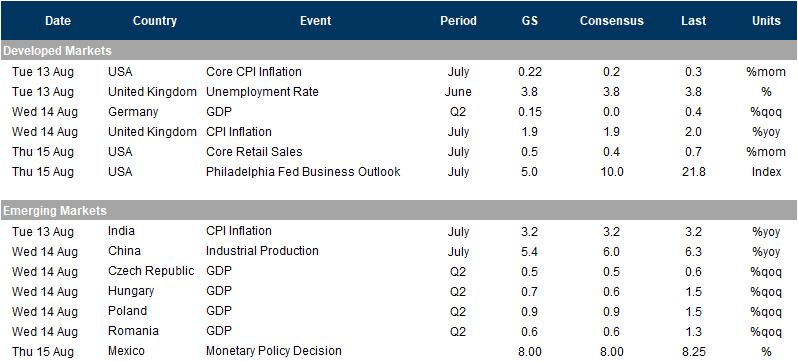

While it is expected to be a largely quiet, summer week event wise, markets will continue to assess the fallout from the latest ratcheting up in the trade war and implications for global growth, as well as the ongoing Hong Kong protests, the focus this week will be back on the data with US CPI and a first look at Q2 GDP in Germany being the highlights. As DB’s Craig Nicol points out, we’ll also get retail sales data in the US along with various sentiment indicators while in China the latest activity indicators are due. Monetary policy decisions are also due in Mexico and Norway.

The main focus of the data this week is the US July CPI report which could give markets another opportunity to sharpen Fed expectations. The consensus expects a +0.2% mom reading for the core which would be enough to hold the annual rate at +2.1% yoy. Away from that we’ve also got the July retail sales report due in the US on Thursday where +0.3% mom core and +0.4% mom control group readings are expected. Thursday is a fairly busy day for data releases in the US in fact with July industrial production, August empire manufacturing and Philly Fed business outlook, and weekly jobless claims data also due. On Friday we’ll also get a first look at the August University of Michigan consumer sentiment survey readings.

Meanwhile in Europe the highlight will be Germany’s Q2 GDP on Wednesday. The consensus is for a modest contraction of -0.1% qoq following a +0.4% qoq expansion in Q1. On Tuesday we also get the August ZEW survey in Germany while final July CPI revisions are due in Germany and Spain on Tuesday and France on Wednesday. The second revision to Q2 GDP for the Euro Area is also due on Wednesday where no change from the +0.2% qoq flash is expected.

In light of the surprisingly weak Q2 GDP data in the UK last week, expect Tuesday’s June and July employment data, July’s CPI/PPI/RPI data on Wednesday and the July retail sales report on Thursday to also be a focus.

Finally in China we’ve got the July fixed asset investment, industrial production and retail sales data all due on Wednesday. It’s also worth noting that we got the July money and credit aggregates data this morning and it was dismal, with aggregate financing rising a paltry 1.01t yuan, and massively below the 1.63t yuan estimate.

As for central banks, there are only two meetings of note next week with both the Norway and Mexico rate decisions due on Thursday. Elsewhere, the NY Fed will release its Q2 household debt and credit report on Tuesday while the OPEC monthly oil report is due on Friday

Summary of key events in the week ahead courtesy of Deutsche Bank:

- Monday: A very quiet day for data or scheduled events with only the July monthly budget statement due in the US.

- Tuesday: The data highlight is the July CPI report in the US. Other data includes the July NFIB small business optimism reading, while in Europe the August ZEW survey and final July CPI revisions are due in Germany and July employment data in the UK. Away from that the NY Fed will also release its Q2 household debt and credit report.

- Wednesday: The overnight focus will be on the July activity indicators out of China. Not long after we get a first look at Q2 GDP in Germany while a second revision is due for the Euro Area. July CPI data is also expected in the UK and France while June industrial production is also due for the Euro Area. In the US the July import and export price index readings are due. Away from that the EIA crude oil inventory report is due.

- Thursday: Overnight, June industrial production in Japan and July new home prices data is due in China. In the UK we’re due to get the July retail sales report while in the US the July retail sales report will also be a focus. The August empire manufacturing, August Philly Fed business outlook, Q2 nonfarm productivity and unit labour costs, July industrial production, weekly jobless claims, August NAHB housing market index and June business inventories data are all due also. Elsewhere, monetary policy meetings are due in Mexico and Norway.

