Ahead of tomorrow’s Fed rate cut, the only lingering question is whether it will be 25bps – which is now fully priced in and may disappoint markets, especially if it is framed in a hawkish tone and optimistic outlook – or the Fed goes all the way, and despite the recent miscommunication fiasco between the NY Fed and its president, John Williams (and WSJ follow up), the Fed opts to go all the way and cuts by 50bps, prompting questions about the state of the US economy (the last time the Fed cut 50bps to start an easing cycle was in September 2007 and the recession started three months later).

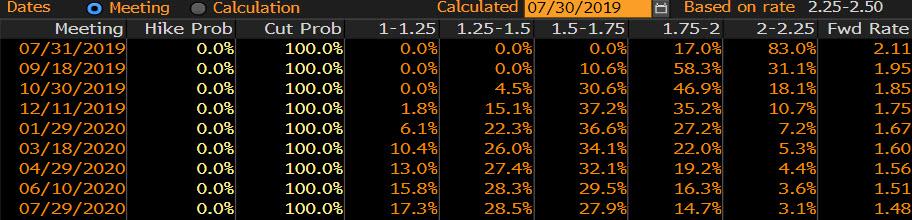

As we have noted in recent days, while the market-implied probability of a 50bps cut has slumped in the past few weeks, and is down to just 17% as of this writing, there are two arguments why the Fed may still go for the “shock and awe” approach.

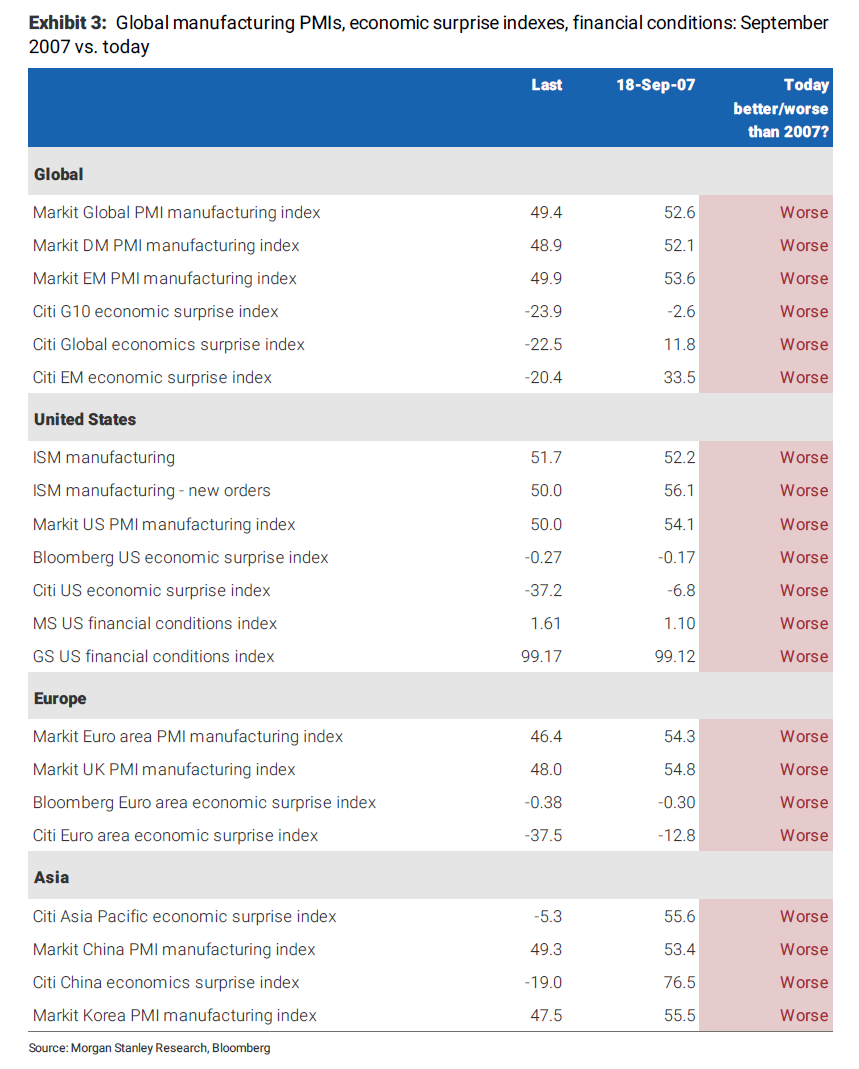

The first one framed by Morgan Stanley, which is confident the Fed will cut 50bps tomorrow, is that while domestic US economic data has posted a substantial improvement in recent weeks, the Fed – which now sees itself as the world’s central bank – is less concerned about current coincident US economic data and more concerned about the leading indicators and future coincident US economic data. The Fed points to global growth, trade uncertainty, and manufacturing weakness to justify its concerns. So, given the claims that US data has been so good, Morgan Stanley compared the current state of affairs in…

