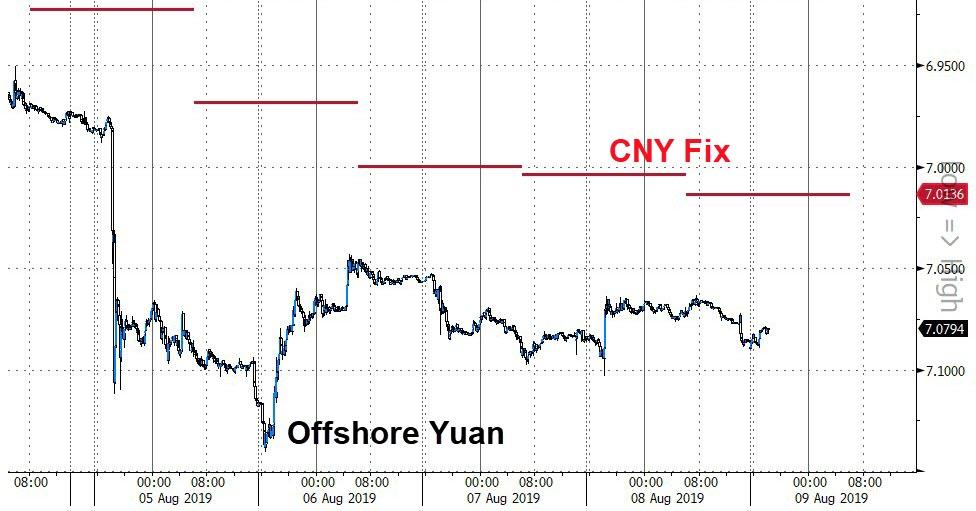

Equity futures and bond yields traded lower ahead of the yuan fix following reports that Washington will not grant any licenses for deals with Huawei (in response to China not buying US ag products). But a weaker than expected fix by the PBOC sparked further selling pressure in US equity futures.

“China wants to prevent panic now,” said Gao Qi, a strategist at Scotiabank.

“The PBOC will continue to send signals to stabilize the yuan in the near term.”

The PBOC Fix was at 7.0136 (weaker than yesterday and towards the weak end of the range of analyst estimates)…

Source: Bloomberg

This weaker fix enables downside for offshore yuan…

Source: Bloomberg

“I suspect the authorities will want to gain more comfort over the next few days and weeks that we’re not seeing a huge intensification of capital outflow pressures, before they possibly allow it to go a little weaker,” said Andrew Tilton, chief Asia Pacific economist at Goldman Sachs Group Inc.

“Right now I suspect they want to desensitize the market to this magic number of 7, and make sure that they are not going to have a capital outflow problem.”

This sparked further losses in Nasdaq futures…

Of course, by the time US cash markets open, a miraculous ramp would have re-appeared, but now, things are ‘escalating’.

via ZeroHedge News https://ift.tt/2MQrUPc Tyler Durden