The unexpectedly early end to the latest round of trade talks in Shanghai, indicating that any goodwill to restore US-China trade is now dead and buried, weighed on global stocks on Wednesday ahead of the highly anticipated Fed meeting, even as US equity futures levitated higher on the back of strong results and even stronger guidance from Apple (which is expected to surpass a $1 trillion market cap again today), with Treasury rates unchanged, the dollar holding firm and Britain’s pound subdued amid rising fears of no-deal Brexit.

Combative warnings from President Trump cast a shadow over the day’s other main event, as the Sino-U.S. trade talks concluded in Shanghai on Wednesday, with Beijing attributing the lack of progress to Washington’s flip-flopping.

“Trade talks have finished without an agreement,” said Justin Onuekwusi, fund manager at Legal & General Investment Management. “Of course, it doesn’t help that almost as a prelude to the conversation you get tweets that are quite antagonistic,” he said, referring to a tweet by Trump warning China against waiting out his current presidential term before finalizing a trade deal.

The fresh trade tensions come ahead a FOMC meeting which is expected to see interest rates reduced by 25 basis points in its first rate cut in more than a decade. Yet the focus is on whether this will be a “one and done”, or Powell will leave the door open for further easing to shore up the world’s largest economy in the face of slowing global growth and the fallout from trade conflicts.

A 25bps rate cut is certain as is another 25 basis point reduction by September – with the market pricing in a 20% chance of a 50bps rate cut today – but what will matter is whether this is seen as a recessionary cut (validated by a 50bps cut), or an “insurance”, or precautionary easing. How Powell frames today’s move will determine if stocks will rise or fall before the end of the day. Expectations for Fed easing helped lift the S&P 500 index 2.4% so far this month.

“Exactly what happens today is far from a foregone conclusion,” said Deutsche Bank’s Jim Reid. “Although the Fed have given no real encouragement to the notion of a 50 basis point (bps) cut it’s worth noting that the last time the Fed began a series of rate cuts, in September 2007, their opening move was a 50 bps cut, and a similar 50 bps cut happened when the Fed began cutting in January 2001.”

Trump on Tuesday reiterated his call for the Fed to make a large interest rate cut, saying he was disappointed in the U.S. central bank and that it had put him at a disadvantage by not acting sooner.

“The bond and equity markets have fully priced in a cut,” Paul Brain, head of fixed income at Newton Investment Management, said in a note. “On balance, there may be some that are disappointed by the size of the cut and the subsequent messaging, but once that is out of the way there will be a realization that rates are heading lower.”

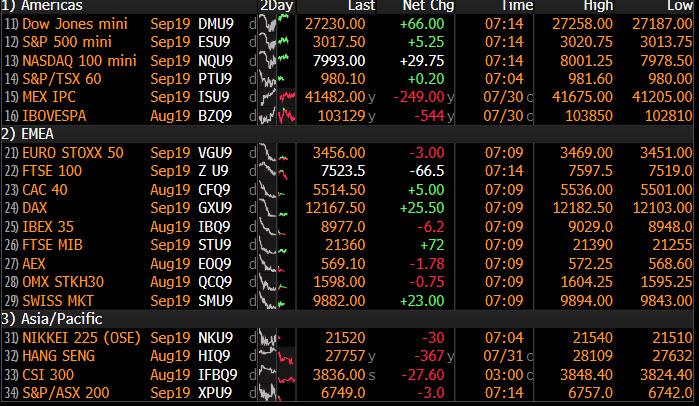

Until the 2pm FOMC announcement, global stocks were biding their time, with the MSCI world index and Europe’s pan regional Stoxx 600 slipping 0.1%, the latter flirting with a fresh one-month low and decidedly underperforming the S&P500, as worries over trade wars and Brexit offset encouraging signals from the earnings season. The Stoxx Europe 600 index struggled for direction amid mixed company reports, with personal and household-goods shares among the biggest losers as L’Oreal dropped after posting disappointing sales figures. Construction companies led gains after upbeat results from Vinci. London’s FTSE fell 0.3% while Frankfurt stocks gained 0.2% and Paris was treading water.

