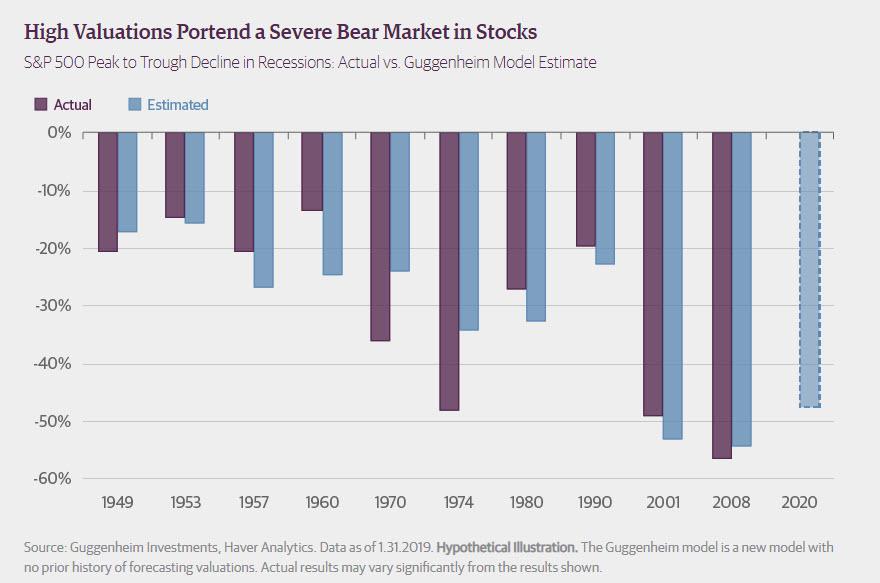

Echoing Guggenheim’s fears that US equities are in for a dramatic collapse, Morgan Stanley’s Mike Wilson warns that “…if equity markets fail one more time at our key resistance point, we believe the reversal is likely to be sharper and deeper than one might expect, even if the earnings recession is more benign than we expect.“

Via Morgan Stanley,

Breaking out is hard to do.

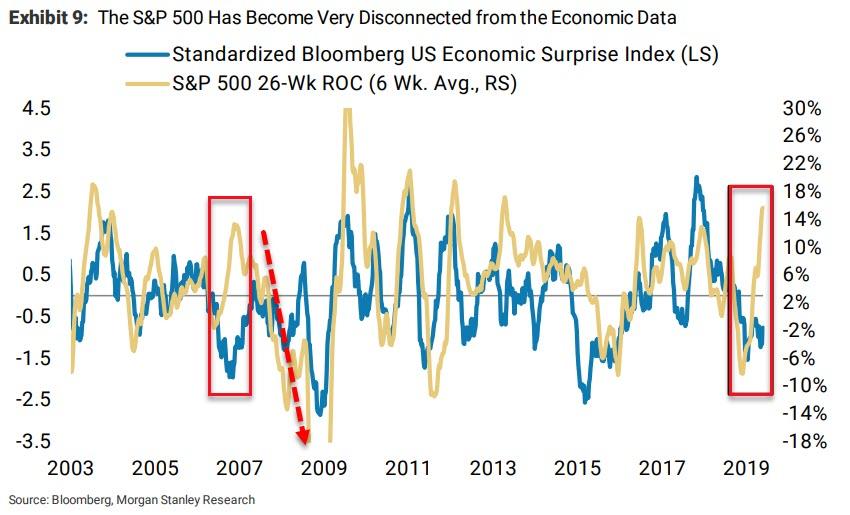

The S&P 500 remains the pied piper for global risk markets yet it continues to struggle with current levels for the third time in the past 18 months. While our 2400–3000 call from 18 months ago may look vulnerable, we think this latest surge will fail again, as we don’t expect a Fed cut to rekindle growth the way market participants may be hoping,and now pricing.

