Goldman CEO David Solomon – known among nightlife circles as DJ D-Sol – is taking a break from his holiday in Mykonos to share some reassuring words with CNN and its audiences. Ever the optimist, D-Sol said economists are overestimating the possibility of a recession either late next year or early the following year.

The basic economy is chugging along okay, Solomon said. The deep post-crisis recession has allowed for a long climb out.

“I don’t think we’re at a moment where there is an impending economic crisis,” Solomon told CNN Business’ Christine Romans. “But look, things could change.”

Of course, Solomon acknowledged that the trajectory of America’s economy is “slowing a bit”, that the threat of a “deepening US-China trade war” has the potential to cause problems.

“The underlying economy is still doing okay. The chance of a recession in the near term is still relatively low,” the Goldman Sachs (GS) boss said. “But we have to watch what’s going on with tariffs.”

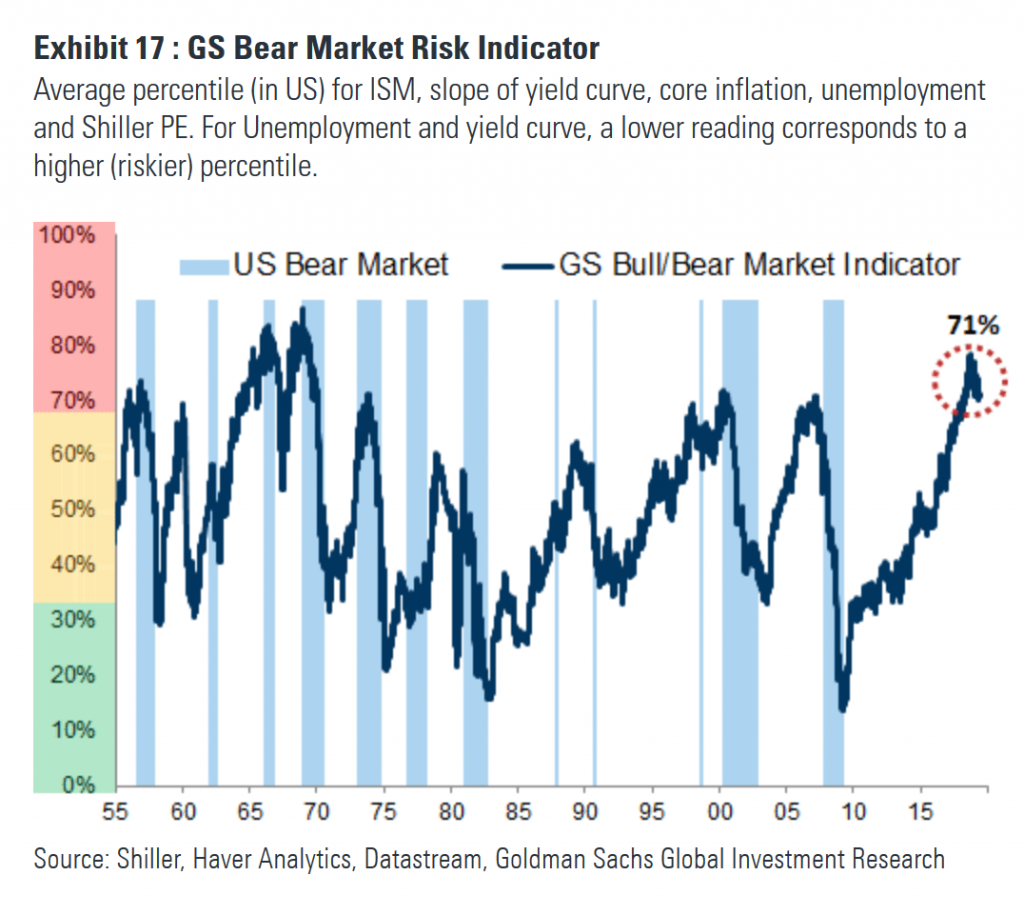

Of course, Solomon probably should have checked in with some of his bank’s own metrics while prepping for the interview. Because, as we’ve pointed out a few times, the GS Bull/Bear Market Indicator shows the risk of a bear market is staggeringly high.

Why does that matter when Solomon is talking about the economy? Because “monetary policy to me sees a little more attached to markets at the moment…and that’s not healthy.”

So far, at least, Solomon believes the true impact of tariffs on the underlying economy has been greatly exaggerated judging by the fluctuations in the markets.

“At the moment, I think the real impact of tariffs has been small, but you’ll have to watch that carefully,” Solomon said. “Those are the kind of things that can change confidence. And confidence can slow down economic activity.”

The CEO also defended Trump’s willingness to rebalance the trade with China.

“I’m not a fan of tariffs, but we need to find a way to push,” Solomon said.

He also took a few moments to throw a few pot shots at Pete Navarro, who recently accused Goldman of outsourcing jobs.

“I saw that. Like a handful of other things I’ve seen him say the last couple of days, I don’t really understand what he’s talking about,” Solomon said.

Solomon weighed in on the controversy surrounding the Federal Reserve, which has been repeatedly attacked by President Donald Trump over interest rates.

“It’s very, very important that we have an independent Fed,” Solomon said, echoing comments made last week by the four living former Fed chiefs.

But, right now, the Fed has been beholden to markets, something that worries Solomon.

“Monetary policy, to me, seems a little bit more attached to markets at the moment. And also politics,” Solomon said. “I don’t think that is healthy.”

via ZeroHedge News https://ift.tt/2YJAXZ8 Tyler Durden