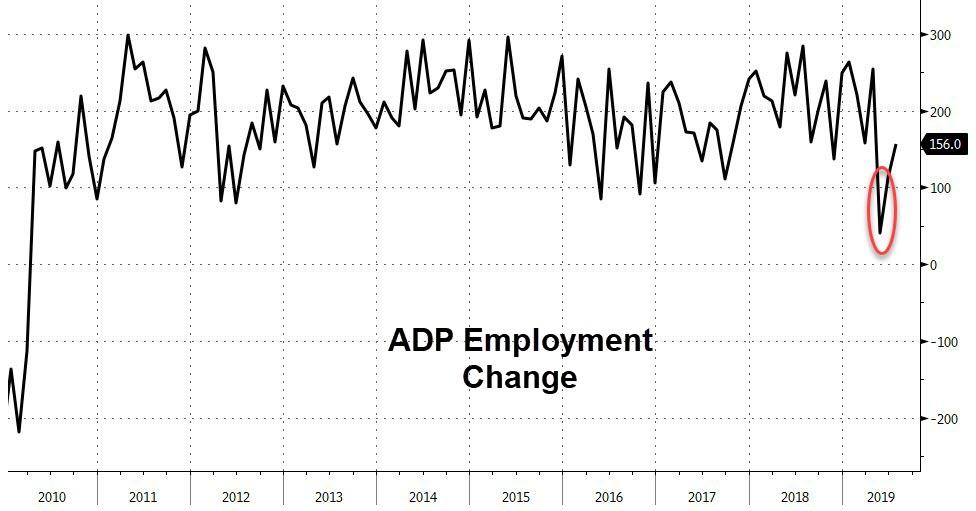

While The Fed has clearly veered from any data-dependence (aside from the level of The Dow), some still care about the state of the nation’s ‘real’ economy and today’s ADP was expected to rebound from dismal May and June data and its did with a better-than-expected 156k print for July.

“While we still see strength in the labor market, it has shown signs of weakening,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute.

“A moderation in growth is expected as the labor market tightens further.”

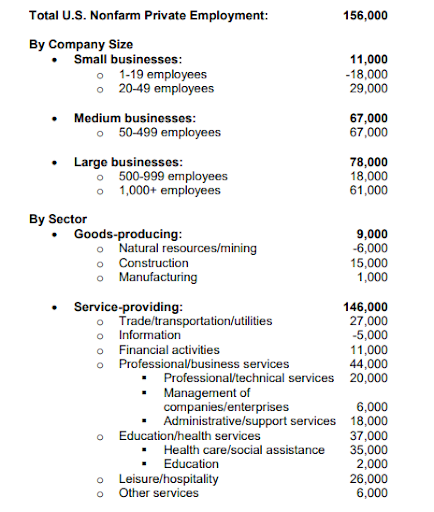

Goods-producing jobs rose 9k while Services dominated once again, rising 146k in July, but notably very small businesses (1-19 employees) have seen job losses for three straight months…

Mark Zandi, chief economist of Moody’s Analytics, said, “Job growth is healthy, but steadily slowing. Small businesses are suffering the brunt of the slowdown. Hampering job growth are labor shortages, layoffs at bricks-and-mortar retailers, and fallout from weaker global trade.”

Goldilocks? Or enough bad data for Powell to cut?

via ZeroHedge News https://ift.tt/2KhPYr0 Tyler Durden