In focus were banks, with strong results from French lender BNP Paribas and Switzerland’s Credit Suisse countering a poor report from British bank Lloyds. Also of note is the sharp rebound in German retail sales, which surged 3.5% M/M, smashing expectations of a modest 0.5% increase, and the biggest monthly increase since 2006.

Asian stocks ex-Japan fell to a six-week low with China mainland stocks down nearly 1% and Hong Kong tumbling 1.3% as China and the U.S. concluded their Shanghai trade talks without signaling any progress and disappointment among investors with corporate earnings. The MSCI Asia Pacific Index fell as much as 0.8% to the lowest level since June 19. Technology was the worst-performing group Wednesday, mainly dragged by Samsung Electronics as the company reported lower profit and said it faces uncertainty due to growing macroeconomic issues. Hong Kong market closed early Tuesday as a storm struck the city. Philippines’ PSEi Index fell 1.3%, led by basic materials companies. Elsewhere, India’s Sensex traded little changed.

Overnight, Chinese data showing factory activity shrank for the third month in a row in July added to the somber mood.

Seemingly oblivious to the global equity woes, US futures pointed to main indexes opening higher as General Electric delivered strong results. On Tuesday, major Wall Street stock averages ended slightly lower with the S&P 500 losing 0.26%, however, momentum reversed after the closing bell when Apple shares soared 4.2% as its Q3 earnings beat estimates and CEO Tim Cook cited “marked improvement in Greater China”.

In currency markets, the dollar index traded flat around 98.064 after pulling back from a two-month high of 98.206 touched on Tuesday. The dollar index was set for a monthly gain of 1.4%, its best since last October. The greenback was also steady against the yen and the euro, with the former undermined on Tuesday by the BOJ’s decision to refrain from expanding stimulus though it committed to doing so “without hesitation” if required. Most other currencies traded in narrow ranges before the Fed meeting.

Meanwhile the British pound hovered near a 28-month low hit the previous day on growing concerns about a disorderly Brexit. GBPUSD recovered from the drop seen in the past two sessions but was still set for a 4% decline this month, its worst showing since 2016. The Australian dollar climbed against all its major peers as headline inflation was higher than the estimate.

Treasuries were modestly higher, led by front-end ahead of the Fed’s expected rate cut. Volumes were light during Asia session and European morning with several additional key events ahead including July ADP employment change, quarterly refunding announcement and month-end. The 10-year yield was at 2.05% after a 3bps decline since July 25. The TSY curve had a small steepening bias, with yields richer by 1.2bp to 2bp across the curve with 10-year ~2.047%, lower by 1bp; Around the world, gilts underperformed, cheaper by 1.5bp vs. Treasuries, as sterling stabilizes following recent sell-off, while bunds keep pace.

In geopolitics, North Korea fired multiple projectiles early on Wednesday which was said to be 2 short-range ballistic missiles and a different type of weapon than previous launches, Following the launch, South Korea convened a national security meeting, while Japan Defense Ministry said no ballistic missiles reached Japan’s territory or exclusive economic zone and sees no immediate impact on Japan’s security from the North Korea launch.

In commodity markets, crude oil futures rose for the 5th straight day, buoyed by a bigger-than-expected drop in U.S. inventories. U.S. WTI crude gained 28 cents to $58.34 per barrel while Brent crude futures LCOc1 added 48 cents to $65.2. Three-month copper on the London Metal Exchange (LME) CMCU3 was almost unchanged at $5,950 a ton.

Expected data include mortgage applications. CME Group, Carlyle Group and Spotify are among companies reporting earnings.

