Authored by Mark Cudmore, Bloomberg Markets Live reported and former Lehman trader.

The events that matter most for investors this week won’t be the ones dominating short-term price-action — those headline-grabbing moments will be old news within a month.

Next weekend’s newspapers and strategy notes may well be focused on the Fed and the jobs report, but by mid-August, we’ll still care far more about three other things happening this week — trade, forward-looking economic indicators and the outlook for future earnings.

It’s been dubbed the most important week of the year for markets: U.S.-China trade talks back on in Shanghai, the likely Fed’s first rate cut in more than a decade, and Friday’s U.S. payrolls are some of the highlights. People are most excited by Wednesday’s FOMC meeting and, by Friday, that will likely have had the largest impact on asset prices.

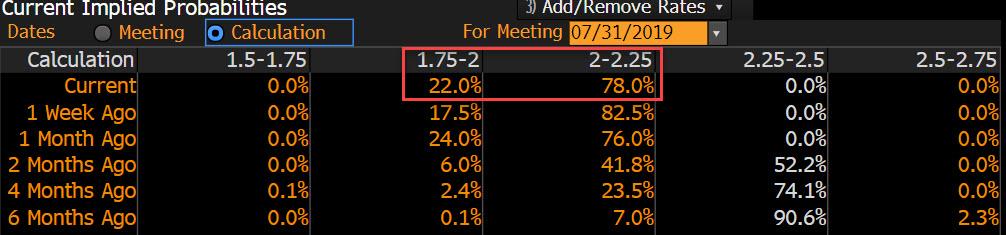

Not the actual rate decision — where a 25bps cut, and no more, is all but guaranteed — but the guidance around what policy moves are likely to come next and why.

And it’s in that context that Friday’s labor data is being hyped up as almost the second most important event of the week. It’s hard to fight the crowd and a good narrative, but the true relevance of this release is being overstated. Most importantly, unemployment is a lagging indicator.

The U.S.-China trade relationship matters far more for the global economy longer-term and will drive future Fed policy anyway. There’s little expectation something concrete will come from this week’s meeting, but the nuanced signaling from both sides at the end will be key for setting expectations for what comes next.

For a forward looking economic indicator look to Wednesday’s PMIs, given they’re a survey of future spending and hiring plans. They are also global, rather than just U.S. focused. They may be the less glamorous data release, with the retail audience less aware, but it’s what investors should focus on when considering where the global, and U.S., economy is headed.

And to get a sense of whether U.S. stocks can extend their record high or will come under pressure — corporate earnings guidance is key. Estimates continue to be downgraded, and 3Q is set to be the first quarter of shrinking earnings for the S&P 500 since December 2015.

Estimates are also falling for 4Q and 1Q 2020 (and still appear too high) and at some point, equity investors are going to have to face that reality.

So while traders should get plenty of short-term volatility this week to dip in and out around the high-profile events, investors with a longer-term focus may want to step back from the noise and focus on the events that really matter.

via ZeroHedge News https://ift.tt/312cV8z Tyler Durden