On Friday, when we learned courtesy of the WSJ that Trump imposed the latest, and very unexpected, round of Chinese tariffs less than 24 hours after Powell’s “insufficient” rate cut, he did so by overruling Treasury Secretary Steven Mnuchin in at least giving Beijing the courtesy of an advance notice, and instead China – like the rest of the world – learned what was coming by reading Trump’s twitter feed, resulting in a violent market selloff. Commenting on this development, we said on Friday that Trump’s refusal “suggested that the trade hawks are now fully in charge of the situation in the White House.”

It turns out we were more right than even we expected, because on Sunday, because as the WSJ reported today in its extensive post-mortem, not only did Trump overrule Mnuchin’s tacit suggestion, but he also overruled all of his advisors – with the exception of trade hawk Navarro – when deciding to ramp up tariffs on China “after a heated exchange in which he insisted levies were the best way to make Beijing comply with U.S. demands.”

We already know the backstory: the trade talks which took place in Shanghai early last week, were brief and unproductive, with U.S. Trade Rep Robert Lighthizer and Treasury Secretary Steven Mnuchin both in China for just over 24 hours, and their itinerary consisted of a dinner the night they arrived and a meeting that lasted about three hours Wednesday. The outcome was a disaster for anyone who was hoping for trade talk progress.

Then, upon their return, the trade negotiators and other top advisers congregated early Thursday afternoon in the Oval Office to brief Mr. Trump on the talks. Lighthizer and Mnuchin conveyed that they didn’t yield the kind of results that Mr. Trump had intended, the people said.

While we already knew of this meeting, it is what happened during, that was first reported by the WSJ today. According to the report, Trump, who had a re-election rally scheduled in Ohio later that day, “wanted to be able to assure farmers—who have been hardest hit by the trade fight as China scaled back purchases of U.S. corn, soybeans and pork—that he had at least secured concrete commitments from the Chinese that they would boost their purchases of U.S. agricultural exports.”

However, that was not meant to be, and “to his frustration, Messrs. Lighthizer and Mnuchin couldn’t give him any guarantees.”

That’s when an angry Trump exploded: “Tariffs,” the president boomed to those present, including national-security adviser John Bolton, top economic adviser Lawrence Kudlow, China adviser Peter Navarro and acting chief of staff Mick Mulvaney.

And the punchline: all of them, except for China hawk Navarro, adamantly objected to the tariffs, the WSJ sources said. That spurred a debate lasting nearly two hours, although at the end “the president said his patience had worn thin and stood by his argument that tariffs were the best form of leverage.” Also, as a reminder, Beijing insists that tariffs must be dropped in return for concessions demanded by the U.S., virtually assuring that any change for a deal breakthrough is now even less.

In the end, Trump’s advisers conceded and helped the president draft the tweet announcing an extension of tariffs to essentially all Chinese imports.

What is even more striking, is that Trump’s decision followed weeks of advice from some of his top advisers, including his son-in-law Jared Kushner, to put China talks on the back burner, according to the people and a former administration official. Instead, the advisers urged Trump to focus on other trade pacts, including the pending deal with Canada and Mexico, which still needs congressional approval, as well as talks with Japan, which in recent weeks have gained momentum, these people said.

The proponents for not escalating the trade feud with China argued that any deal with Beijing is likely to be attacked as too soft by Democrats in Congress, and that an escalation in tariffs will eventually start to become a drag on the economy.

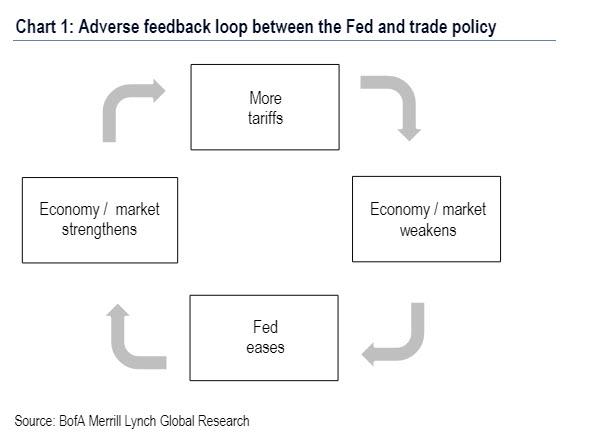

There is of course the “other” reason for the tariffs: the Trump-Fed feedback loop discussed extensively earlier today…

… and as the WSJ notes, “Trump’s resolve to impose the tariffs may have been further strengthened by the Federal Reserve’s decision just one day earlier to cut its benchmark interest rate by a quarter percentage point, which could give an already strong U.S. economy extra fizz.”

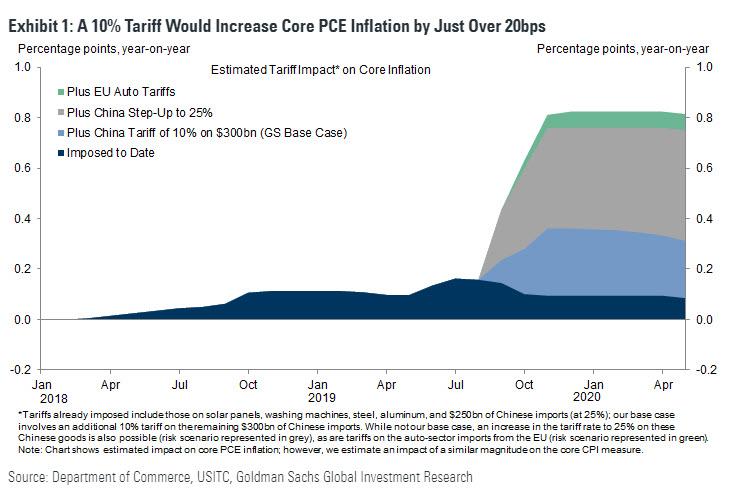

Then there is the fact that contrary to export warnings, the US economy has not suffered as a result of the ongoing trade war – unlike that of China, whose GDP is plumbing record lows – while inflation has remained dormant, failing to rise due to tariffs.

