Authored by Charis Hamilton via Econimica blog,

-

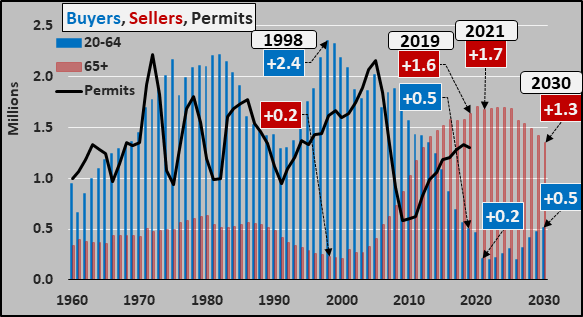

The Annual Growth Of Potential Home Buyers Is Decelerating To Near Zero And Will Remain There For The Next Decade.

-

The Annual Growth of Potential Sellers is Surging and Will Continue To Do So Over The Next Decade.

-

A Surplus of Homes Are Being Built Versus The Minimal Growth In Buyers.

-

The Fed Will Cut Rates In Pursuit Of Prolonging The Housing Bubble.

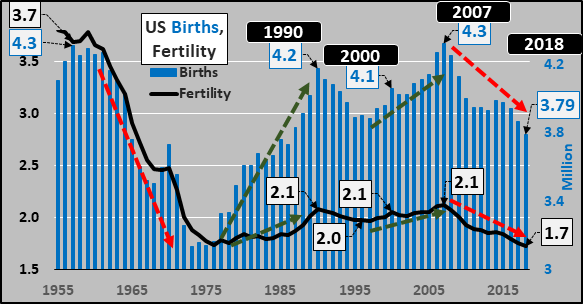

US Births, Fertility – 1950 to Present

From 2008 through 2018, there were 4.4 million fewer births in the US than the US Census estimated there would be in its 2008 projection. 2018 US births were over 500 thousand fewer than those seen in 2007. The sharp and ongoing 12% decline in births since 2007 is entirely contrary to the sharp increases in asset prices and economic activity…and the Census and Federal Reserve expectations. The chart below details annual births (blue columns) and the fertility rate (black line). During each previous economic upturn and financial bubble, the gains were widespread enough to incent a higher fertility rate and higher quantity of births…until the opposite result has been observed for over a decade in the current cycle. Whatever policies are in place are not translating to economic and financial well being among the child bearing population…and fertility and births reflect this.

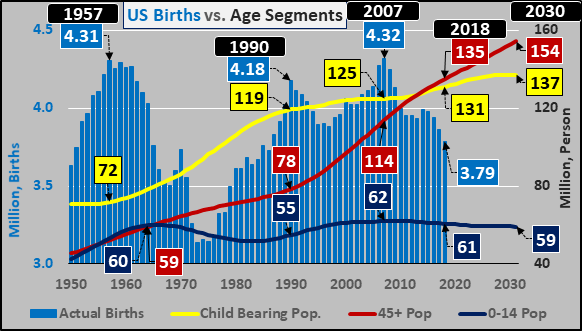

Below, births (blue columns) versus the population segments. The dark blue line representing the 0-14yr/old population versus the 45+yr/old population (red line) is so telling. Since 1962, the 0-14yr/old population is essentially unchanged while the 45+yr/old population has more than doubled…rising by +76 million. Meanwhile, the minor increases in the 15-45yr/old childbearing population (yellow line) continue to be overridden by falling fertility rates. Thus a childbearing population that is nearly double the size it was in 1957 is having 12% fewer total births…and births continue falling fast.

Ok, you get the idea. Total births in 2018 were 12% below the 2007 and 1957 double birth peaks and 17% below what was projected by the Census just a decade earlier. The vast majority of population growth is now among the 65+ year old population…in particular, the fastest growing segment by percentage and also in total numbers is the 75+ year olds.

