The price of China’s favorite food is about to hit all time highs.

As a result of the decimation of Chinese pig herds, which have been crippled by the ongoing spread of so-called “pig ebola”, i.e. African swine fever which has crippled domestic pork production, RaboBank expects China’s pork prices to hit a record high by the fourth quarter of 2019 even as imports continue to surge.

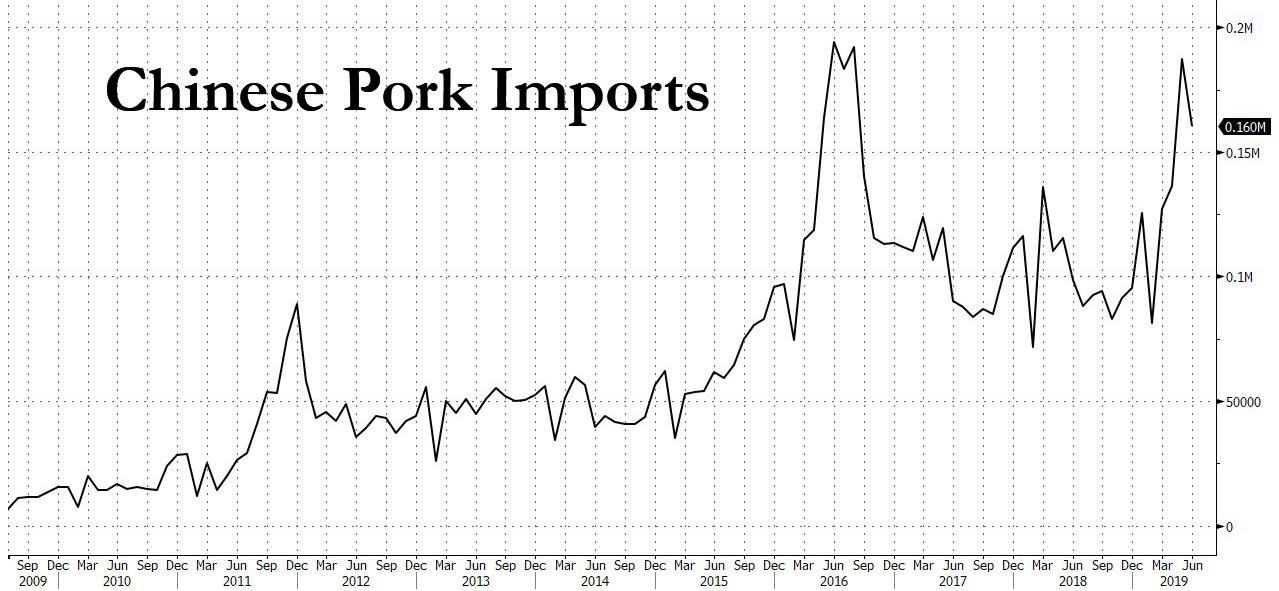

Last Tuesday China’s customs data showed that pork imports in June surged from the previous year, as the world’s top consumer of the meat stocked up on supplies after African swine fever swept across the country’s pig herds. China brought in 160,467 tonnes of pork in June, up 62.8% from the same month last year, according to data from the General Administration of Customs. This was down 14% from 187,459 tonnes imported in May.

China’s pork imports for the first six months of the year came in at 818,703 tonnes, up 26.3% from a year earlier according to Reuters. Meanwhile, pork prices rose by nearly 30% in June compared with a year earlier, according to the Ministry of Agriculture and Rural Affairs, with the spread of African swine fever showing no sign of abating, causing domestic production to plunge.

Retail pork prices have also increased in recent weeks but at a slower pace than whole sale prices, with prices up 34.6% from a year earlier at 27.29 yuan per kg as of July 10. And while China’s agriculture ministry is investigating local veterinary authorities in 10 provinces as it tries to slow the ongoing spread of the deadly African swine fever virus, few analysts expect it to succeed, and instead see prices rising even higher:

“China’s pork and hog prices are likely to break the previous record high in 2016 by the fourth quarter,” said Pan Chenjun, senior analyst for animal protein at Rabobank. He also expects pork production to fall by 30% or about 16 million tonnes, leaving a gaping hole in the country’s protein supply. Analysts warn the disease could hit some farms more than once, and ratings agency Fitch forecasts pork output will stay below 2018 levels through 2021.

Rabobank pointed out that Chinese data showed that sow, or mother pig, inventory had dropped 26.7% and the number of hogs had fallen 25.8% at the end of June compared with a year ago. But it believes that the herd losses in specific regions are much worse, down by 40 to 60 per cent since last August. For 2019, the bank expects the total herd loss to exceed 50 per cent.

