Millennials will tell anyone – the “greatest economy ever” is a hoax. That is because many young adults aren’t just priced out of the housing market; they have never recovered from the 2008 financial crisis.

The Wall Street Journal (WSJ) investigated several trends that have transformed millennials into a generation of renters. The Journal’s latest report is an eye-opener into the shaky finances of the next generation that will take over the entire U.S. workforce by 2024.

Alex Ruiz, 29, and his wife, Stephanie Johnson, spoke to WSJ about insurmountable student debt, little savings, rising rents, the affordable housing crisis, and the bleak outlook on life.

The couple is located in Asheville, N.C., where residential real estate markets have jumped 70% post the financial crisis, making it unaffordable for the pair to buy a home. Rising rents and student loans have drained every last penny out of the two, who are unable to save for a downpayment.

“Day to day we’re OK generally,” said Mr. Ruiz, a case manager at a government-funded agency.

“But the depressing part is when we take a hard look at the possibility of our future.”

For many generations, homeownership was a pillar of the American dream. Since the dream died shortly after the 2008 crisis, many are rethinking what that new dream could be.

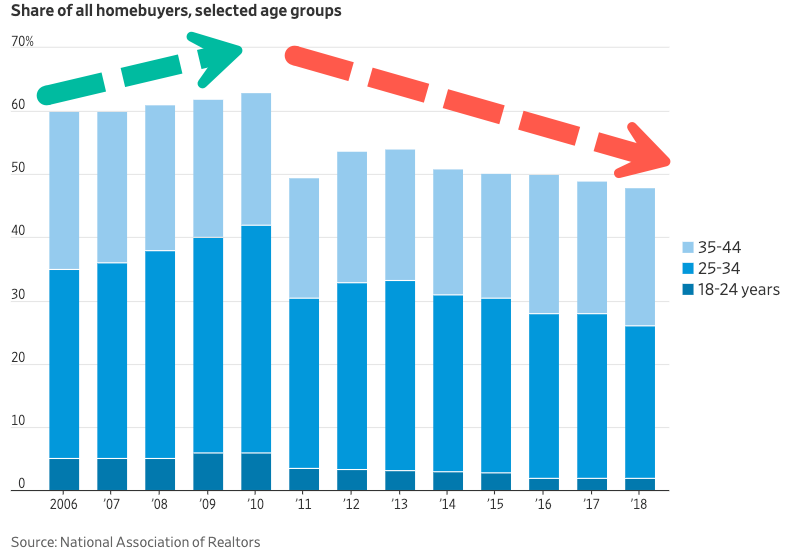

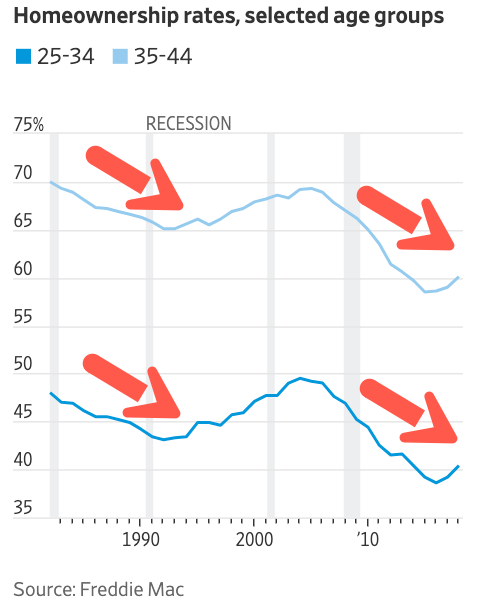

Millennial homeownership rates have crashed over the last decade. The median age of a home buyer is 46, the oldest since the National Association of Realtors began keeping records in 1981. The trend is expected to accelerate into 2020.

Millennials who became young adults in the stock market and real estate crash a decade ago, came out in the aftermath with “no bargaining power when they entered the job market, crimping their earnings ever since,” said The Journal. They watched their families get obliterated with financial hardships, determined that owning a house wasn’t in their interest.

Now that millennials are generally at an age where it’s accustomed to settling down: buy a home, get married, and have children — many are rethinking the American dream because they cannot afford it.

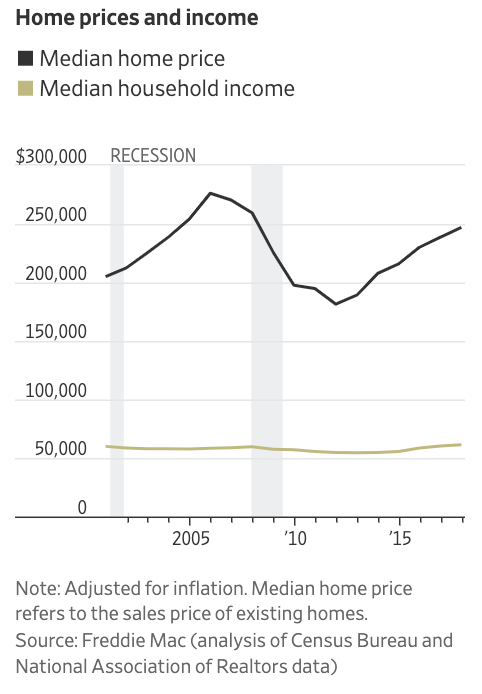

From 2012 to 2018, the average price of lower-priced homes jumped 64%, according to mortgage-data tracker CoreLogic, while the price of higher-end homes increased just 40%. During the same period, wage growth for average workers remained depressed.

A study earlier this year showed that six out of ten millennials don’t have $500 to cover their rent or food expenses; in the event, they lose their jobs in the next downturn.

The effects of poor financial health have forced many millennials to live in their parents’ basements, according to census data. This means many can’t even afford rising rents in many of the Case-Shiller 20-Cities.

“Lower homeownership for young adults means lower economic growth,” said Sam Khater, chief economist of mortgage-finance giant Freddie Mac. “That’s it in a nutshell.”

The millennial homeownership rate is at the lowest levels in three decades. About 40% of young adults, ages 25 to 34, were homeowners in 2018, according to Freddie Mac. That is down from 48% in 2001 when Gen X-ers were young adults.

Stagnate wage growth is the crux of the problem. Home prices have dangerously outpaced wage gains over the last decade. From about the end of 2000 to the end of 2017, median home prices increased 21% after adjusting for inflation, while median household income grew 2%.

The median net worth for millennial households crashed by a third from 2001 to 2016 after adjusting for inflation, according to the Federal Reserve.

Even if millennials start purchasing homes this year through earlier 2020 – they’re likely buying the top of the market.

The effects of not buying, or buying late, should become more evident through the early 2020s as millennials settle down. The median family net worth of homeowners is $230,000 compared with just $5,000 for renters.

Without home equity, millennials are screwed in the next economic downturn.

And several decades from now, around 2040, millennials will keep working through their retirement years.

Which leaves us to today, as the 2020 U.S. presidential election is around the corner, many Democratic presidential candidates are offering student loan debt forgiveness and universal income to struggling millennials.

A snapshot of the student loan crisis: Only 26 people were granted debt forgiveness out of 34K applicants in the U.S. this year, says @CNBC.

A recent economic study suggested that canceling student loan debt could actually be a huge boost to the economy: pic.twitter.com/FMAjfsXhvK

— AJ+ (@ajplus) November 29, 2018

Could millennials, who are over 75 million strong, have a much more significant impact on the election than previously thought?

via ZeroHedge News https://ift.tt/2YyyHTJ Tyler Durden