Over the weekend, it finally dawned on Goldman that a protracted trade war – which it not really a trade but a defining clash of the world’s two most advanced superpowers – is bad for the US economy. Yes, the bank which for the longest time was expecting 4 rate hikes this year and for the US-China “trade war” to magically end with an amicable handshake and a hug some time in the next few months, and which only changed its forecast to a rate cut after Powell said he would engage in “mid-cycle easing”, has now once again flip-flopped and in a report published on Saturday warned that it now expects a “bigger hit from the trade war” for the US economy.

The policy uncertainty effect may lead firms to lower capex spending as they wait for uncertainty to resolve. Relatedly, the business sentiment effect of increased pessimism about the outlook from trade war news may lead firms to invest, hire, or produce less. Using industry-level data, we find that greater exposure to sales to China has been associated with slower capex growth as the trade war has intensified. We estimate a total uncertainty and sentiment drag on GDP of 0.1-0.2%.

Overall, we have increased our estimate of the growth impact of the trade war. In our baseline policy scenario, we now estimate a peak cumulative drag on the level of GDP of 0.6%, including a 0.2% drag from the latest escalation. The drivers of this modest change are that we now include an estimate of the sentiment and uncertainty effects and that financial markets have responded notably to recent trade news. Based on our estimates, we have taken down our Q4 growth forecast by 0.2pp to 1.8% (qoq ar).

Yet while Goldman may only now be realizing that trade wars tend to lead to negative outcomes, others have been rather clear on what the consequences from the ongoing clash of civilizations between the US and China mean for the world economy.

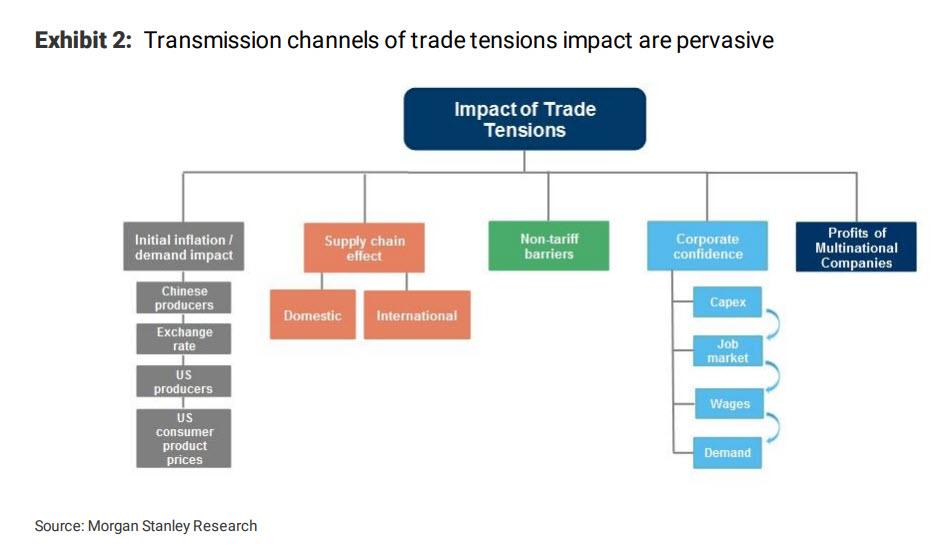

As we have highlighted before, and as Morgan Stanley pointed out last week, “trade tensions are the key overhang on the macro outlook as the channels of transmission are pervasive, the impact non-linear,and the effects of easing will be lagged.”

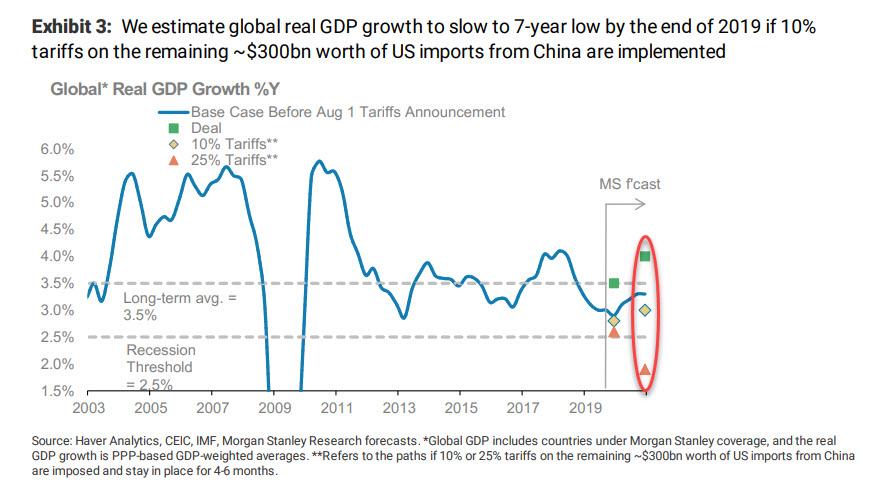

And speaking of Morgan Stanley, unlike a still bullish Goldman which is only now seeing the light and will be cutting its S&P forecasts in the near future, MS has been bearish all along, downgrading global equities in July, and warning that if the latest proposed round of tariffs is implemented, it sees global growth dipping to a 7-year low of 2.8%Y by end 2019 and remaining weak in the range of 2.8-3.0%Y in 1H20 despite policy easing. This would imply that global growth is moving closer to the global recession threshold of 2.5%.

