restrictions on technology exports to China. While these moves may curtail immediate escalation risks, disagreements over key sticking points are still an obstacle to reaching a comprehensive deal quickly.

Trade policy uncertainty seems unlikely to abate, particularly considering the broader context – Japan reinstating an application process for select exports to Korea; France approving a bill imposing a new tax on services provided by large internet companies; and the US announcing a Section 301 investigation in response, while concerns persist regarding both tariffs on EU autos and Mexico. Hence, we think the overhang on the macro outlook from corporate confidence and capex will continue.

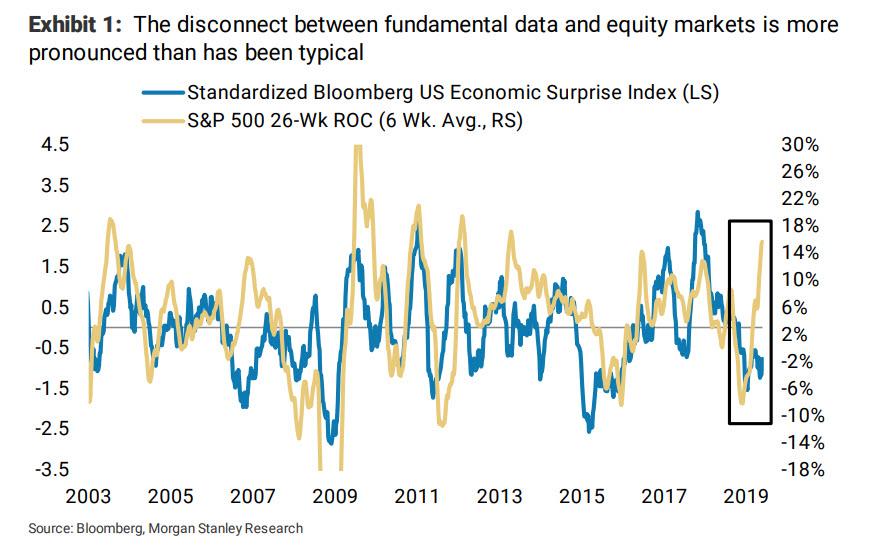

Sub-par growth environment to persist: On the current evidence, we think that our base case outlook – global growth stays weak in 2019 before gradually recovering to still-below trend levels in 2020 – remains intact. Notwithstanding this weak growth backdrop, asset markets have continued to hold up well. As our chief US equity strategist Mike Wilson notes, this disconnect between fundamental data and actual/promised future central bank easing is more pronounced in the equity market than has been typical in the past.

The growth and market impact of trend-following systematic strategies over the past decade may have driven this sharp divergence. In this context, Mike cautions that any reversal in stock prices could lead to a faster and deeper drawdown than many are expecting.

If we are wrong and a stronger and faster recovery does play out, we think it would either be because:

- Trade tensions are completely resolved within the next 2-3 months, removing the key overhang on the macro outlook; or…

- China moves to enact further stimulus directed towards public spending (versus a greater emphasis on tax cuts earlier this year), with a more immediate impact on growth.

Have a great Sunday.

via ZeroHedge News https://ift.tt/30WJCUI Tyler Durden