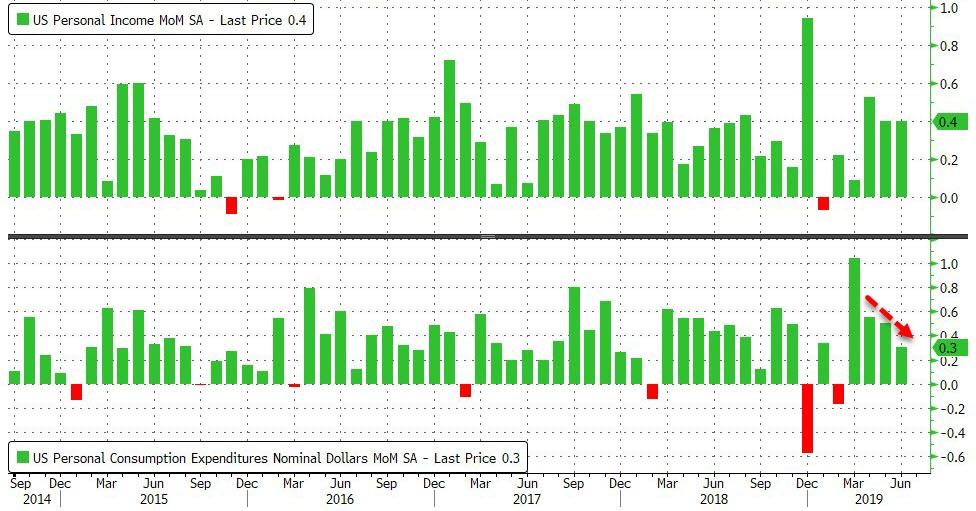

After May’s surprisingly positive rebound, income and spending growth was expected to slow in June and both printed right at expectations (+0.4% MoM and +0.3% MoM respectively).

This is the 4th month of slowing spending growth in a row…

However, thanks to the historical revisions, incomes are rising at 4.9% YoY as spending growth slows to 3.9% YoY…

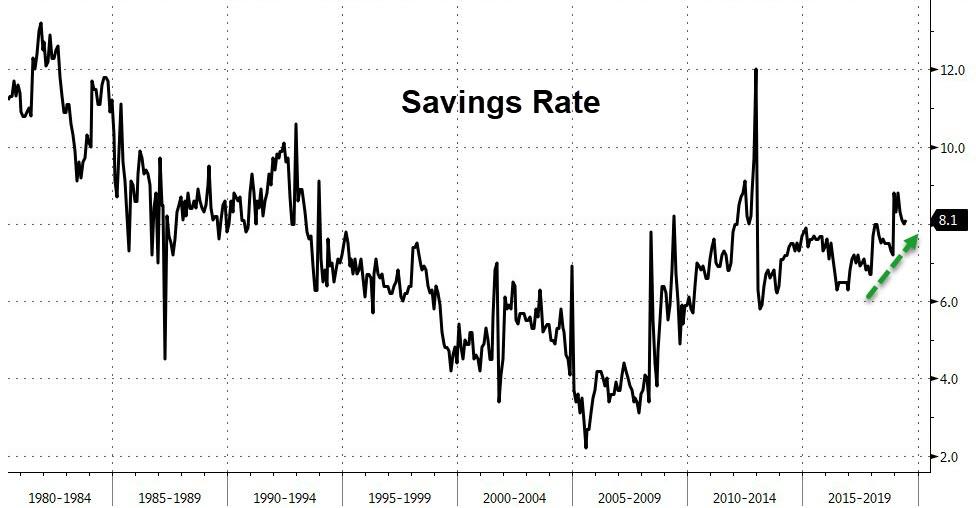

Which has stabilized the savings rate…

And finally, The Fed’s favorite inflation indicator – Core PCE Deflator – rose 1.6% YoY, cooler than the +1.7% YoY expectations.

So maybe, just maybe, there’s one item for Powell to hang his rate cut on.

via ZeroHedge News https://ift.tt/2ymamSt Tyler Durden