After Week 3 of the second quarter earnings season, 217 S&P 500 companies (57% of 2Q earnings) have reported, with earnings continuing to come in modestly above beaten down estimates, driven by Internet giants (Alphabet and Facebook) and semiconductors (Intel and Texas Instruments), according to BofA data.

Reported companies’ earnings topped consensus by 3%, driven by Communication Services and Tech, but excluding Boeing (which had a $5.6B charge related to the 737 Max), earnings would have come in 5% above estimates. Bottom-up consensus 2Q EPS rose 0.1% last week to $40.63 (from $40.57), 0.5% above analysts’ expectations as of July 1, or 1.8% above expectations (and in line with our forecast) excluding Boeing’s charge.

That’s the good news, and it only relative to consensus which once again was too bearish heading into the quarter. The bad news is that on a Y/Y basis, we are set for another consecutive, if modest, earnings contraction.

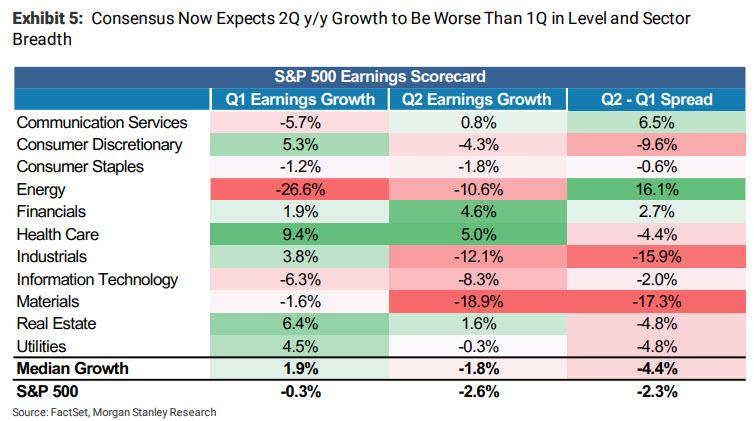

As Morgan Stanley reminds us, S&P 500 1Q EPS growth came in at -0.3% y/y when all was said and done. Blending the reported numbers from companies that have already reported with estimates for those remaining, the consensus S&P 500 2Q EPS y/y growth is now forecast to be -2.6%. In 1Q, 5 of the 11 S&P 500 sectors had negative y/y growth. For 2Q, the breadth is much worse, with 8 out of 11 sectors expected to come in with negative y/y growth.

This syncs with Morgan Stanley’s bearish view that the trough quarter is likely to be 3Q when the dust finally settles, but the bank still thinks the rebound off of that trough will not be as steep as consensus currently models.

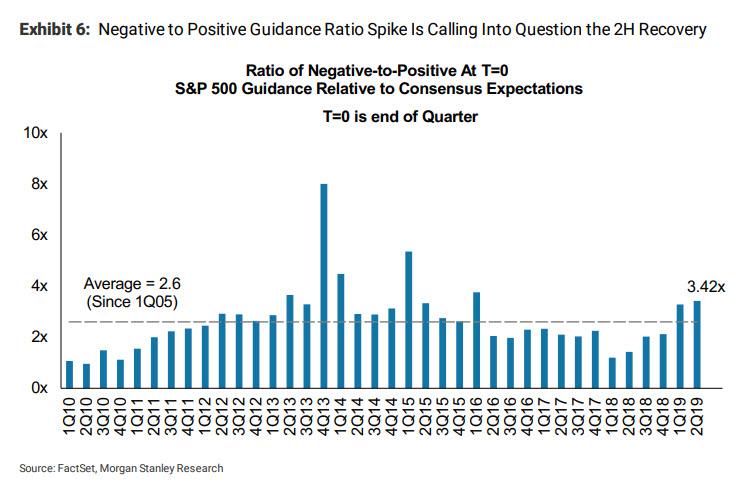

What is far more discouraging, is the fact that the second half recovery is looking a lot less likely. The economic data continues to disappoint relative to expectations with little evidence yet that a bottom is near. Meanwhile, companies appear to be pouring cold water on their own forecasts, with the negative to positive guidance ratio remaining elevated – a trend that is expected to continue into 3Q.

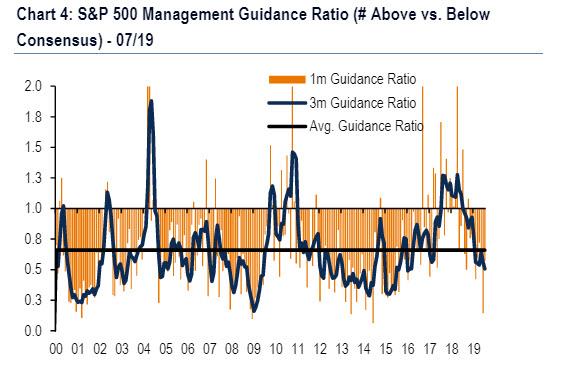

As Bank of America adds, despite better-than-expected earnings, second half estimates have fallen 1% since the start of July on weak guidance. The bank’s three-month ratio of above- vs. below-consensus earnings guidance (GR) fell to 0.56, below-average and a 3.5-year low.

These negative revisions are in line with bearish Morgan Stanley’s earnings growth model, which continues to suggest the consensus (i.e. company guidance) forecasts are still too high.