Market Snapshot

- S&P 500 futures up 0.2% to 3,019.50

- STOXX Europe 600 up 0.06% to 385.36

- MXAP down 0.6% to 158.48

- MXAPJ down 0.7% to 519.26

- Nikkei down 0.9% to 21,521.53

- Topix down 0.7% to 1,565.14

- Hang Seng Index down 1.3% to 27,777.75

- Shanghai Composite down 0.7% to 2,932.51

- Sensex up 0.06% to 37,418.69

- Australia S&P/ASX 200 down 0.5% to 6,812.56

- Kospi down 0.7% to 2,024.55

- German 10Y yield fell 0.7 bps to -0.406%

- Euro down 0.08% to $1.1146

- Brent Futures up 0.7% to $65.16/bbl

- Italian 10Y yield rose 8.7 bps to 1.308%

- Spanish 10Y yield fell 2.8 bps to 0.324%

- Brent Futures up 0.9% to $65.16/bbl

- Gold spot down 0.02% to $1,430.53

- U.S. Dollar Index up 0.06% to 98.11

Top Overnight News

- China and the U.S. concluded a new round of trade talks in Shanghai on Wednesday following a hiatus of almost three months, with little immediate evidence of progress being made toward ending their year-long dispute

- The talks come at a time when President Trump lashed out at China for what he said is its unwillingness to buy American agricultural products and said it continues to “rip off” the U.S.

- A tropical storm shut Hong Kong’s financial markets for the first time in almost two years, adding chaos to a city which has been wracked by protests for weeks

- German unemployment rose and demand for new workers dwindled, a sign that weakening economic momentum is starting to affect the labor market. Spanish economic growth slowed more than expected in the second quarter, adding another layer of gloom to an increasingly fragile situation in the euro region

- “We now have a fresh approach to negotiating a deal and are well prepared to leave the EU,” U.K. Brexit Secretary Stephen Barclay said on Twitter, adding that he was confident as two new Brexit committees “are now up and running”

- The White House is monitoring what a senior administration official called a congregation of Chinese forces on Hong Kong’s border

- North Korea fired multiple unidentified projectiles off its east coast early Wednesday, Yonhap reports, citing the South Korean Joint Chiefs of Staff

Asian equity markets followed suit to the negative performance seen across global peers amid trade concerns following US President Trump’s Twitter rant regarding China, while the looming FOMC decision, mixed Chinese PMI data and earnings deluge added to the cautious tone. ASX 200 (-0.5%) was dragged lower by losses in utilities and financials but with downside stemmed by strength in the energy sector after a rally in oil prices, while Nikkei 225 (-0.9%) suffered the ill-effects of a firmer currency with the best and worst performers in Tokyo driven by their quarterly results. KOSPI (-0.7%) weakened after North Korea conducted another launch which was said to be a new type of weapon and with earnings also in focus including index heavyweight Samsung Electronics which showed final Q2 oper. profit and revenue topped preliminary results but still suffered a 56% Y/Y drop in profits. Conversely, its main rival Apple saw a different fate with the US tech giant gaining around 4.5% after-hours due to a beat on both top and bottom lines and although it missed on iPhone sales its revenue forecast for next quarter surpassed Street estimates. Elsewhere, Hang Seng (-1.3%) and Shanghai Comp. (-0.7%) conformed to the wide risk averse tone after President Trump’s recent criticism on China and warning of a much tougher deal if China holds out until after the next US elections, with participants also digesting mixed Chinese PMI data in which the headline Manufacturing PMI beat expectations but remained below the 50 benchmark level and Non-Manufacturing PMI missed forecasts. Finally, 10yr JGBs traded relatively flat and were only marginally supported by the risk averse tone as well as the BoJ’s presence in the market for JPY 1.24tln of JGBs with 1yr-10yr maturities.

