Argentine markets were in turmoil on Monday after voters roundly rejected pro-business reformist president Mauricio Macri and his austere economic policies in primary elections held over the weekend.

Instead, Populist Peronist candidate Alberto Fernández won the weekend primary by a much wider-than-expected margin, leaving him a shoe-in to win in the fall, and end Argentina’s one-term experiment with a more business friendly regime.

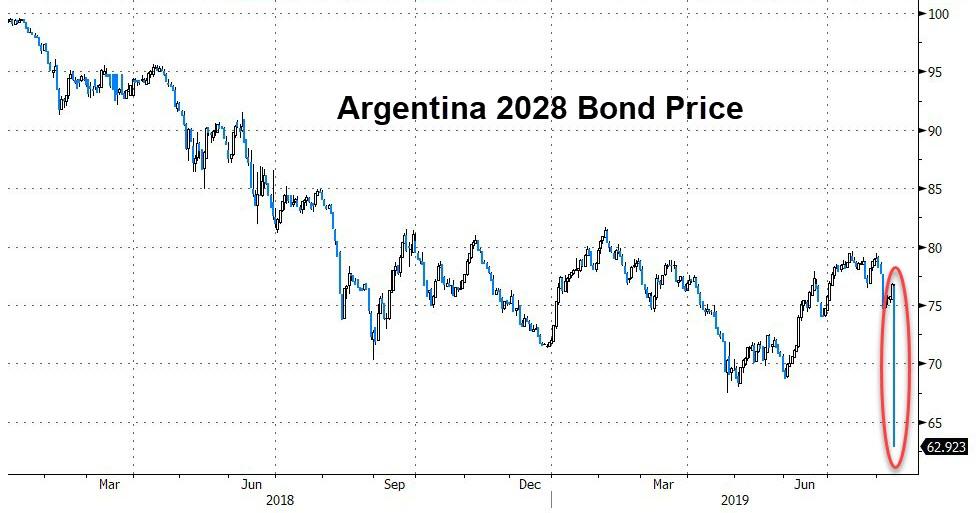

Argentina’s 2028-maturing, euro-denominated government bond was down more than 11 cents in European trading, Tradeweb data showed. The Argentine century bond also sold off.

Meanwhile, the cost to insure Argentine debt swelled.

Fernández’s primary win wasn’t a surprise. In fact, markets had been anticipating a strong showing by Fernandez and vice presidential candidate Cristina Fernandez de Kirchner with a growing sense of dread.

The Argentine peso opened TKJTKTK

Many fear that if Macri loses this autumn’s election, it could mean that the economic stability his government ushered in recently will come to an abrupt end. Under Macri, Argentina received the largest IMF bailout on record, $50 billion, largely to help stabilize the peso.

“The probable deterioration of sentiment and the resulting tightening of financial conditions in coming days and weeks may pose yet another headwind to the still fragile recovery of the Argentine economy,” said Tiago Severo, economist at Goldman Sachs.

He added: “More importantly from a political standpoint, renewed depreciation pressures on the peso may delay and perhaps even reverse the incipient decline in consumer price inflation, harming the image of the Macri administration and weighing further on the president’s re-election bid.”

On Sunday night, there were scenes of jubilation among Fernández’s supporters around Buenos Aires, with chants of “We’re going to return.” Macri and his supporters were somewhat more restrained.

via ZeroHedge News https://ift.tt/2YYsn8k Tyler Durden