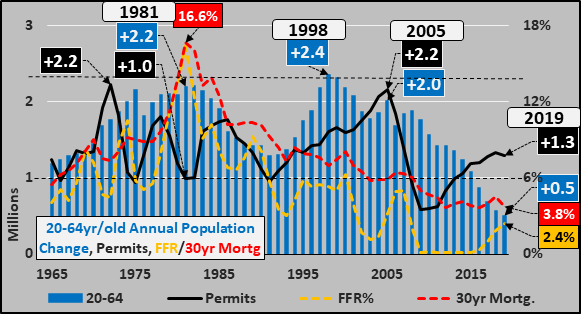

Home Buying Population, Housing Permits, Interest/Mortgage Rates

So, what does this mean for housing? On a net basis, nearly all housing is purchased by the 20 to 64yr/old population segment…so, the chart below shows their annual change (blue columns), housing permits (black columns), Federal Funds rate (yellow dashed line), and the 30 year mortgage (red dashed line). The 20 to 64yr/old population saw twin annual growth peaks in 1981 and 1998, adding in excess of 2.2 and 2.4 million during those two years. As for housing permits, they vacillated from 1 to 2.2 million annually from 1965 to 2005.

But the core population and housing permits essentially haphazardly mirrored one another from ’65 through ’05. However, since ’05 permits tanked unlike anything seen since 1950 while growth among potential buyers has fallen to levels unseen since prior to 1950. Of course, the adoption of ZIRP by the Fed and record low 30 year mortgages have spurred home builders…in conjunction with investors looking for a cash flow vehicle and foreigners looking for a safe place to park excess cash. However, now all three sources of buying have their own problems…population growth among buyers is falling away, foreigners have been spooked by currency and administration actions, and investors facing rent-to-property valuation ceilings.

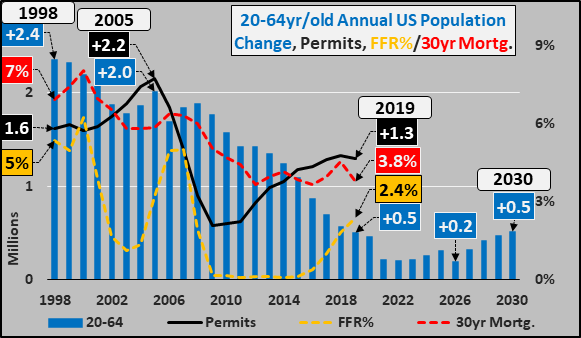

And everything, save for one, is about to get worse aside from the Federal Funds rate (and resultant mortgage rates) going down. While valuations are through the roof, annual growth of potential buyers is a fraction of that seen in ’98 or ’05, foreigners have net ceased their purchasing partly due to relative dollar strength, and whether foreign or domestic, investing at these valuations with flattening rents simply no longer pencils.

As the blue columns in the chart above from 2019 through 2030 show, the annual growth of buyers will be at a level unseen since before WWII. By 2021, 20 to 64 year old growth is projected to be just 200 thousand annually (and this is entirely dependent on immigration, otherwise declines will rule). On a monthly basis, this means less than 20 thousand new potential employees, less than 20 thousand new potential homebuyers, car buyers, etc. per month. So, the next decade is one of essentially little to no growth among buyers (blue columns below) while potential sellers (65+ year olds, red columns) surge. The case for full employment and minimal further working age population growth (and thus, minimal further jobs growth) is made HERE.

Anyone unsure of the Fed’s motives in cutting interest rates need only look at the primary pillar of the US economy, the housing market, the decline of potential buyers versus surge in sellers.

The only remaining tool the Fed has is ZIRP and more likely NIRP to hammer mortgage rates to new record lows in an attempt to continue blowing the housing bubble and save the banks from their fate, otherwise.

Birth data is via the CDC, population data via the UN report, World Population Prospects 2019.

via ZeroHedge News https://ift.tt/2K9d4QA Tyler Durden