- Friday: The main data highlights are in the US with the July housing starts and building permits data, and preliminary August University of Michigan consumer sentiment survey due. In Europe the June trade balance for the Euro Area is expected. Elsewhere, OPEC will release its monthly oil market report.

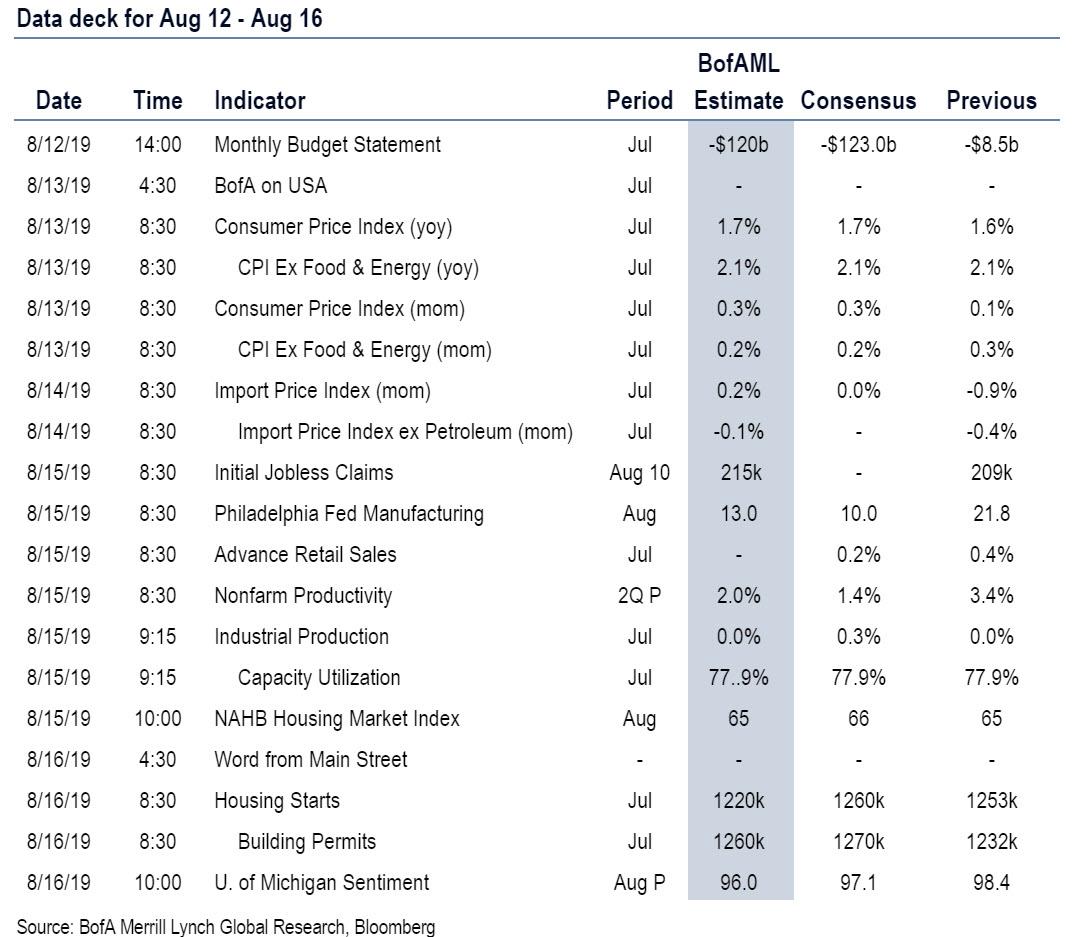

The key economic data releases this week are the CPI report on Tuesday, retail sales on Thursday, and the Philadelphia Fed manufacturing index also on Thursday. There are no scheduled speaking engagements from Fed officials this week.

Monday, August 12

- There are no major economic data releases scheduled today.

