Last week, in the aftermath of the FOMC statement which to justify the “most pointless rate cut in the history of the Fed” blamed the Fed’s first rate cut cycle in 12 years not on the resilient US economy but on “global developments” we said that “The Fed is now officially the world’s central bank: any global economic instability anywhere in the world will lead to new record highs in US stocks”

The Fed is now officially the world’s central bank: any global economic instability anywhere in the world will lead to new record highs in US stocks

— zerohedge (@zerohedge) July 31, 2019

Of course, such global economic instability also includes trade wars, something that was certainly not lost on the president who less than 24 hours later announced that the post G-20 trade war ceasefire with China was over, and in pursuit of even more rate cuts announced that the he would impose 10% tariffs on the $300 billion of remaining Chinese imports.

The problem for Powell is that by scapegoating the global economy for the rate cut, the Fed is now trapped having certified before the world that any further escalations in Trump’s trade war are effectively a justification for more rate cuts. Whether this was Powell’s intention is unclear, although it certainly means that Trump is now de facto in charge of the Fed’s monetary policy by way of US foreign policy, and it also means that as BofA writes on Friday, “the Fed is unintentionally underwriting the trade war.”

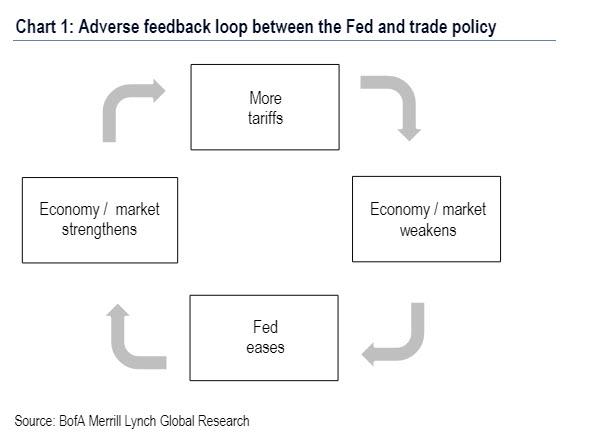

Here, the only thing one can perhaps add is that the Fed may very well be intentionally underwriting Trump’s trade war. In either case, as Bank of America’s chief economist Michelle Meyer writes, such a circular framework is a problem for many reasons, and as the bank admits, it is worried about an adverse feedback loop where the trade war hinders economic growth, therefore prompting additional Fed easing, which in turn allows for greater trade war escalation. This is shown in the chart below.

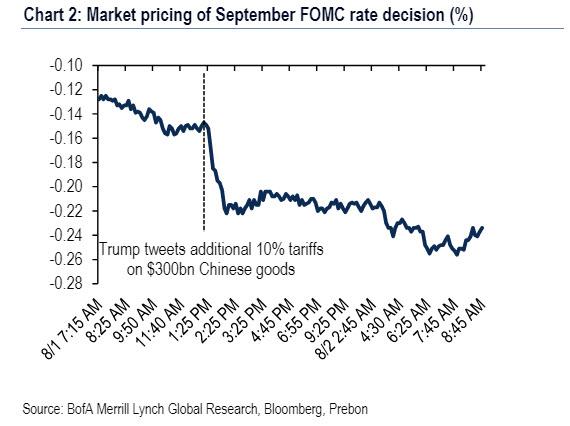

To no surprise – we predicted just this outcome moments after the Fed statement – the market went from pricing in a roughly 60% probability (15bp) of a cut in September before President Trump’s tweet to more than 90% (24bp) in minutes…

… and as JPMorgan discussed earlier, there are now 117bp of cumulative cuts priced in by the end of 2020 (including the 25bp cut already delivered).

In any case, the market’s reaction to what Powell stated was more than appropriate, as the Fed is now trapped by US trade policy. And while there was some confusion in the press conference, one message was clear: the Fed will use its tools to “insure” against downside risks from weak global growth and trade policy uncertainty. In its post mortem, Bank of America saw three important takeaways from Powell’s press conference:

- The Fed is taking weak global growth and trade uncertainty as exogenous events. This means that if global growth weakens further or the trade war escalates (which seems to be the case), it will prompt the Fed to ease further to provide an offset. In the press conference, Powell mentioned the word “global” 20 times, “trade” 30 times and “uncertainty” 9 times.