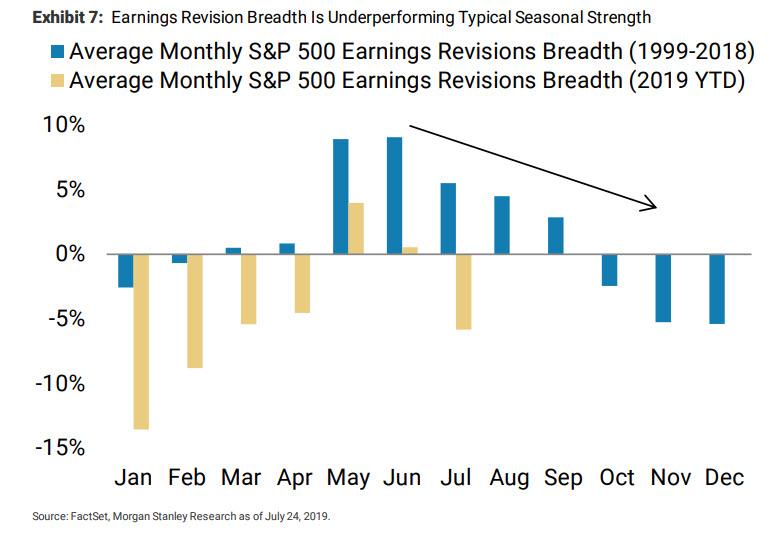

While companies are very good at managing earnings in the current quarter, their ability to forecast earnings growth is questionable when compared to Morgan Stanley’s top down earnings growth leading indicator. The current deviation between the model and the consensus remains much larger than normal at 5-10 percent. The revisions this year have been consistently below seasonal norms and it is worth noting that July is one of the seasonally strongest months for earnings revisions and yet month to date we are seeing some very weak numbers.

With July the swing month for the 1H/2H of the year, this does not bode well for those hoping for a big reacceleration in the back half.

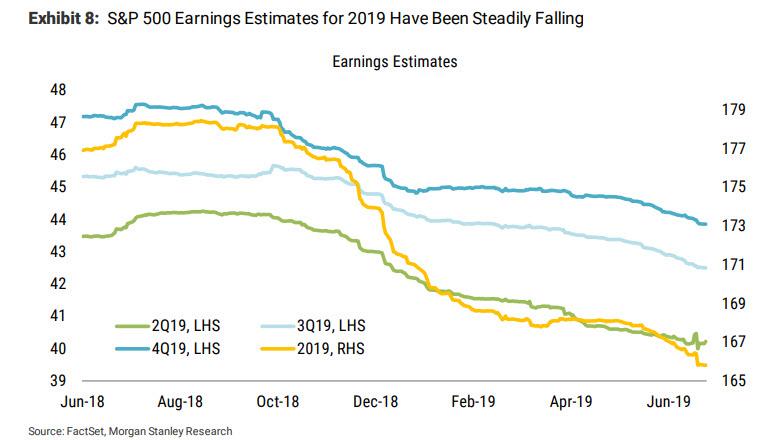

Furthermore, Since Morgan Stanley’s infamous call for an earnings recession last September of last year, earnings forecasts have been coming down steadily, with 2019 falling from a high of $180 in January2018 to just $166 today.

That’s a fall of approximately 8 percent, which is much greater than a typical year. As a result, Morgan Stanley remains cautious about the forecasts for 3Q and 4Q and believes they will continue to fall over the course of the year such that 2019 is flat/down y/y versus 2018. Typically, once NTM EPS growth goes outright negative, the market reacts very differently as it starts to contemplate the worst, according to Mike Wilson, who thinks the chance of that outcome is greatest during the third quarter when the comparisons are toughest, and as such the current quarter will be the defining one whether the US falls into a recession.

The bottom line, according to Morgan Stanley, is that “the fundamental data has been disappointing this year and in many cases, it is still getting worse, not better.”

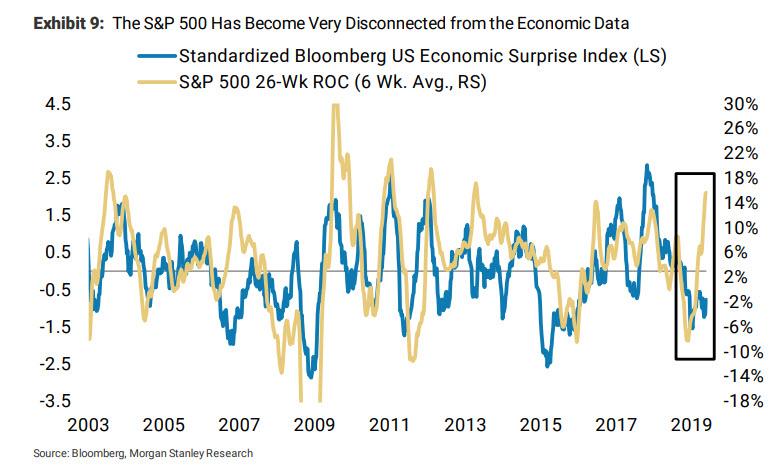

Finally, the last chart suggests that the equity market is more disconnected from the data than is typical, and as Morgan Stanley noted over the weekend, this is a function of very aggressive central bank activity and expectations for future action. In the past month, it’s largely become a foregone conclusion that the Fed will cut at least 25bps tomorrow. There have also been growing expectations for the ECB to not only cut rates but also restart its Quantitative Easing program. The bank’s house view is for the Fed to cut 50bps this week and for the ECB to cut another 10bps and restart QE by September. The only question at this point is how much of this is already priced in. Based on the chart below, it looks like a lot, if not all of it.

via ZeroHedge News https://ift.tt/2Kdf7mL Tyler Durden