Beyond Belief…

China stocks dipped in the afternoon after a morning buying panic…

UK stocks limped lower, outperforming the rest of Europe as its currency crumbled…

European Bank stocks dropped back into the red for 2019 again…

US markets were mixed with Small Cap soaring off early weakness but the rest of the majors ending red with Nasdaq worst…

NOTE – Trannies spiked at the close into the green barely.

Is a Fed rate-cut enough to make new highs in stocks… just like we did in 1987…

Small Caps were saved by another huge short-squeeze…

BYND was battered…

And Under Armor was hammered…

VIX is about to enter the riskiest part of the year…

Another extremely narrow range day in Treasuries that ended with yields down 1-2bps across the curve…

The Dollar Index trod water on the day

Cable continued its slide (down 7 of the last 8 days) – heading for its worst month since Oct 2016…

NOTE – this will be the lowest monthly close for sterling since Jan 1985

Cryptos rallied on the day led by Bitcoin Cash (Bitcoin remains below $10k)…

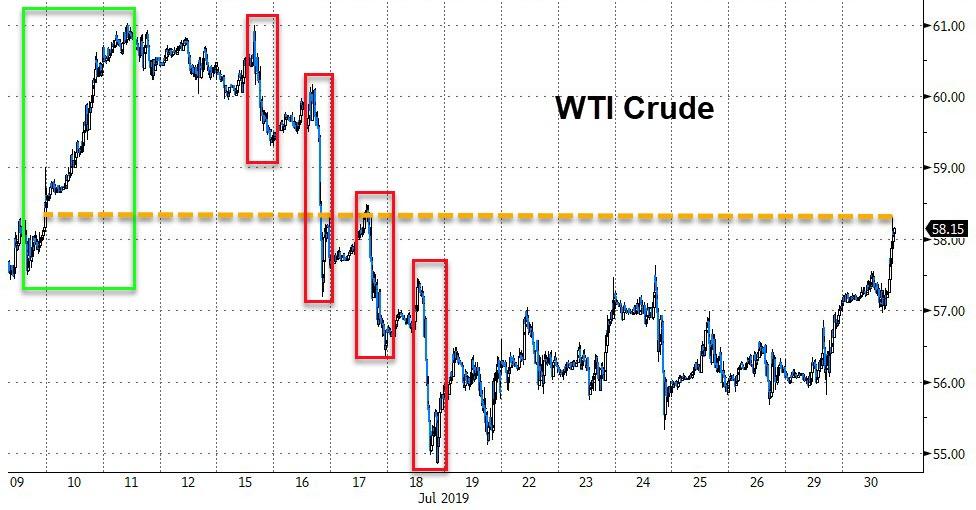

Oil prices spiked today as China trade talks and Iran tensions raised premia as copper crumbled, PMs both rallied…

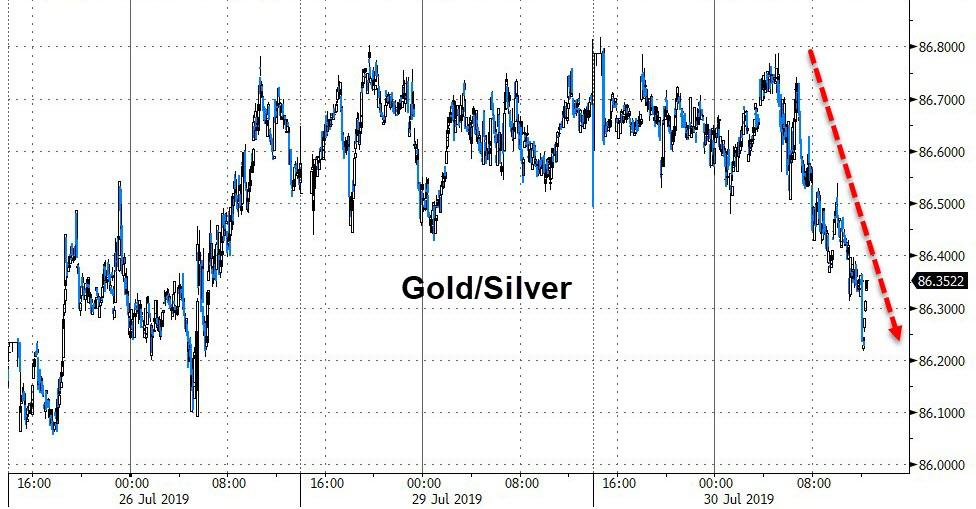

Silver outperformed Gold again…

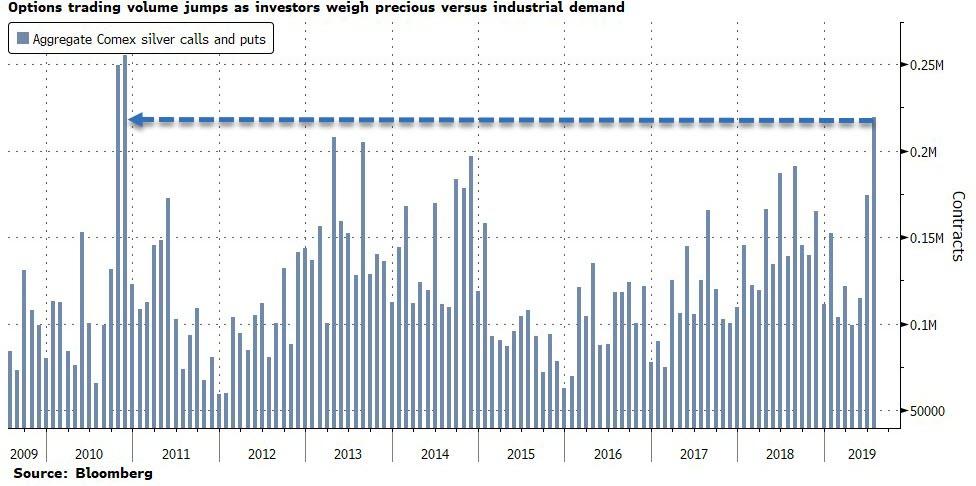

Speculators are piling into the silver-options market as the precious metal returns to the limelight ahead of the Federal Reserve meeting, where policy makers are widely expected to cut borrowing costs.

As Bloomberg’s Nancy Moran and Michael Roschnotti notes, the combined volume of calls and puts has surged above 218,000 contracts this month, on course for the highest since November 2010. The bulls driving the trading are of the mind the commodity will catch up to the gains of its pricier cousin gold, while the bears are counting on weakening global manufacturing to hurt industrial demand.

WTI spiked back above $58 ahead of tonight’s API inventory data…

Finally, given the market’s expectations of at least a 25bps cut tomorrow, one wonders what the point is when global financial conditions are back at extreme easy levels…

Data-dependent my left nut!!

via ZeroHedge News https://ift.tt/2Yh2Jfq Tyler Durden