- The Fed believes that the pivot in monetary policy from hikes to patience and now to cuts is part of the reason that the US economy has fared well. In other words, the Fed does not see the recent strong data as a reason not to cut but as confirmation that signaling a rate cut was the correct policy. This speaks to the idea that much of monetary policy works through forward guidance.

- All else equal, the inflation shortfall would have provided cover for easier monetary policy. Wage growth has been below expectations and long-term inflation expectations have been too low. The Fed is not pleased that 2% has been the ceiling – they want it to be the average.

In sum, Bank of America is sticking with its call that the Fed will cut a cumulative 75bp in this “midcycle correction”, with the next cuts in September and October. But, as Meyer cautions, if the trade war escalates, it won’t be a midcycle correction and instead will be the start of a real easing cycle.

And while there is nothing at all wrong with BofA’s forecast, there is just one problem: the market is expecting much, much more from the Fed.

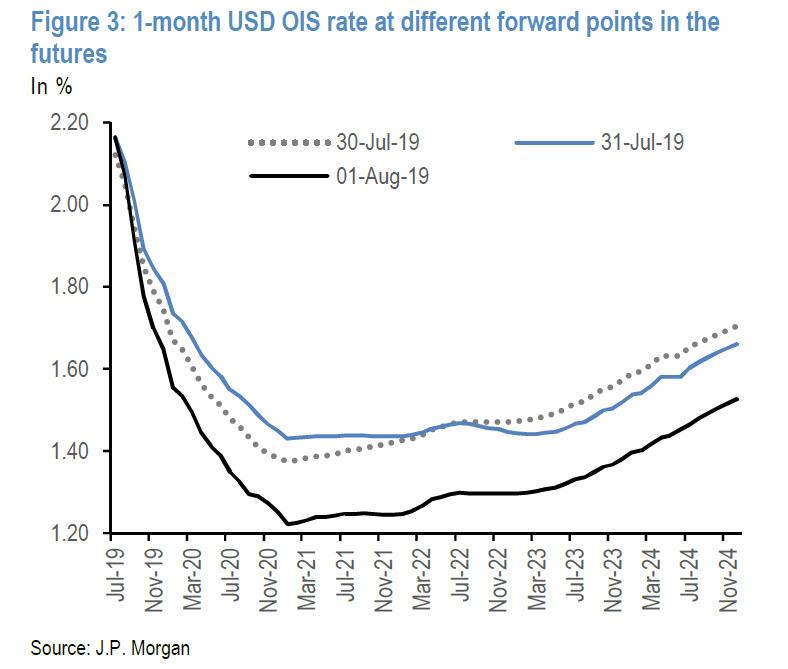

As JPMorgan showed earlier, not only did rate markets continue to price in a protracted rate cut cycle until the beginning of 2021 after this week’s FOMC meeting, but the curve flattened completely between the beginning of 2021 and the beginning of 2023, pointing to persistent flatness following Trump’s traiff tweet. This suggests that, even before this week’s tariff announcement, the Fed was seen by rate markets after this week’s FOMC meeting as less likely to deliver the 1995/1998 “mid-cycle adjustment” “insurance rate cuts” experience that both the Fed and equity markets have been looking for.

It also means that even before Trump’s shocking tariff announcement, the disconnect between rate and equity markets had worsened after the FOMC meeting! Naturally, Trump’s announcement – which was certainly timed to prompt even more rate cuts by the Fed – only made things even worse with the market now demanding even more easing from the Fed.

To put this visually, the disconnect between rates and equities has never been wider. And, as JPM’s Nikolaos Panigirtzoglou calculated, for this disconnect to persist, the Fed will need to keep cutting rates by another 100bp by the beginning of 2021 to satisfy both equity and bond markets at the same time. In other words, the only way the divergence between bonds and stocks is sustainable, is if the Fed cuts at least another 4 times.

Will the Fed do this? To paraphrase JPM, not a chance… unless Trump escalates trade war so badly he pushes China, and by implication, the world to the verge of a global depression. The risk, of course, is that knowing Trump he may find it very difficult to stop before pushing the world beyond the edge, where not even ZIRP, NIRP and QE by the Fed – or even outright monetization of equities – will have much of an impact.

via ZeroHedge News https://ift.tt/2YFfMH0 Tyler Durden