-

US and global manufacturing (via PMIs)

-

US and broader economic data (via popular surprise indices),and

-

US financial conditions

…to that which existed on or just before the September 18,2007 FOMC meeting, when readers may recall, the FOMC cut 50bp at that meeting. Here, Morgan Stanley urges to look at the first cut in 2007 without the benefit of hindsight – meaning, the Fed’s decision to cut 50bp had nothing to do with the coming recession (which started just three months later, in December of that year) or the ensuin financial crisis. It was about lessening downside risks coming from tighter financial conditions. Today, it’s about downside risks coming from global growth and trade uncertainty. And as shown in the chart below, things look worse today than at the September 2007 meeting on every metric.

Looking at the above comparison between 2019 and 2007, Morgan Stanley concludes that “it will be hard for the FOMC to look at Exhibit 3and think a 25bp cut would be enough at this point.”

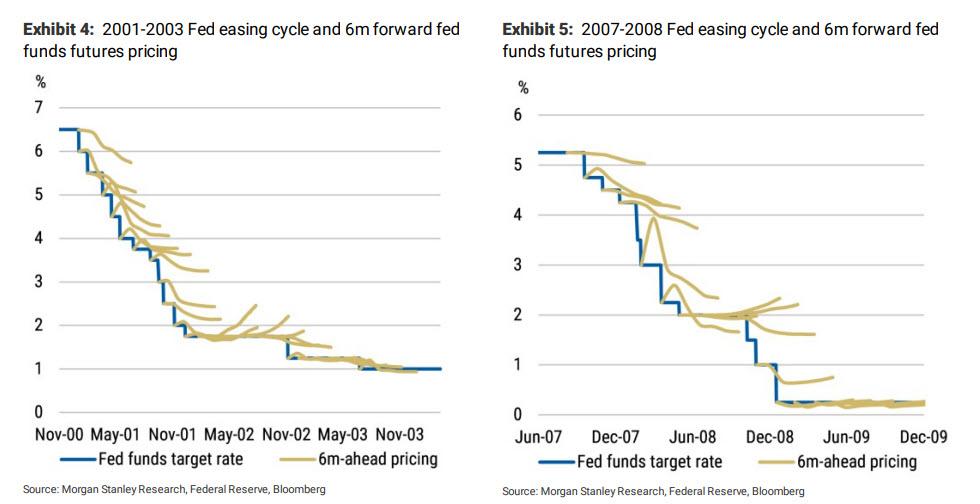

Besides the macroeconomic argument, Morgan Stanley also brings up the purely tactical one: with interest rates already precariously low for an easing cycle (thanks to the “r-star” which appears to be in the neighborhood of zero), “every rate cut needs to count.”

As Morgan Stanley explains, with limited room to cut rates, the Fed should save rate cuts for when they are most needed, and due to the limited room the Fed has to lower interest rates, every rate cut needs to count. But how do you make every rate cut count? Simple: by delivering more than what markets price in (i.e. 25bps). That is exactly what happened during the 2001-2003and 2007-2008 hiking cycles

Also, during those cycles, the Fed had much more room to lower rates than it does today.

* * *

A second reason for why the Fed will likely surprise the market dovishly and cut 50bps, comes from Nomura’s Charlie McElligott today, who instead of looking at macroeonomic conditions, whether domestic or international, focuses on persistent dollar strength, the “nervous” funding and money markets, and the (partially) clogged up dollar liquidity.

As McElligott explains, a scenario where the Fed would shock the markets with a 50bps cut would likely come down to their (unspoken) concerns around

- USD strength (as a clear headwind to achieving their inflation goal and as a headwind to US exporters) which comes part and parcel with

