As expected, China’s central bank set its brand new benchmark Loan Prime Rate lower in an attempt to reduce funding costs as the world’s second-largest economy watches its economy slow amid a slowdown in new credit creation and the ongoing trade war with the US. To some, however, it was not low enough.

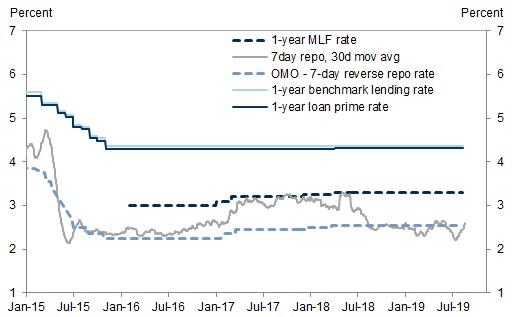

The PBOC on Tuesday set the revamped loan prime rate at 4.25% – just 6 basis points below the previous level wjocj was at 4.31% and also below the previous lending rate of 4.35% – in line with its stated goal of bringing the rate more closely in step with its medium-term lending facility for one-year loans, which stands at 3.3%. However, various banks had expected a more aggressive rate cut: ahead of the fixing, SocGen said that it expects “a de facto reduction of anywhere between 0bp and 100bp in in the new benchmark lending rate next week. If we have to venture a more precise guess, 10bp-25bp looks to be the more likely range to begin with.“

The new benchmark rate, which we dubbed China’s Libor as it is tied is based on input from banks, is more market-driven than the PBoC-set lending rate it is meant to supplant since the one-year medium-term lending facility rate.

As previewed on Monday, when it announced the LPR over the weekend, the PBoC said the new lending benchmark was intended to “deepen reform of interest rate marketisation, improve the efficiency of interest rate transmission and promote reduced financing costs for the real economy.”

As further noted, Beijing is requiring all new bank lending to be benchmarked against the LPR, but existing loans — including Rmb27tn ($3.8tn) in long-term mortgage loans — are exempted. Analysts said that could limit the LPR’s impact.

“The problem is the LPR doesn’t impact deposit rates and it doesn’t help re-price the existing loan stock,” said BofA’s Helen Qiao. As quoted by the FT, she added that the new rate increased uncertainty for businesses accustomed to the stability of China’s longstanding lending and deposit benchmarks, last adjusted in 2015. Qiao said the adjustment to 4.25 per cent for the new LPR was smaller than the 25-basis-point move downward that markets had been expecting.

Under the regime — which is a revamp of the previous LPR that was introduced in 2013 but was largely ignored by banks — a quote will be published on the 20th of every month, collated from submissions by 18 state-owned, commercial and foreign banks that are based on the one-year MLF rate plus a premium.

The central bank’s move is part of an attempt to overhaul and simplify the bank’s monetary policy mechanisms, which currently include open market operations to influence short-term lending rates, as well as longer-term benchmark loan and deposit rates also set by the PBoC. The new lending benchmark should also help lower the cost of borrowing for private companies facing tighter credit conditions and an economic downturn linked to the trade war with the US.

The PBoC now can ostensibly cut the medium-term lending facility rate to which the LPR is linked and direct any margins on top of that lower via verbal guidance to banks, while phasing out benchmark deposit and lending rates. However, as Qiao warned, the new LPR risked being simply another policy signal in an already crowded mix.

There is also the danger that the rate is cut too low: as Nomura analysts wrote, the PBoC’s ability to lower lending rates was “quite limited due to restraints on credit growth as well as banks’ vulnerability”, while rating agency Moody’s said the new LPR mechanism was credit-negative for Chinese banks’ profitability

As Bloomberg’s Mark Cranfield pointed out, China’s stocks – which closed just lower for the day – were underwhelmed with the new prime rate at 4.25%, “as some traders were looking for the rate to be set even lower than the Bloomberg forecast of 4.24%.” As he added, “there is still room for an RRR easing this month, but the big bazooka of a deeper reduction in borrowing costs is still being held back. Equities will need to find positives in other areas to sustain the ebullient mood of the last few sessions.”

via ZeroHedge News https://ift.tt/33MhB4E Tyler Durden