Top Asian News

- China, U.S. Trade Talks End Early in Shanghai

- Hong Kong Rioting Charges Signal Harsher Line Against Protesters

- Hintze’s CQS Strikes Deal With Asia Managers in Regional Push

Major European indices are mixed [Euro Stoxx 50 Unch], as this morning saw the early finish of US-China trade talks with initial reports indicating that the talks ended with no sign of a breakthrough after an earnings dominated morning for indices. Sectors are also mixed with no standout sector at present. In terms of this mornings earnings, L’Oreal (-3.8%) are under pressure after missing on sales growth in-spite of the Co’s CEO noting that H1 was the strongest in terms of like-for-like growth in decades; notably the Co. also announced a EUR 750mln share buyback. Sticking with the CAC 40 (+0.1%) this morning also saw earnings from Airbus (+0.8%) who beat on Q2 revenue and confirmed FY guidance; recently, the Co. also benefitting recently from WSJ reports indicating that internal risk analysis at Boeing (BA) showed the likelihood was high of further cockpit emergencies following the first crash. Elsewhere, of note for banking names Credit Suisse (+4.2%) are firmer after beating on Q2 net revenue and net income as are BNP Paribas (+3.5%) post earnings where the Co’s Q2 revenue beat on consensus.

Top European News

- Salvini Weighs Early 2020 Vote, Govt Breakup in Fall: Repubblica

- Polish Inflation Unexpectedly Surges to Highest Level Since 2012

- Next Surges as E-Commerce Sales Boost Fuels Guidance Upgrade

- DUP’s Foster Says Ireland Must ‘Get Real’ on Deal: Brexit Update

In FX, AUD, NZD – The Aussie stands as this morning’s G10 winner amid promising domestic inflation data which follows the RBA’s back-to-back rate cuts since June. CPI Y/Y rose to 1.6% (Prev. 1.3%) in Q2 but remains below the Central Bank’s 2-3% target. In terms of implications on monetary policy, the CB is likely to stand pat on rates for now in order to examine further effects of its recent rate cuts and the government’s tax cut package. AUD/USD trades closer to the top of the intraday range thus far, after testing 0.6900 to the upside. Elsewhere, the Kiwi is lacklustre after the ANZ business confidence further deteriorated alongside the activity outlook. NZD/USD hovers just above the 0.6600 mark having visited a current intra-day low of 0.6590.

- DXY, CNY – Relatively side-ways trade for the DXY (for now) heading into the FOMC’s latest policy decision (full preview available in the Research Suite) and with little impetus from the fallout of US-China talks in Shanghai. The initial reports/commentary on the meeting provided little substance. Although no breakthrough was reached (as expected), discussions are said to have been constructive and future talks between the nations will happen. DXY remains flat above 98.00 having earlier tested the figure to the downside. Meanwhile, the CNH also remains tentative and within a narrow range vs. the Buck after having visited its 50 DMA (6.8967) at the European open.

- GBP, EUR – Overall little changed thus far with the Pound capped amid fears of a Halloween no-deal crash and tomorrow’s BoE policy decision and QIR (full preview available in the Research Suite). GBP/USD continues to meander sub-1.2200, and as a reminder, the following support levels are still in play: 1.2110 (March 17 low), 1.2085 (Jan 17 low), 1.2000 (psychological) and 1.1841 (2016 flash crash low). Elsewhere The EUR remains flat within a 20-pip intraday range as mostly in-line inflation, growth and unemployment metrics failed to spur a reaction ahead of the FOMC’s policy decision. EUR/USD trades just below 1.1150 ahead of minor support levels at 1.1133/14/21/01, although large option expiries (1.3bln at 1.1145 and 1.2bln at 1.1100-05) may keep the pair contained heading into today’s NY cut.

- EM – Another day of gains for the Lira as traders anticipated the CBRT’s QIR to signal further normalisation in its domestic economy, in which it delivered. The Central Bank cut its 2019 year-end inflation forecast mid-point to 13.9% from 14.6% whilst its 2020 figure was maintained at 8.2%, adding that the economic outlook has brightened compared to the April release. USD/TRY breached its 200 DMA (5.5600) to the downside and took out a support level at 5.5500 to print a low of 5.5150 ahead of a Fib support at 5.4172.