- Dollar funding/liquidity “tightness” into a slowing global economy

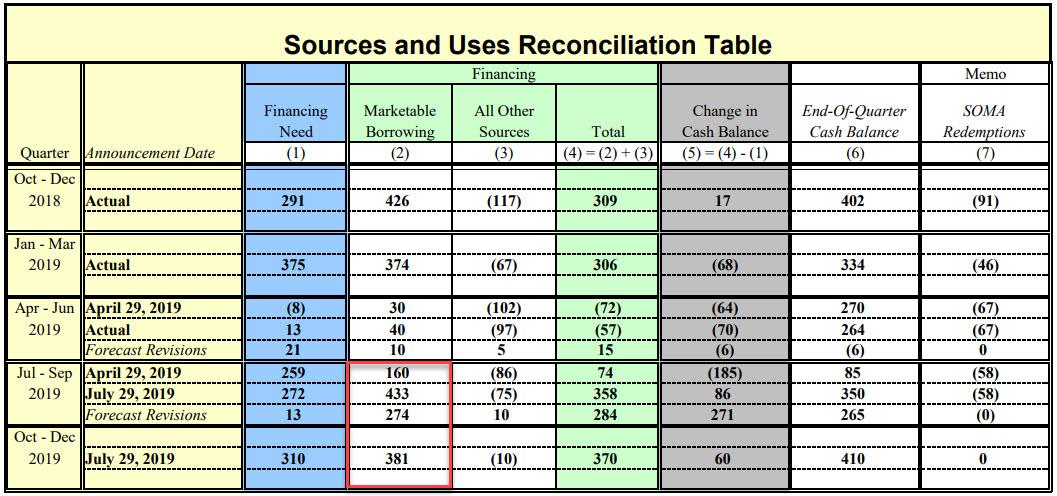

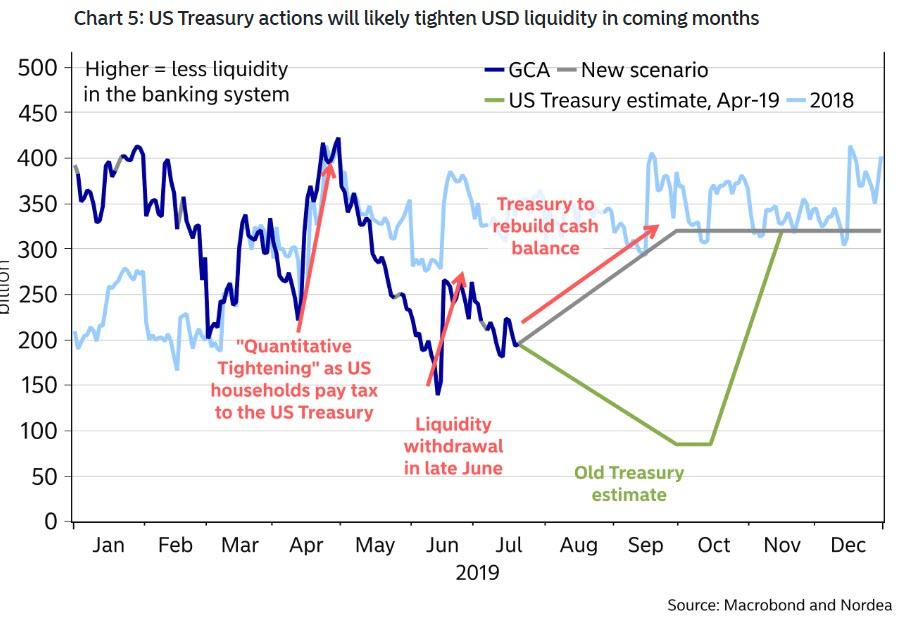

Specifically, USD-funding markets/indicators are getting even “nervier” and beyond the already-increasingly erratic month-end turn “tightness.” Here, McElligott also refers to the latest Treasury refunding/issuance announcement, where the Treasury said it now expect to borrow a whopping $433B in Q3 to rebuild the cash supply following the suspension of the debt ceiling “deal”, this as we noted yesterday, is more than double the April estimate.

This means a massive wall of T-Bill issuance coming in the next 2 months – one which will promptly soak up liquidity from the banking system (see chart below), into a backdrop where Dealer balance sheets are already loaded to the gills along-with increasingly “price-sensitive” domestic investors and foreign real $ who too remain sensitive to the cost of the almost “punitive” FX hedge.

To underscore his point that dollar plumbing/liquidity looks “messy” across a number of markets / indicators, McElligott notes the following:

-

We have seen meaningful FRA-OIS widening since the end of May (3m nearly doubling from 16bps to current 30bps) which is likely to stay elevated in coming weeks, in light of the aforementioned issuance/collateral soon to hit the market;

-

Cross-Currency Basis for US Dollar funding is now too ‘cat (more expensive for foreign entities to fund in Dollars—i.e. 3m EURUSD from +4.75 on Jan 9th to today’s -25.5bps);

-

The anomalous dynamic of Fed Funds (effective rate) trading above IOER (and despite a number of IOER cuts throughout QT), which is a “free money arb” for banks that should not exist because in theory, banks should lend at the higher FF rate instead of parking money with the Fed where they are paid “lower” IOER—but are not doing so;

-

Despite the Fed’s dovish pivot since early January to reverse the “financial conditions tightening tantrum” of 4Q18, the SOMA runoff has continued unabated throughout 2019, where said “supply shift” (more going to private investors and not Fed) has continued upward pressure on repo rates vs OIS (tighter funding);

-

And finally, as bank reserves have continued to shrink (the supposed basis for the Fed’s stance change) in addition to the now “known” / imminent Bill-issuance spike potential impact across money rates, SOFR volatility/spread to IOER is too likely to remain elevated (tighter funding)

To the Nomura strategist, this collective technical “USD funding tightness” is behind the dollar index trading at 27 month highs, despite imminent perceived Fed cut(s) and data softening—which in turn have teased many in the market to try to get “short Dollar.”

