Oil prices extended gains overnight off the back of API inventory data and a drop in Libya production

“I expect draws in crude stockpiles, but not as big as we’ve seen in the last few weeks,” says Mark L Waggoner, president at commodity brokerage Excel Futures.

“Refinery run rates will be ramping up a bit because we’re still in the middle of summer and driving season”

API

-

Crude -6.024mm (-2.75mm exp)

-

Cushing -1.449mm

-

Gasoline -3.135mm

-

Distillates -890k

DOE

-

Crude -8.50mm (-3.25mm exp)

-

Cushing -1.533mm

-

Gasoline -1.791mm

-

Distillates -894k

Crude inventories have fallen – significantly – for seven straight weeks, but last week saw stocks dropping across the entire energy complex as Barry-driven shut-ins came back online.

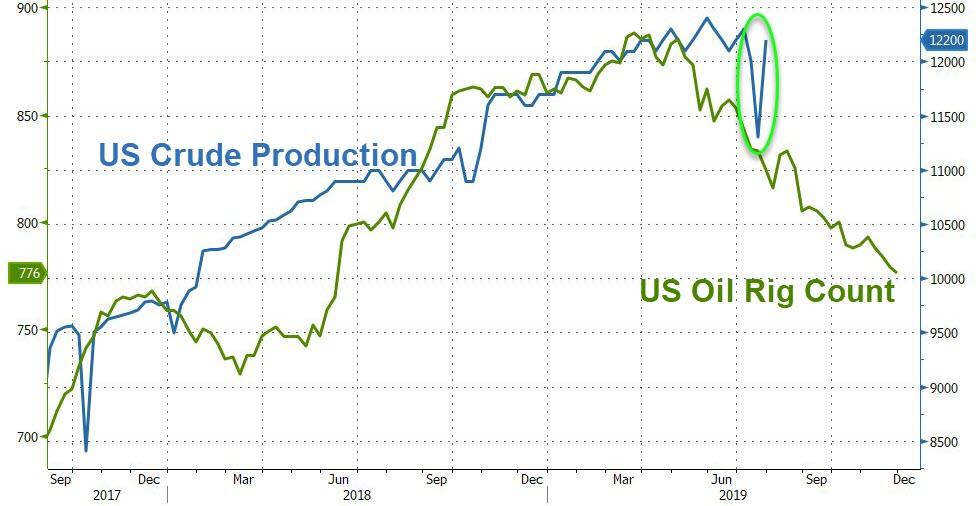

After the prior week’s collapse in crude production (thanks to Storm Barry shut-ins), production rebounded as expected…

WTI hovered around $58.50 ahead of the DOE print and extended gains after the big draws…

Finally, Bloomberg Intelligence Senior Energy Analyst Vince Piazza says:

It’s surprising how well supported oil benchmarks are, considering much of the bullishness is engineered by tensions in the Persian Gulf and risk of bottlenecks in the Strait of Hormuz and despite resilient U.S. output volume.

Weaker petroleum demand is the overriding issue, yet recent refined product data seems to discount that concern, while expectations for interest-rate cuts supporting risk assets have reemerged as an investment narrative. Infrastructure additions expected in 2H should also support benchmarks.

via ZeroHedge News https://ift.tt/2K5p4UD Tyler Durden