US equity markets are excitedly recovering last week’s losses as hope once again washes across global markets that lower rates, fiscal recklessness will save the world. The explicit driver of the bounce is yet another short-squeeze – the second biggest since the start of 2019.

Source: Bloomberg

The last time we saw a bounce like this was the first days of June, when – again – a heavy oversold reading going into a barrage of Fed speakers prompted more panic-buying…

Source: Bloomberg

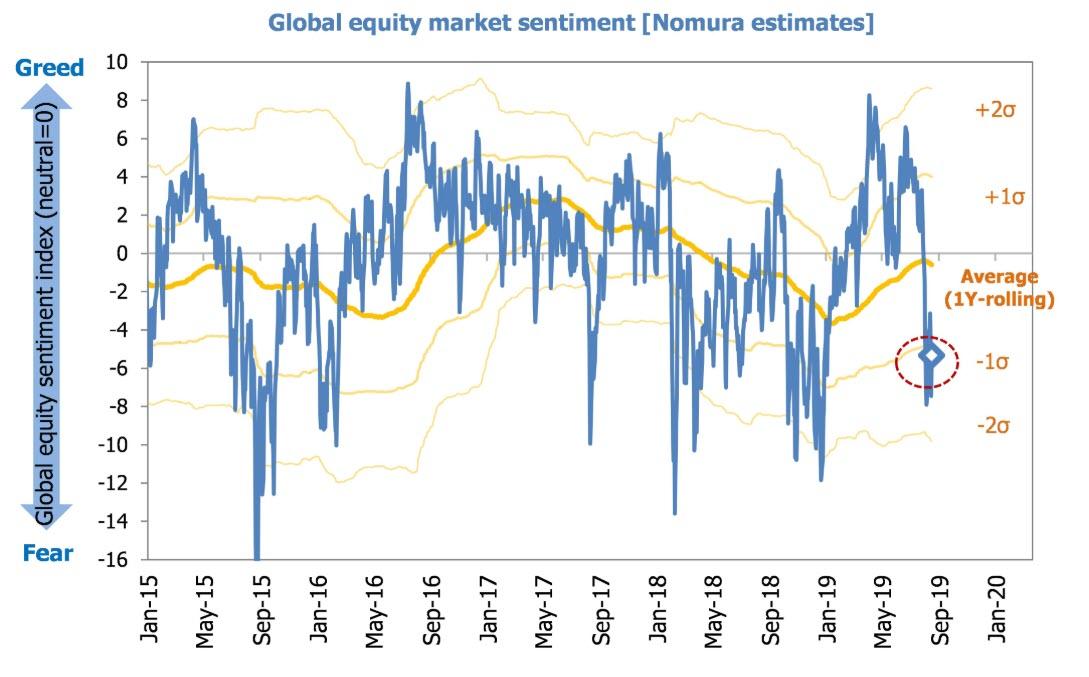

However, Nomura’s Global Markets Research group note that while US/global equities rebounded at the end of last week, global stock market sentiment still remains negative.

While US and global equities rebounded at the end of last week, its gauge to capture the global stock market sentiment remains in negative (risk-averse) territory, but has improved slightly, contracting slightly from -7.5 on 15th August to -5.5 on 16th August.

“Sentiment has managed to avoid the ‘panic zone’ of two standard deviations below the mean, but there is no clear recovery in investor sentiment, with sentiment continuing to bounce back and forth in a range of one to two standard deviations below the mean.”