Of course, to the inflation-targeting obsessed Fed, this “strong Dollar” dynamic is an inflation headwind; an economic/exporter headwind; and now – most importantly – “a very political headwind to the US Administration.“

Meanwhile, with other central banks globally pivoting in their own efforts to resume easing/currency devaluation efforts (particularly ECB resumption soon), there is increased pressure on the Fed to “go fast”, especially ahead of the 2020 election cycle, where they do not want to be part of the political landscape.

* * *

With all that said, the decision how much to cut will ultimately be up to Jerome Powell and the FOMC, and it will be unveiled at 2pm tomorrow. Which then brings us to the only binary question that matters for traders ahead of tomorrow’s historic – first easing cycle in 12 years -event:

How might the market react to different outcomes?

While there are various combinations of rate cuts and statement language, Morgan Stanley considers the market reaction to three of the most probable outcomes:

25bp rate cut and retention of the “closely monitor” language

-

Expect market to price in 15-20bp of rate cuts at the September meeting.

-

Expect market to price 40-55bp of rate cuts by year-end out of August 1, or 65-80bp by

-

year-end from today, i.e., inclusive of the 25bp cut delivered on July 31.

-

Expect market to price 90-105bp of rate cuts over the 12 months from today, i.e., inclusive of the 25bp cut delivered on July 31.

-

Expect UST 2y to trade at 1.71-1.83%

-

Expect UST 2s10s to trade at 25-29bp

-

Expect UST 2s30s to trade at 76-84bp

50bp rate cut and a reversion to the”patient” language

-

Expect market to price in 5bp of rate cuts at the September meeting.

-

Expect market to price in 25-40bp of rate cuts by year-end out of August 1, or 75-90bp

-

by year-end from today, i.e., inclusive of the 50bp cut delivered on July 31.

-

Expect market to price 100-115bp of rate cuts over the 12 months from today, i.e.,

-

inclusive of the 50bp cut delivered on July 31.

-

Expect UST 2y to trade at 1.63-1.75%

-

Expect UST 2s10s to trade at 28-32bp

-

Expect UST 2s30s to trade at 81-90bp

50bp ratecut, replace”closely monitor” with “continueto monitor” (basecase)

-

Expect market to price in 10bp of rate cuts at the September meeting.

-

Expect market to price in 40-60bp of rate cuts by year-end out of August 1, or 90-110bp

-

by year-end from today, i.e., inclusive of the 50bp cut delivered on July 31.

-

Expect market to price 115-125bp of rate cuts over the 12 months from today, i.e., inclusive

-

of the 50bp cut delivered on July 31.

-

Expect UST 2y to trade at 1.55-1.63%

-

Expect UST 2s10s to trade at 32-36bp

-

Expect UST 2s30s to trade at 90-96bp

JPMorgan has a somewhat streamlined take on how to trade tomorrow’s binary rate cut, which it breaks down into a “good case” and “best case”

-

Good case (odds: 20%) – the Fed cuts the FF and IOER rates by 25bp and concludes the balance sheet run-off process (which is 6 weeks earlier than previously scheduled). The statement stays largely the same as before. Powell doesn’t use the word patient and signals at least one additional 25bp cut this year. His emphasis during the press conf. isn’t just on “insurance” but also disinflationary headwinds, a flat yield curve, and ongoing int’l pressures. Powell doesn’t shy away from balance sheet questions and says this very much remains a key component of the policy toolkit (and hints the balance sheet could be utilized even before the FF returns to zero). No one dissents.

-

Best case (odds: 10%) – everything in the “good case” except the Fed cuts rates 50bp.

Finally, we present one final consideration from McElligott, who thinks a 50bps power cut perversely risks a market interpretation that this is then “just” a one-time “insurance cut” action, as opposed to a 25bps “slow-and-steady” cut which opens door to more behind.

Meanwhile, with the more-probable 25bps cut outcome, there still remains “execution risk” with regards to Fed forward guidance as well, as the Fed needs to execute the above “dovish 25bps cut” at the least in order to keep door open for further action, or risk disappointing markets.

via ZeroHedge News https://ift.tt/333zIT6 Tyler Durden