Authored by Sven Henrich via NorthmanTrader.com,

The Fed has a math problem and so do markets. Everyone from the president on down is demanding rate cuts, lots of them. “Mid-cycle” adjustment Fed Chair Jay Powell called the July rate cut and it’s bought the Fed precious little as markets sold off in the wake off more trade tensions and yields continued to plummet. And now markets demand more. Lots more. A 50b rate cut appears to be the bare minimum markets demand for September. Call it pricing it in, and the implication is clear: The Fed can’t ill afford to disappoint.

And what markets are currently pricing in is anything but a “mid-cycle” adjustment:

That’s nearly a 100bp rate cut over the next year. President Trump of course wants a 100bp now AND some QE sprinkled on top of that:

…..The Fed Rate, over a fairly short period of time, should be reduced by at least 100 basis points, with perhaps some quantitative easing as well. If that happened, our Economy would be even better, and the World Economy would be greatly and quickly enhanced-good for everyone!

— Donald J. Trump (@realDonaldTrump) August 19, 2019

Leaving a discussion about the economic wisdom of such demands at this time aside for the moment, let’s look at the implications of Mr. Trump’s demand, and, on a longer time frame, the market’s demand for 100bp in rate cuts.

See the problem is the Fed has very limited ammunition vis a vis previous cycles and that fact seems to escape everyone.

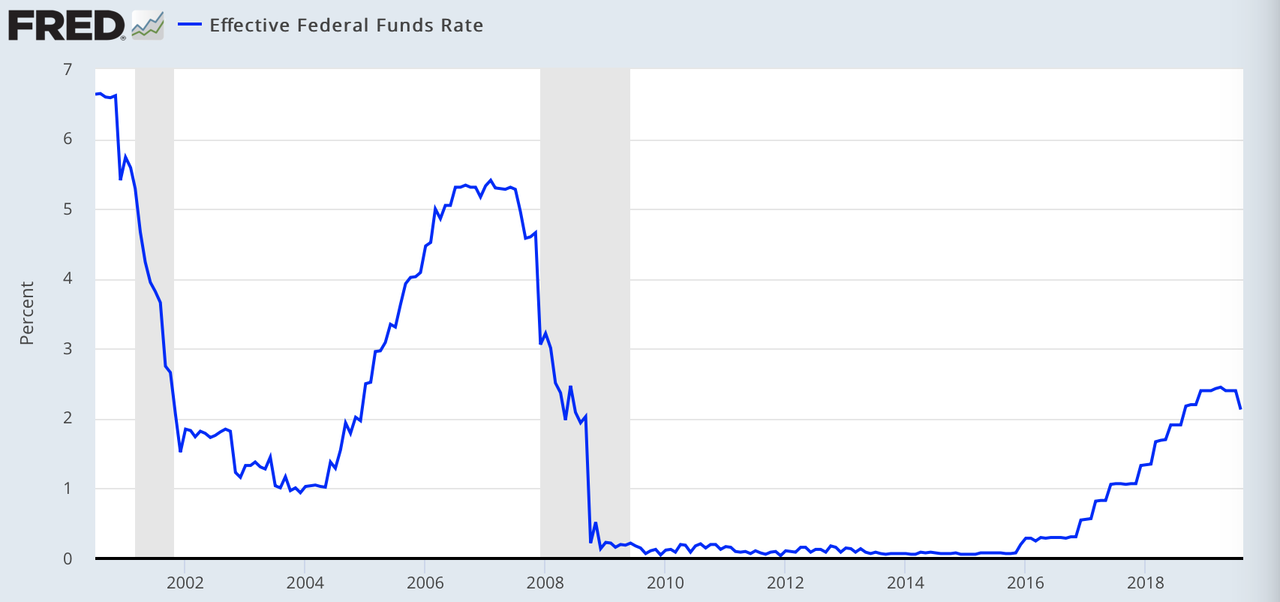

Between December 2015 and December 2018 the Fed raised rates 9 times from zero bound. Historically speaking the weakest rate hiking cycle ever. In 2018 expectations were still high for further rate hikes in 2019. In fact Goldman Sachs had projected 5 rate hikesfor 2019 as late as November of 2018.

Those days are long gone as global yields have collapsed and economic data has continued to show significant slowing. Hence the rate cut in July:

And therein lies the math problem. With one rate cut already under its belt the Fed now only has 8 rate cuts to work with before being right back at zero bound.

Cutting by 50bp in September would leave the Fed with only six 25bp rate cuts to play with. Cutting another 50bp over the next year would leave the Fed with only four 25 bp rate cuts implying the Fed would have given back nearly half of its entire rate raising cycle in just 12 months which took it 3 years to accomplish. Doesn’t sound like a “mid-cycle’ adjustment to me.

For reference: In 2001 the Fed had to embark on a rate cutting cycle of 550bp to stop the unfolding recession. In 2007 it took 500bp. This time the Fed has started its rate cutting cycle from a 225-250bp basis. See when cycles turn in earnest they get angry and demand a lot of Fed handholding.

So I must ask: With such limited ammunition to work with and so much ammunition required to actually stop a cycle turn, why would the Fed waste more rate cuts with markets still near all time highs and unemployment still at 50 year lows? Why risk a 50bp rate cut and be left with only six 25 bp rate cuts in the coffer? Recession risk after all is rising and even Pimco is acknowledging this. Unless the ultimate future is negative rates into the negative 200bp-250bp territory zone, which would imply a full out disastrous crisis, then perhaps markets are expecting way too much from Momma Fed at this stage.

And if this is the case, then markets may be setting themselves up for disappointment. The first test of this thesis will come on Friday during Jay Powell’s Jacksonhole speech. Markets are eagerly awaiting a signal to confirm more aggressive rate cuts. The Fed has a math problem and a market beast that wants to be fed. By the Fed.

Jay Powell can ill afford to disappoint. But there may be another problem lurking. If the Fed goes too aggressive, feeling beholden to markets, it may inadvertently send another signal altogether: Recession risk is real and markets may ultimately not like the sound of that either. Best of luck Jay Powell.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News https://ift.tt/2KHTSLh Tyler Durden