In commodities, the oil complex has held onto most of its API-induced gains with WTI futures hovering just below USD 58.50/bbl and Brent north of USD 65/bbl. The report showed that crude inventories fell by 6.02mln barrels over the last week, a larger decline than the expected 2.60mln barrel drawdown. Traders today will be eyeing two events as catalysts: 1) The weekly EIA report for confirmation of the decline in stocks, 2) the FOMC’s policy decision for any Dollar or sentiment-induced action. Elsewhere, sources stated that Libya’s El-Sharara oilfield (300k BPD) has halted production amid a valve closure on a pipeline, although it is not clear how long the closures could last. Of note, WaPo reported that the Trump administration is set to announce that it will waiver five difference nuclear related sanctions on Iran, although it is currently unclear whether the waivers will be oil related. Looking at metals, gold and copper remain flat, as usually the case ahead of the FOMC’s decision.

US Event Calendar

- 8:15am: ADP Employment Change, est. 150,000, prior 102,000

- 8:30am: Employment Cost Index, est. 0.7%, prior 0.7%

- 9:45am: MNI Chicago PMI, est. 51, prior 49.7

- 2pm: FOMC Rate Decision

DB’s Jim Reid concludes the overnight wrap

So today is the long-awaited Fed decision day, where markets are fully pricing in what is expected to be the first rate cut since December 2008. But exactly what happens today is far from a foregone conclusion, as the question still on investors’ minds is by how much the Fed will cut, and whether there’ll be any messages about the future path of rates going forward. The market currently fully prices a 25bp cut and implies an 16% chance of a larger 50bp cut. Although the Fed have given no real encouragement to the notion of a 50bps cut it’s worth noting that the last time the Fed began a series of rate cuts, in September 2007, their opening move was a 50bp cut, and a similar 50bp cut happened when the Fed began cutting in January 2001. Rates were higher back then though. The last time the Fed started an easing cycle with a 25bps cut was in September 1998, when they ultimately cut rates 3 times and successfully prolonged the expansion until the recession in 2001.

In their preview last Friday (link here ), our US economists predict a 25bp cut, but they say that “the key question is how Chair Powell and the Committee frame the narrative for further easing through year end.” With this in mind, investors will be paying close attention to Chair Powell’s press conference. Our economists write that they “do not expect the Committee to pre-commit to another cut in September”, but instead the amount of further easing is going to be data dependent. Will a market hungry for stimulus accept this?

Indeed we’re at a fascinating juncture in markets. It feels like the global macro risks are building for late summer/autumn (hard Brexit, US/China trade uncertainty, US/EU trade issues to come before year-end and global manufacturing effectively in recession) but all of us are reluctant to fight the central banks. Is this a trap? Indeed even our traditionally bullish Binky Chadha has some reservations about the risk/reward from this starting point. In his piece last week ( link ) he suggested that there have been 19 Fed easing cycles since the 1950s and this one fits almost exactly inline timing wise with the average slowdown in ISMs and LEIs through history. However, where it differs markedly is that only once (in 1995) has a rate cut occurred when the S&P 500 was around record highs. On average, the market has peaked 4 months before the cutting cycle started and was down a median -12% in between the two points. Also, he pointed out that 9 of the 19 rate cutting cycles failed to avert a recession. The recessions typically saw a -27% peak to trough drawdown in the S&P (mostly after the first cut) and on average bottomed 5 months after the Fed started cutting. Of the 10 that didn’t end in recessions, growth rebounded quickly – on average after 2-3 months – and although the S&P still fell around -7%, within 6 months of the first cut they had gained 12% from the lows and sat comfortably above pre-cut levels. So history would suggest quite a binary outcome from here and based on this alone one would have to say that the risk/reward doesn’t look particularly compelling especially as we’re at record highs. So don’t fight the Fed is a famous refrain but nearly 50% of the time they’ve been powerless to stop negative economic and market momentum in a growth slowdown.

