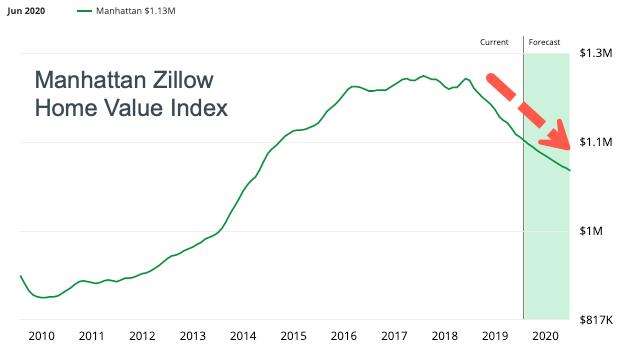

A new report from real estate company Douglas Elliman shows that second-quarter housing data in New York City is faltering, reported Crain’s New York Business.

Apartments sold in Manhattan in the second quarter plummeted 36.7% from the second quarter of 2017. The median sales price for the units plunged 19.2% during that period to $2.6 million from $3.3 million, according to Douglas Elliman.

Existing-homes make up 87% of all residential sales in Manhattan, fell 12.3% from the year prior. The median sales price for the apartments was $975,000 in the second quarter, marginally higher but off the top of $995,000 that was tagged last summer.

Jonathan Miller, president and CEO of the market research and appraisal company Miller Samuel, warned about the softening Manhattan housing market and said sales prices are a lagging indicator. He notes that the market has been trending down for three successive quarters.

“I characterize that as a reset, and it does have the potential to fall farther,” Miller said.

“Demand is continuing to be softer than it was last year.”

And it was only last year when we cited a report from Bank of America that rang the proverbial bell on the US real estate market, which said existing home sales have peaked, reflecting declining affordability, more significant price reductions and deteriorating housing sentiment.

“Call your realtor,” the BofA note proclaimed: “We are calling it: existing home sales have peaked.”

Last week, home sales in June dropped more than expected, suggesting that the housing market across the country continues to falter despite lower rates.

The National Association of Realtors said existing-home sales fell 1.7% to a seasonally adjusted annual rate of 5.27 million units last month.

The slowdown in housing comes despite lower mortgage rates, an uptick in wages, and the lowest unemployment rate in nearly 50 years (that’s if you believe the government’s statisticians).

The Wall Street Journal recently reported that foreign buyers plunged 21% YoY. The participation of foreigners has been a critical element in driving luxury markets across the country, and specifically — ones in New York.

Miller said inventory is quickly building with more than 6,000 units for sale in Manhattan.

The slowdown in Manhattan is a combination of an exodus of foreign buyers; President Trump’s income tax changes, which limited the deductions for mortgage interest to the first $750,000 borrowed and capped state and local taxes (including property taxes) to $10,000; the increasing probability of a window of vulnerability for the U.S. economy that could generate a shock large enough that would spark the next recession; trade war uncertainty that has resulted in companies reworking supply chains out of China into Southeast Asia; and a global synchronized slowdown.

“We’re definitely going through a period of change,” Miller said, “and it’s not entirely clear where it’s heading right now.”

With the Federal Reserve embarking on the first interest rate cut since the 2008 financial crisis, Wall Street and most investors have the whole rate cut narrative wrong – it’s not pre-emptive whatsoever but rather several quarters too late. Once the Fed starts cutting – they will eventually stop at zero. A recession is ahead, this is more bad news for real estate markets like the ones in New York City that could soon experience significant reversals.

via ZeroHedge News https://ift.tt/2M7ASYD Tyler Durden