Authored by Christopher Cembik via Saxobank.com,

Like in previous years, the annual Jackson Hole symposium that will take place on August 22nd and 23rd will certainly be a major market-moving event.

It is usually the best place for central bankers to hint at new policy moves. In recent years, Bernanke gave clue about the launch of QE2 and QE3, Draghi announced the possibility to start asset purchases in the euro area and SNB’s Jordan confirmed the need for further unconventional monetary policy just a few months after removing the CHF cap in 2015.

This year should confirm that we are well into a global monetary policy reversal as a growing number of central banks has decided to cut rates in the past weeks. What we know so far is that Fed’s Powell is expected to deliver his speech on Friday. We don’t have the list of speakers yet (it should be announced very soon) but the focus should be on “Challenges for Monetary Policy”, including discussion about implications of divergence in interest rates, impact of QE on capital markets, new mandate of central banks and path to normalization.

What we expect:

- Central bankers should confirm they are ready to act preemptively again in order to extend the current business cycle and avoid a recession. Looking on the macroeconomic front, there are many reasons to worry. We see that nine major economies are in recession or on the verge of it, notably Germany, the United Kingdom, Italy, Brazil and Argentina. For some of them, risks to growth clearly result from the impact of trade war, but for some other it is mostly the consequences of bad politics and bad policies implemented other the past years.

- As this is the current market focus, it is likely that central bankers will give their view on the inverted yield curve. Once again, they will probably dismiss the significance of it. Interestingly, on that matter, the Federal Reserve Bank of Saint Louis has recently published a paper on the relation between yield curve inversions and recessions (you can have access to it here). The conclusion is clear: “In Germany, France and the USA, almost every yield curve inversion was followed by a recession within a few years, suggesting that false positives may be unlikely in these countries”. We can always debate whether this is the best way to predict recession, but we should agree that recent inversion is the signal that the bond market considers that long term growth prospects are weak, which I tend to agree with.

- Fed’s Powell could downplay potential of 50 basis point cut in September. Depending on the metrics we refer to, investors firmly consider there is room for cutting by 50 bps next month (likelihood of 35% according to the CME and 48% according to Bloomberg). The higher the expectation…the bigger disappointment. Therefore, we cannot exclude market turmoil again if Powell is too careful regarding the Fed’s next move and communicates on a 25 bps cut.

- How low can policy rates go? We may have an answer to that question this week. A recent Bank of Japan’s paper on “reversal rates” concludes it is at minus 1% for the eurozone. It seems to imply there are still a lot of room for the ECB to lower deposit rate in September… (access here).

- Last but not least, central bankers should warn against the risks related to currency war, in relation to the USA designating China as currency manipulator. The currency war is the natural extension of the trade war, but the risk is elevated that it ends up in higher public indebtedness and inflationary storm, as it was the case in the 1970s.

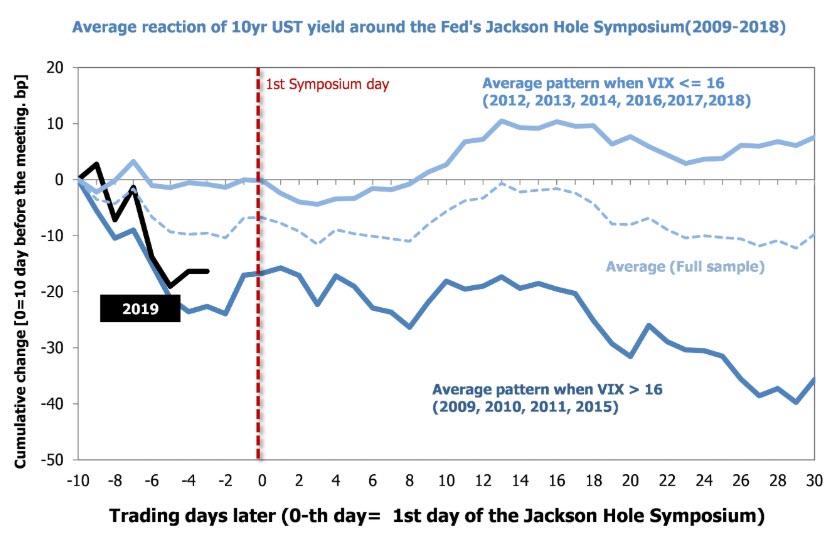

Nomura’s Global Markets Research group notes that it is difficult to anticipate market responses following Jackson Hole; both equities and interest rates are to a large extent driven by daily events. That said, while initial forecasting is difficult, we think insights can be gained by taking a look at patterns in the market on trading days before and after past Jackson Hole meetings. We have taken a look at the behaviour of 10yr UST yields and the 10yr-2yr UST yield curve before and after Jackson Hole meetings from 2009 through 2018. At the same time, we divided the data into two sample groups according to the VIX level on the day before the Jackson Hole meeting (comparing when the VIX averaged above 16 for prior 20 days to when the VIX averaged below 16) to reflect market conditions at the time of the meetings.

Fig. 13: Average reaction of 10yr UST yield around the Jackson Hole symposium (2009-18)

When the VIX remained at a higher level just before the Jackson Hole symposium, the 10yr UST yield tended to continue on a downtrend.

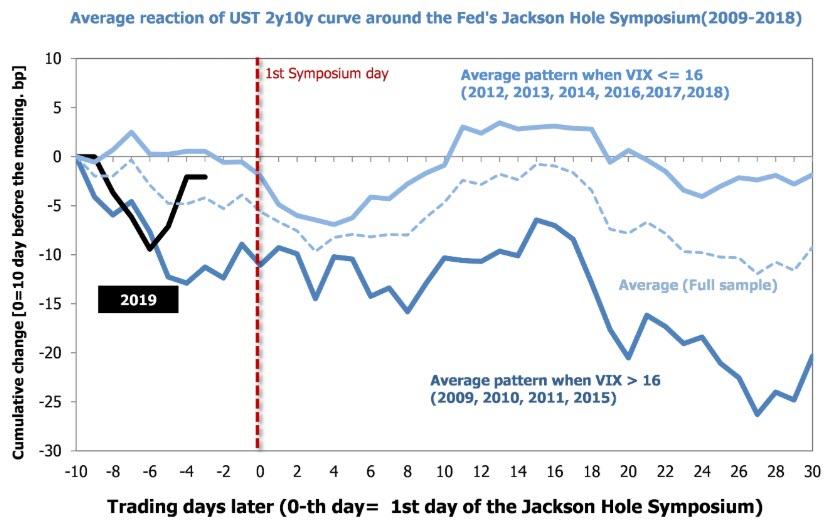

We found that (1) when the VIX was high (16 or above), interest rates and the yield curve both tended to remain on a downtrend following the Jackson Hole meeting, and (2) when the VIX was low (below 16), interest rates and the yield curve both tended to turn up following the meeting.

Fig. 14: Average reaction of UST 2y10y yield curve around the Jackson Hole symposium (2009-18)

When the VIX remained at a higher level just before the Jackson Hole symposium, the UST 2y10y curve tended to remain in a flattening mode.

While the cause-and-effect relationship with the meeting is not clear, at the least we think these observations show that when the equity market is risk-off (i.e., when the VIX is rising), interest rates tend to continue to decline and the yield curve tends to remain in a flattening mode following Jackson Hole, with a low probability of interest rates going higher and the yield curve shifting into a steepening mode.

While there is no telling whether this pattern will hold this week, we think it worth keeping in mind that market conditions are presently close to the environment described in pattern (1).

via ZeroHedge News https://ift.tt/30hjkfX Tyler Durden