Ahead of today’s FOMC decision, President Trump said yesterday that “I would like to see a large cut” in rates, maintaining his calls for easier monetary policy from the Fed. Separately, comments via Twitter from the President sent S&P futures lower before the US open, as he said that “China is doing very badly, worst year in 27 – was supposed to start buying our agricultural product now – no signs that they are doing so. This is the problem with China, they just don’t come through.” In response, The People’s Daily – the official paper of the Communist Party, said overnight that China has no motive to “rip off” the US and has never done so, and China won’t make concessions against its principles on trade. All this is occurring as the US and China have kick started a new round of trade talks in Shanghai. Watch this space for any headlines.

After this set back pre-market, US equities didn’t fall any further during the actual session but failed to get back to flat after trading in a relative narrow band through the day. The S&P 500 (-0.26%), NASDAQ (-0.24%), and DOW (-0.09%) all ended lower, though US bank stocks did gain +0.47% in contrast to their European cousins (more below). Fixed incomes moves were also muted, with 2- and 10-year treasury yields -1.4bps and -0.9bps lower, while HY credit spreads mirrored the moves in equities, widening +3.5bps. Earnings news was again mixed, with Under Armor (-12.28%) underperforming after signaling for a revenue decline from its core North American market. Procter and Gamble (+3.82%) and Merck (+0.96%) both gained after beating analyst expectations. After markets closed, Apple reported better-than-expected revenue and traded +4.42% overnight. Though iPhone sales and revenue disappointed, the company performed better via its mac, iPad and wearable business lines. Apple also reported gross margins at the top end of analyst estimates, illustrating that they continue to generate growth without lowering prices.

Meanwhile in Europe it was a gloomy day for equities, with the STOXX 600 falling -1.47%, its worst fall in 12 weeks and the index’s lowest close in a month. The continent’s indexes were lower across the board, with the DAX (-2.18% and worst day for 6 months), CAC 40 (-1.61%) and the FTSE MIB (-1.99%) all losing ground. Banks in particular suffered, with the STOXX Banks down –2.90%, bringing the index’s falls over the last two days to -3.77%, the biggest two-day fall since May. It’s not 100% clear to me why yesterday was such a bad day but weak Euro area data (see below), disappointing earnings, and perhaps worries about US/China trades talks may have weighed.

Bonds advanced for the most part, with ten-year bund yields matching their record low from earlier this month at -0.399% after falling -0.8bps yesterday. Spreads widened however, with Italian ten-year spreads over bunds up +2.1bps, while European HY spreads were up +6bps. Gilts rallied -1.9bps as fears of a hard Brexit continued to build.

The FTSE 100 outperformed again, only down -0.52%, although as before this was due to sterling’s continued slide, with the currency down -0.52% (trading largely unchanged this morning) against the dollar as it fell to fresh two-year low (only 0.89% off 34 year lows) as investor’s concerns over a no-deal Brexit outcome continued. The falls came as Prime Minister Johnson spoke to the Irish Taoiseach, Leo Varadkar, with a press release from Downing Street saying that “the Prime Minister made clear that the UK will be leaving the EU on October 31, no matter what”. He is also making it quite clear that he won’t sit down with EU leaders unless they agree to re-open the Withdrawal Agreement – something they have shown no appetite in doing. So unless someone blinks, or Parliament finds a way (including an election) to reverse course, then we are heading for a hard Brexit.

Overnight in Asia we have seen China’s July PMIs with manufacturing printing at 49.7 (vs. 49.6 expected), marking it the third consecutive month in contractionary territory. There was improvement in conditions for large enterprises (at 50.7 vs 49.9 last month) while small (at 48.2 vs 48.3 last month) and medium (at 48.7 vs. 49.1 last month) enterprises continued to deteriorate. The new export orders component rose to 46.9 (vs. 46.3 last month) but continues to remain well below 50. The services PMI came in at 53.7 (vs. 54.0 expected) bringing the composite PMI to 53.1 (vs. 53.0 last month). After the official PMIs, the focus is likely to turn to China’s Caixin manufacturing PMI tomorrow which focuses more on private sector/SME and is expected to print at 49.5. Meanwhile, China’s political leadership has announced its priorities for 2H 2019 by pledging to tackle ongoing tensions over trade “effectively” while offering incremental additions to stimulus policies.