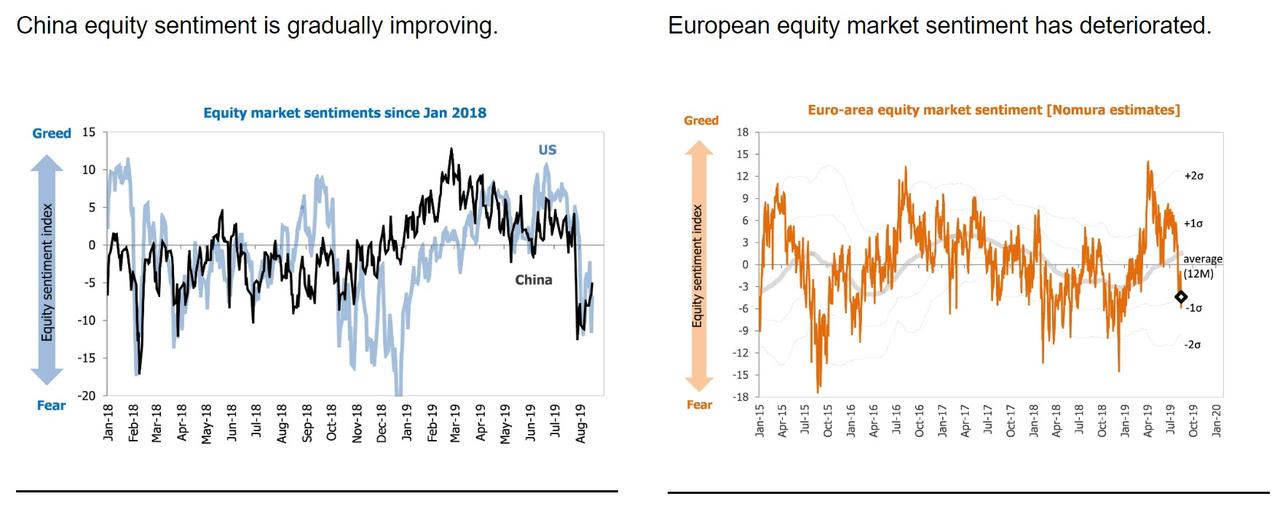

By region, Nomura notes the improvement in US and China equity market sentiment, but euro area equity market sentiment has deteriorated, and the fragility of equity supply demand conditions in this area is particularly noteworthy.

Nomura says macro funds US equity dip-buying.

“We believe that an end to the global economic recession trades currently brewing in the market will require trading on positive surprises, namely on expectations for (1) the withdrawal of the fourth round of tariffs on Chinese goods or the US and China concluding a trade agreement, (2) an emergency rate cut by the Fed of the order of 50-100bp (or an implicit promise to make such a cut in September), or (3) a coordinated fiscal response. The stock market rallies at the end of last week look to have been somewhat motivated by factors (2) and (3) and look to have been macro-driven.”

Nomura says that it is worth noting that global equity markets are in a bit of a nervous phase in which rises and declines can be quite conspicuous, with a seasonal decline in liquidity also coming into the equation.

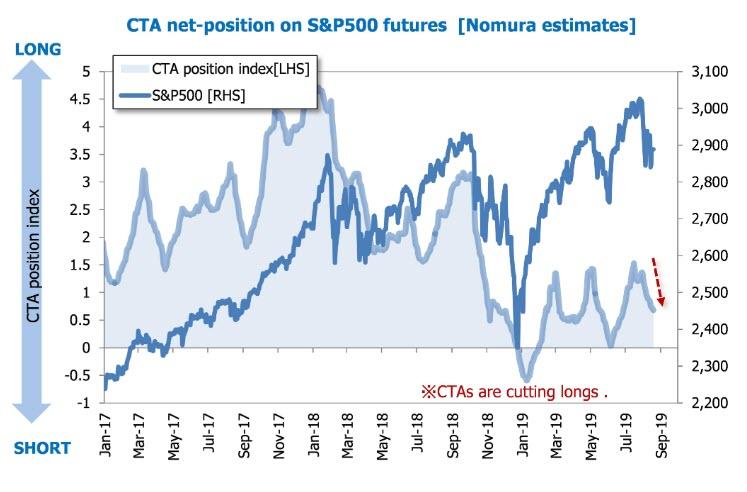

“However, the over-arching situation is that the market jitters resulting from a negative spread between 2-year and 10-year US Treasury yields and signs of economic slowdown in major areas outside of the US are yet to be resolved, and evidence of such can be seen in a slight shift in preference from cyclicals to defensives by long-short funds, and larger short positions in Nikkei 225 futures, Hong Kong Hang Seng futures, and German DAX futures at trend-following CTAs.”

Even assuming that CTAs are swayed to some degree by daily market fluctuations, Nomura believes they have been continuing their net selling of equity futures in major regions.

via ZeroHedge News https://ift.tt/33LVhrW Tyler Durden