Moreover,as risks of further escalation in trade tensions are high, the risks to the global macro outlook are similarly skewed to the downside. To wit, should the US implement 25% tariffs on imports from China and China responds with counter measures and these measures stay in place for 4-6 months, we think the global economy will enter recession in three quarters’ time

Alas, if one looks at some of the key real-time indicators of global economic activity, the recession may already be here and no additional tariffs are even necessary:

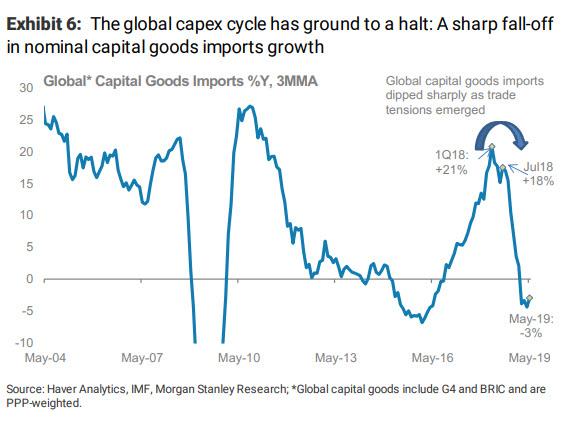

As Morgan Stanley’s chief economist Chetan Ahya writes, “the previous rounds of escalation in trade tensions have already had a pronounced impact on global growth. Primarily via its impact on corporate confidence and capex, global growth has already decelerated meaningfully from a peak of 4.0%Y in 1Q18 to just 3.0%Y in 2Q19 (close to the lows of the 2015-16 down-cycle).”

Moreover, if one gauges recessions as positive to negative inflection points, the incoming data for July indicates that we are already there. To wit:

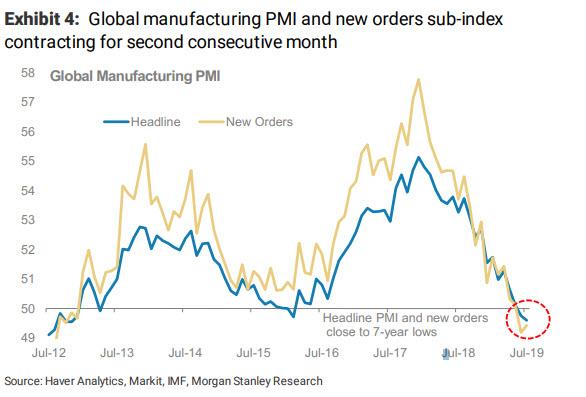

- Global PMIs and new orders indices have contracted for the 2nd consecutive month and are at 7-year lows:

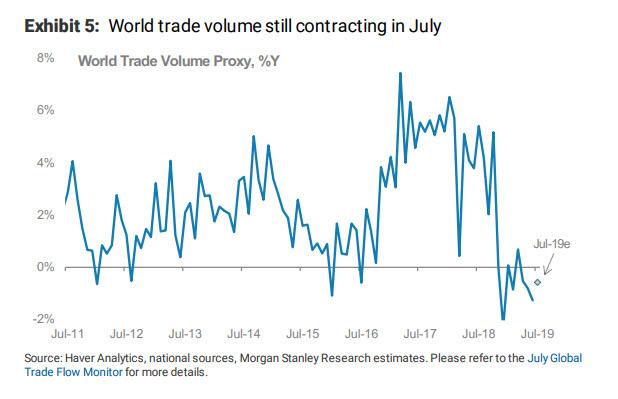

- Trade activity,an important hard data point to gauge the health of the global economy, has extended its weak run and likely contracted again in July:

- Finally, the global capex cycle has ground to a halt: A sharp fall-off in nominal capital goods imports growth:

And some more on Morgan Stanley’s ominous conclusion:

If trade tensions escalate further, we believe we will enter a global recession in 3 quarters’ time. For some time now, we have been highlighting that our bear case scenario is that US implements 25% tariffs on all imports from China and that China responds with countermeasures, implying there will be no deal in sight. In that scenario,as these measures stay in place for 4-6 months, we will enter into a global recession in 3 quarters. This most recent episode of escalation in trade tensions have already brought us closer to this scenario. Our US public policy team believes that the risks are tilted towards further escalation, which suggests that risk to the outlook is firmly skewed to the downside. Against this backdrop, we are concerned that global recession risks are now rising materially.

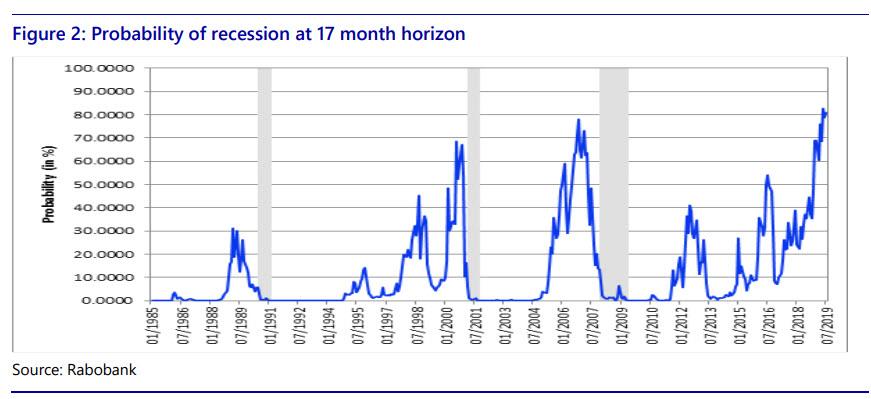

And speaking of the coming recession, nobody is more bearish than Rabobank. As we showed last week, the bank now sees recession odds in the next year at an all time high 81%, greater than during the either 2001 or 2007 bubbles:

We expect Goldman, whose economists have become the laughing stock of Wall Street…

this macro stuff is really confusing pic.twitter.com/6PKvX6pgXj

— StockCats (@StockCats) August 12, 2019

… to fully process this information in 4 to 6 months.

via ZeroHedge News https://ift.tt/2YW21Qp Tyler Durden