Staying with Asia, Hong Kong’s Chief Executive Carrie Lam said yesterday that there is “no room for optimism for the second quarter and the entire year,” on GDP growth given the US-China trade war and other “uncertainties,” while pledging to “spare no efforts” to deal with anti-government protests that risk harming the city’s growth. Hong Kong’s GDP data is due today at 4:30 pm (Hong Kong time). Elsewhere, this morning North Korea fired two short-range ballistic missiles off its east coast, conducting its second such test in a week ahead of US Secretary of State Michael Pompeo’s visit to Asia. South Korean Defense Minister Jeong Kyeong-doo said in remarks after the launch that “If they threaten us and provoke us, North Korea’s regime and the North Korean military is with no doubt defined as our ‘enemy.’” This suggests that such actions could cause Seoul to reconsider its decision to downgrade the threat level of its neighbour.

This morning in Asia markets are following Wall Street’s lead with the Nikkei (-0.74%), Hang Seng (-1.11%), Shanghai Comp (-0.53%) and Kospi (-0.15%) all down. Elsewhere, futures on the S&P 500 are up +0.23% while WTI crude oil prices are up +0.67% on a report from the American Petroleum Institute that US crude inventories dropped by 6.02 million barrels last week.

In terms of data yesterday, the Conference Board’s consumer confidence came in well-above expectations at 135.7 in July (vs. 125.0 expected), the highest level in 8 months. The present situation reading also rose to 170.9 while the expectations measure rose to 112.2. Also encouragingly, the prior month’s readings on each of those metrics were revised several points higher. The closely-watched labour differential, which is a good leading indicator for the labour market, rebounded +5.2pts after last month’s sharp drop, approaching again its highest level of the expansion. Separately, the core PCE inflation figure for June came in at 1.6%, consistent with DB econ’s forecast but 0.1pp below consensus. Our economists also noted that, as a function of revisions, the trend over the last few months has weakened while 2017-2018 looks even stronger. This gives further ammunition to the FOMC’s doves at today’s meeting.

In Europe however, ahead of today’s Q2 GDP and July inflation release for the Eurozone, the releases only added to concerns over the economic slowdown. French GDP in Q2 grew by a smaller-than-anticipated 0.2% qoq (vs. 0.3% expected), while the Swedish economy actually contracted by -0.1% (vs. 0.3% growth expected). The European Commission’s economic sentiment indicator for the Eurozone fell to 102.7 in July, down from 103.3 in June and its lowest level since March 2016, and the sectoral breakdowns didn’t offer much hope either, as the industrial confidence reading fell to -7.4, its lowest since July 2013, and services confidence fell to 10.6, its lowest since September 2016. And to finish off the gloomy picture, Germany’s GfK consumer confidence reading fell to 9.7, the lowest figure in over two years, while German HICP inflation fell to 1.1% in July, the lowest since November 2016. The ECB and market tends to focus on the HICP, which is used for German inflation-linked bonds, though it has different weights from CPI (which surprised to the upside at 1.7%).

Turning to the day ahead, the outcome of the much-anticipated FOMC meeting is obviously the highlight for investors. It’s also a very big day for data releases, with the highlights being the advance reading of Eurozone GDP in Q2, along with the June unemployment rate and July CPI. In addition, there are German retail sales for June and the unemployment change for July, Italian Q2 GDP and unemployment for June, French CPI inflation for July, Canadian GDP for May, and from the US the MNI Chicago PMI for July. In terms of earnings, the main releases tomorrow include General Electric, Airbus and Lloyds Banking Group, and we have the second night of Democratic primary debates.

via ZeroHedge News https://ift.tt/2Yx0AaI Tyler Durden