Tuesday, August 13

- 06:00 AM NFIB small business optimism, July (consensus 104.0, last 103.3)

- 08:30 AM CPI (mom), July (GS +0.27%, consensus +0.3%, last +0.1%); Core CPI (mom), July (GS +0.22%, consensus +0.2%, last +0.3%); CPI (yoy), July (GS +1.74%, consensus +1.7%, last +1.6%); Core CPI (yoy), July (GS +2.13%, consensus +2.1%, last +2.1%): We estimate a 0.22% increase in July core CPI (mom sa), and while we expect an unchanged year-over-year rate on a rounded basis (at +2.1%) we see the risks there skewed to the upside. Our monthly core inflation forecast reflects a boost from tariffs of around 0.05pp (step-up from 10% to 25% rate on $200bn of Chinese imports), which we expect to manifest in the household furnishings, auto parts, and personal care categories. We also expect a modest boost from tobacco prices related to new taxes in Illinois. We also expect a rise in used car prices, albeit sequentially smaller than in the June report. On the negative side, we look for a modest pullback in the apparel category following methodological changes earlier this year. We estimate a 0.27% increase in headline CPI (mom sa), reflecting a boost from gasoline prices.

Wednesday, August 14

- 08:30 AM Import price index, July (consensus -0.1%, last -0.9%)

Thursday, August 15

- 08:30 AM Retail sales, July (GS +0.3%, consensus +0.3%, last +0.4%); Retail sales ex-auto, July (GS +0.6%, consensus +0.4%, last +0.4%); Retail sales ex-auto & gas, July (GS +0.5%, consensus +0.4%, last +0.7%); Core retail sales, July (GS +0.5%, consensus +0.4%, last +0.7%): We estimate that core retail sales (ex-autos, gasoline, and building materials) rose at a solid pace for a fifth consecutive month (we estimate +0.5% mom sa), reflecting another record Amazon Prime Day. We also note that the recent trade war escalation was likely too late to significantly affect the July report. We estimate a 0.6% increase in the ex-auto measure and a 0.5% increase in the ex-auto-ex-gas measure, reflecting a rise in gasoline prices. We expect the headline number to increase at a more moderate pace (+0.3%) given softer auto sales in the month.

- 08:30 AM Philadelphia Fed manufacturing index, August (GS +5.0, consensus +10.0, last +21.8); We estimate that the Philadelphia Fed manufacturing index fell by 16.8pt to +5.0 in August after rebounding by 21.5pt in July.

- 8:30 AM Nonfarm productivity (qoq saar), Q2 preliminary (GS +1.6%, consensus +1.4%, last +3.4%); Unit labor costs, Q2 preliminary (GS +1.9%, consensus +1.8%, last -1.6%): We estimate non-farm productivity slowed to +1.5% in Q1 (qoq ar), above the trend achieved on average during this expansion. This reflects weaker business output growth in Q2 and little change in growth in average hours worked. We expect Q2 unit labor costs—compensation per hour divided by output per hour—to rebound by 1.8% as a result of slower productivity growth in the quarter.

- 08:30 AM Initial jobless claims, week ended August 10 (GS 215k, consensus 212k, last 209k); Continuing jobless claims, week ended August 3 (consensus 1,685k, last 1,684k): We estimate jobless claims increased by 6k to 215k in the week ended August 10 after declining by 8k in the prior week.

- 08:30 AM Empire State manufacturing index, August (consensus +1.9, last +4.3)

- 09:15 AM Industrial production, July (GS +0.3%, consensus +0.1%, last flat); Manufacturing production, July (GS -0.1%, consensus -0.3%, last +0.4%); Capacity utilization, July (GS +78.0%, consensus +77.8%, last +77.9%): We estimate industrial production rose 0.3% in July after last month’s flat reading, reflecting a rebound in the utilities category but an offset from a retrenchment in mining production growth. We estimate manufacturing production growth was flat in June and that capacity utilization edged up by one tenth to 78.0%.

- 10:00 AM Business inventories, June (consensus +0.1%, last +0.3%)

- 10:00 AM NAHB housing market index, August (consensus 66, last 65)

Friday, August 16

- 08:30 AM Housing starts, July (GS -0.5%, consensus flat, last -0.9%); 08:30 AM Building permits, July (GS 2.5%, consensus 3.1%, last -5.2%): We estimate housing starts declined by 0.5% in July.

- 10:00 AM University of Michigan consumer sentiment, August preliminary (GS 96.5, consensus 97.3, last 98.4); We expect the University of Michigan consumer sentiment index declined by 1.9pt to 96.5, as stock market volatility could potentially weigh on sentiment.

Source: Deustche Bank, BofA, Goldman

via ZeroHedge News https://ift.tt/2MckciH Tyler Durden