Market internals remain weak…

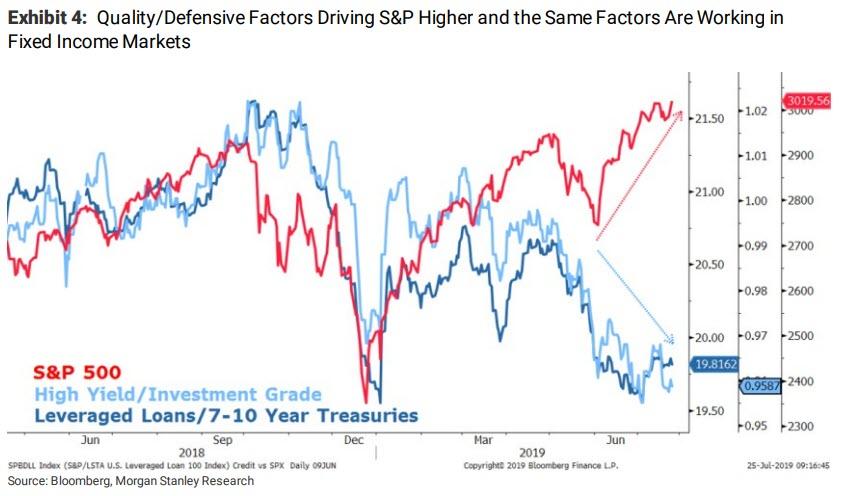

While the S&P 500 has made new highs, leadership remains decidedly defensive, with bond proxies and high-quality stocks disproportionately contributing to performance.

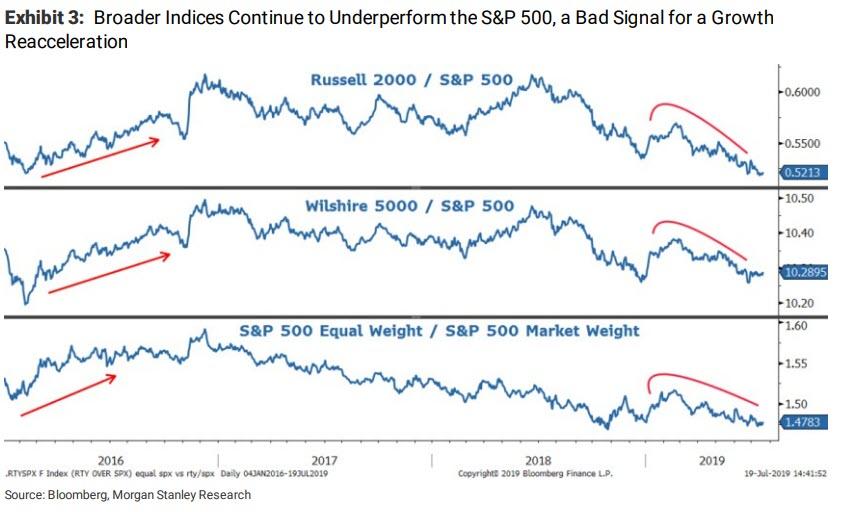

Underperformance of broader indices like the Russell 2000, Wilshire 5000,and equal-weighted S&P 500 suggest poor breadth, which is not a healthy development.

… Because fundamentals remain weak.

