S&P Global Ratings is now warning about $5.2 trillion in corporate debt coming due through 2024, reported International Financing Review (IFR).

The $5.2 trillion includes bonds, loans, and revolving credit facilities from financial and non-financial companies in the US. It represents almost half of the global rated debt expected to mature during the period.

S&P said despite market volatility, recent issuance of bonds and loans had been more than enough to meet future maturity demands.

“We expect maturities to be largely manageable,” Sudeep Kesh, head of credit market research at S&P Global Ratings told IFR.

“The recent Fed rate cut, and expectations of another rate cut in September will support a benign financing environment in the near term.”

This comes as J.P.Morgan Global Manufacturing PMI has slipped under 50 for much of the summer, and a growth rate cycle slowdown in the US economy forced investors to invert the 2s10s yield curve last week, increasing fears of a recession in the next 12 to 18 months.

“There is a constant push and pull between central banks lowering rates, and deteriorating economic conditions. We don’t see that going away soon,” said Kesh.

“Spreads are still quite a bit tighter than they were earlier in the year,” he said. “Recent weakness is not that pronounced other than at the very low end of the credit spectrum, which tends to always have some pressure.”

IFR said investors are terrified that corporate leverage is at record highs. Lower rates will allow firms to refinance existing debt and push out near term maturities to kick the can down the road even more.

IFR referenced another recent report from S&P that said median debt-to-Ebitda for Triple B and Double B rated public companies is back at levels not seen since 2006.

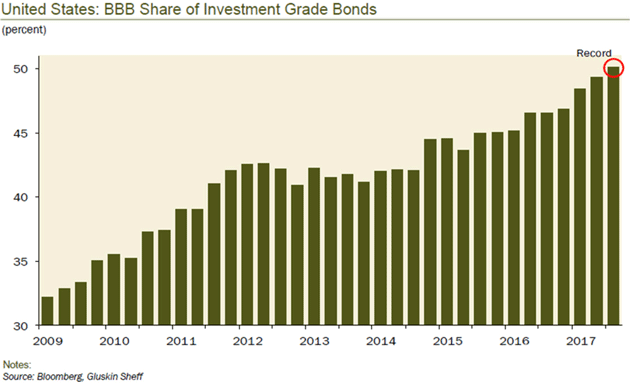

Triple B debt remains the most significant imbalance in the corporate debt space, at least 50% (or $4 trillion) of corporate debt falls under the tranche.

The concerns of a downgrade wave of Triple Bs has subsided thanks to the Federal Reserve lowering interest rates last month.

Investment-grade credit default swaps have remained elevated for the last four weeks but trade under June highs.

IFR said insurance companies, who hold a lot of Triple B debt, could be forced to sell the debt into illiquid markets when ratings move from BBB to BB (otherwise known as junk).

“The biggest concern for insurance companies is less a maturity wall and more downgrade risk,” said John Simone, head of insurance solutions group at Voya Investment Management.

“Companies are reacting to that by paying down debt and improving balance sheets. We think the BBB issue is a little over done, but we continue to monitor that.”

Much of the debt has been used for financial engineering schemes, not generally used in expanding the business or increasing cash flow.

“A lot of corporations have issued a lot of debt to buy back stock, instead of investing in new plants and growth, for example,” said Simone.

And it seems the corporate debt bubble might have found a pin last week when Harry Markopolos, the investment manager who exposed Bernie Madoff, said “impending losses will destroy GE’s balance sheet, debt ratios and likely also violate debt covenants. GE’s cash situation is far worse than disclosed in their 2018” annual report to regulators.

Pension funds, money managers, and insurance companies are only allowed to keep investment-grade debt in their portfolios, so when a downgrade wave from investment-grade to junk hits, likely sparked by an economic downturn or the collapse of GE, the corporate debt market could implode.

As for the $5.2 trillion due through 2024, well, it’s likely that some companies will default and or even fold when the next recession strikes, likely in the next year and year and a half.

via ZeroHedge News https://ift.tt/2TRlgtu Tyler Durden