“The economic effects (of the trade dispute), at least in President Trump’s eyes, haven’t been massive on the U.S. economy and he’s got what he thinks the Fed is lowering rates to accommodate his trade policy,” said Chad Bown, a senior fellow at the Peterson Institute for International Economics. “Perhaps that emboldened him to do more tariffs.”

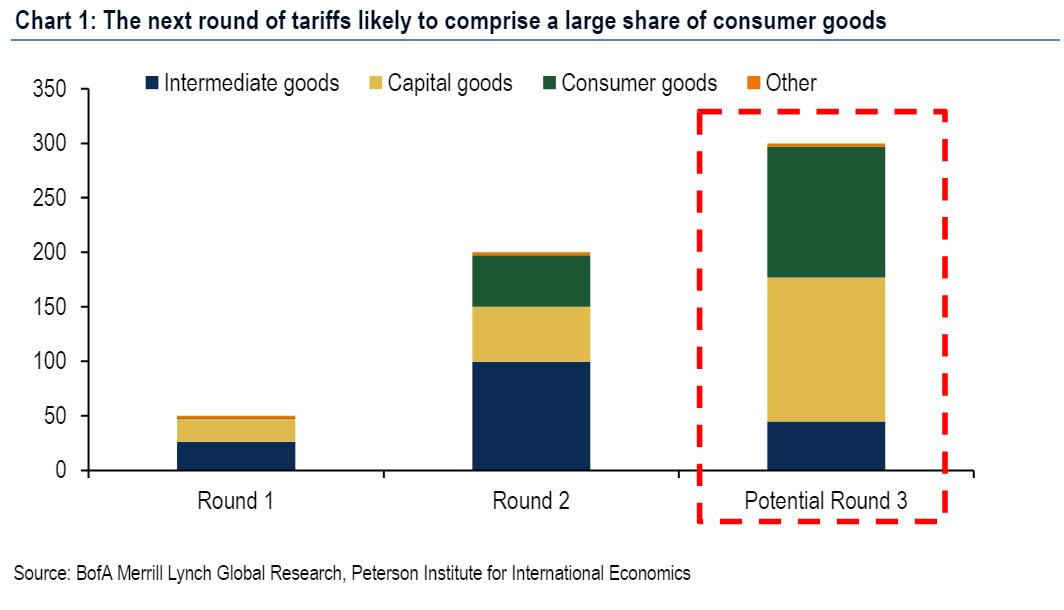

Of course, this too will soon change if Trump follows through with the 3rd round of largely “consumer-focused” tariffs (as described here)…

… which will have a far more immediate and profound impact on inflation, resulting in not only surging prices…

… but also an economic slowdown, which will likely translate into a stagflation in the coming months, with the Fed trapped to make any material monetary policy changes.

Meanwhile, China – which surely did not expect this adverse escalation in relations – has even bigger fish to fry with the situation over the ongoing instability in Hong Kong and ever more aggressive protests, likely forcing Beijing to intervene directly, as it warned over the past 48 hours it would unless protests fizzled out, which they are unlikely to do. And just so it has a pretext to do so, last week, just before the trade talks got under way, China’s Foreign Ministry accused Washington of being behind mass antigovernment protests in Hong Kong, with a spokeswoman calling them “the work of the U.S.”

What this means is that the chance of any trade deal resolution is now at best a mirage:

“Within Chinese government circles, there are strong voices against any deal with the Trump administration,“ said Myron Brilliant, head of International Affairs at the U.S. Chamber of Commerce. “With each escalation by either government, the two sides grow further apart and prospects of a comprehensive high-standard agreement more remote.”

Still, despite the deterioration in talks, Mr. Trump signaled confidence in the U.S. position from his New Jersey golf resort on Saturday. “Things are going along very well with China,” he said on Twitter, although it is fair to say that not even the algos believed that.

“They are paying us Tens of Billions of Dollars, made possible by their monetary devaluations and pumping in massive amounts of cash to keep their system going. So far our consumer is paying nothing—and no inflation. No help from Fed!”

Perversely, the Fed is helping – it is doing so by underwriting Trump’s trade war, and the more said trade conflict escalates, the more aggressively the Fed will be bound to ease, helping Trump achieve his goal of at least boosting stocks temporarily higher…. before they crash.

Why? Because as BofA explained earlier today, the game theoretical equilibrium that has emerged for the trade war is one of “no pain, no deal”, and while a substantial equity market correction could delay the threatened tariffs, so far the market refuses to even consider a “substantial correction” – while the S&P 500 did sell off by almost 2% on Thursday after the tariffs were announced, this is a negligible drop from an all time high in the S&P above 3,000.

As a result, and given that markets were at all-time highs just a few days earlier, BofA believes that it will probably take at least a textbook definition market correction (i.e., a 10% decline) to move the needle on trade policy.

In short: the fate of the US-China trade war it in the hands of the market now, just as it was in November and December, when Trump capitulated faced with the prospect of an S&P500 bear market. This time won’t be different.

via ZeroHedge News https://ift.tt/2GLJqAc Tyler Durden