China began to import more pork in March when domestic wholesale prices started to rise. Imports of US pork – which fell 75% to 1,609 tonnes between July and December 2018 after China retaliated with tariffs in response to US duties on Chinese goods – have soared. Since January, imports from the US have more than tripled from 5,788 tonnes to 17,603 tonnes in May. While US pork imports to China face a 62% tariff, Bloomberg has cited unnamed sources saying that Beijing has approved duty waivers for some Chinese companies.

African swine fever will also put downward pressure on middle-class consumer spending, which Beijing is counting on to help boost growth in an economy that is expanding at its slowest pace in nearly three decades. China’s middle class accounts for around 400 million people, or 28.6% of the 1.4 billion population.

According to SCMP, economists at Capital Economics warned that Chinese consumption growth will be weighed down in the near term by consumer price inflation which is set to reach an eight-year high, due in large part to rising pork prices resulting from African swine fever.

“This will drag down real income growth and likely lead to a further deterioration in consumer sentiment,” they said in a report this month.

This also means that China is facing its first stagflationary episode since 2011: last month, China’s consumer price index

rose 2.7% Y/Y, driven by higher food prices in pork and fruits, according to the National Bureau of Statistics. And with spending curtailed, China’s economy will likely continue to contract even as prices of food stables rise.

* * *

Meanwhile, and as a result, prices for other meats including chicken and duck, are also expected to rise substantially, putting further pressure on the discretionary spending of Chinese consumers.

One direct – and soon to be very rich – beneficiary of China’s pig ebola are duck farmers. As the SCMP reports, on a 30-hectare (74-acre) plot of land in China’s Shandong province poultry hub, more than half a million white-feathered ducks are busy eating, chattering and laying eggs to produce cheap meat for thousands of factory canteens.

With birds already packed into around 60 open-sided buildings, farm owner Shenghe Group is expanding further, aiming to raise output by 30 per cent this year to capture record profits as a plunge in pig numbers shrinks production of pork, China’s favourite meat.

“The market prospects are very good now because of African swine fever,” said Shenghe Chairman Wang Shuhong, whose firm sells about 300,000 ducklings a day for fattening and slaughter.

Expect demand for ducks to soar, for the simple reason that the deadly pig disease has already reduced China’s hog herd by more than a quarter, according to official data, however as many as half of the country’s breeding sows are thought to have died or been slaughtered to cope with disease outbreaks.

Meanwhile, soaring pork prices have already fueled a surge in poultry meat demand. Chicken breast is about 20% more expensive than a year ago, while duck breast has nearly tripled in price to 14,600 yuan (US$2,125) a tonne, according to Shenghe. While this is still only about half the cost of pork, but such prices are unheard of in China, where breast is typically the cheapest part of the bird.

As the SCMP also reports, about 80% of the world’s ducks are raised in China, but are traditionally eaten in the south, where fried duck tongues, braised feet and spicy duck neck are popular snacks, and duck intestines make up a hotpot.

In recent years, as pork prices spiked, more ducks have been processed for use by cost-conscious catering firms, supplying large canteens feeding schools, factories, businesses and the military. These buyers are now switching as much pricey pork as they can to duck.

A procurement manager with a catering firm that supplies about 100 large clients around China said he has replaced about 20 per cent to 30 per cent of the pork on menus with either chicken or duck meat. He declined to be identified because of the sensitivity of the issue.

“We may switch even more. But our concern is that the poultry price is now going up as well,” he said.

The price of day-old ducklings, sold by farms like Shenghe, has hovered around 6 yuan, three times the usual level, since July last year. While the torrid price surge eased last month as farmers held off restocking during hot summer weather, they are rising again and set to go higher, said Dong Xiaobo, China general manager for French genetics company Orvia, the No. 2 supplier of breeding ducks.

Orvia is sold out six months ahead and has even had calls from pig farmers considering raising ducks after losing their hogs to African swine fever.

“I’ve never seen this in our 10 years in this market,” said Dong.

As swine fever continues to spread, China’s vice-premier Hu Chunhua has urged poultry farmers to help fill the protein gap to maintain social and economic stability.

Meanwhile, with output of about 5 million tonnes last year, less than half China’s chicken production, duck meat has plenty of room for growth, especially since the barrier to entry is lower for ducks than broiler chickens and breeding stock is more available, said Rabobank analysts.

Ironically, any rapid expansion carries its own disease risks, as in densely stocked farms, diseases like bird flu, several strains of which are circulating in China, will spread easily.And it remains to be seen whether duck farmers can hold on to a bigger share of the meat market when pork output recovers. As a reminder, in 2012 and 2016, duck farmers were forced out of the industry in droves when overproduction killed profits, and most people still want more pork dishes than any other meat, said the catering company manager.

But Shenghe’s Wang, who is planning to expand downstream with a slaughterhouse later this year, is not worried. “Pork output won’t go up in the next three years and will take at least five years to recover,” he said.

The bottom line: as China’s pork farmers face a dismal future, their duck farming friends are making more money than ever.

via ZeroHedge News https://ift.tt/2SOifcR Tyler Durden