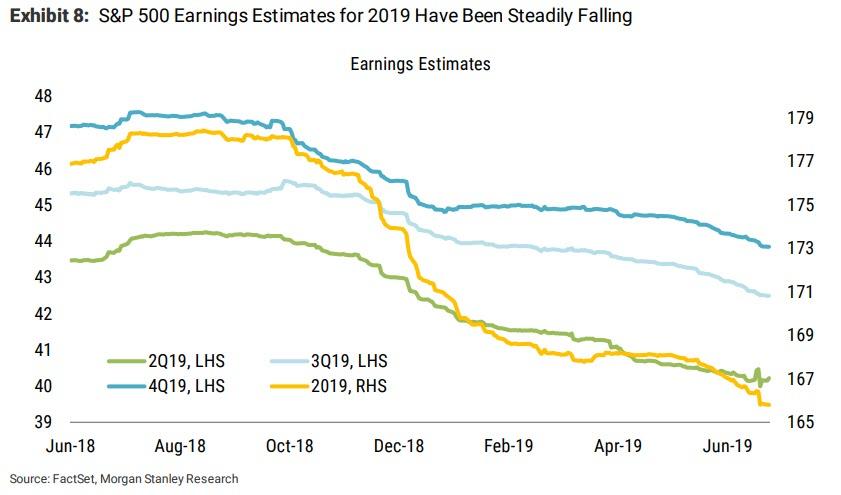

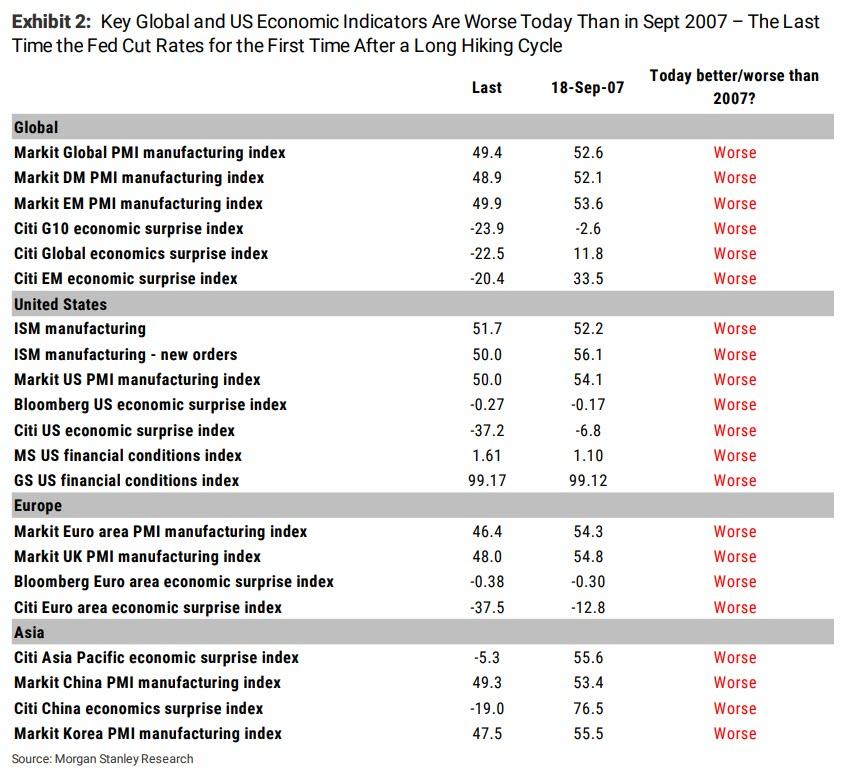

We have been consistent in our view that growth would disappoint this year on both the earnings and economic fronts. Earnings forecasts have fallen significantly since the beginning of the year and economic surprises have skewed to the downside.

Big disappointments in capital spending and business surveys suggest growth could slow further in 2H. Our economists are forecasting a material deceleration in 2H US GDP vs 1H.

Discretionary investors running below average exposure, systematic strategies running above.

Over the past decade, systematic strategies have tripled in size to $900B, meaning, like a bull in a china shop, they can knock things over when they decide to leave. They may be pushing a rally that is increasingly disconnected from deteriorating fundamentals now, but this works both ways – they could accentuate a price reversal at key technical resistance levels.

Wilson concludes, …if equity markets fail one more time at our key resistance point, we believe the reversal is likely to be sharper and deeper than one might expect, even if the earnings recession is more benign than we expect.

via ZeroHedge News https://ift.tt/30Xl3aq Tyler Durden