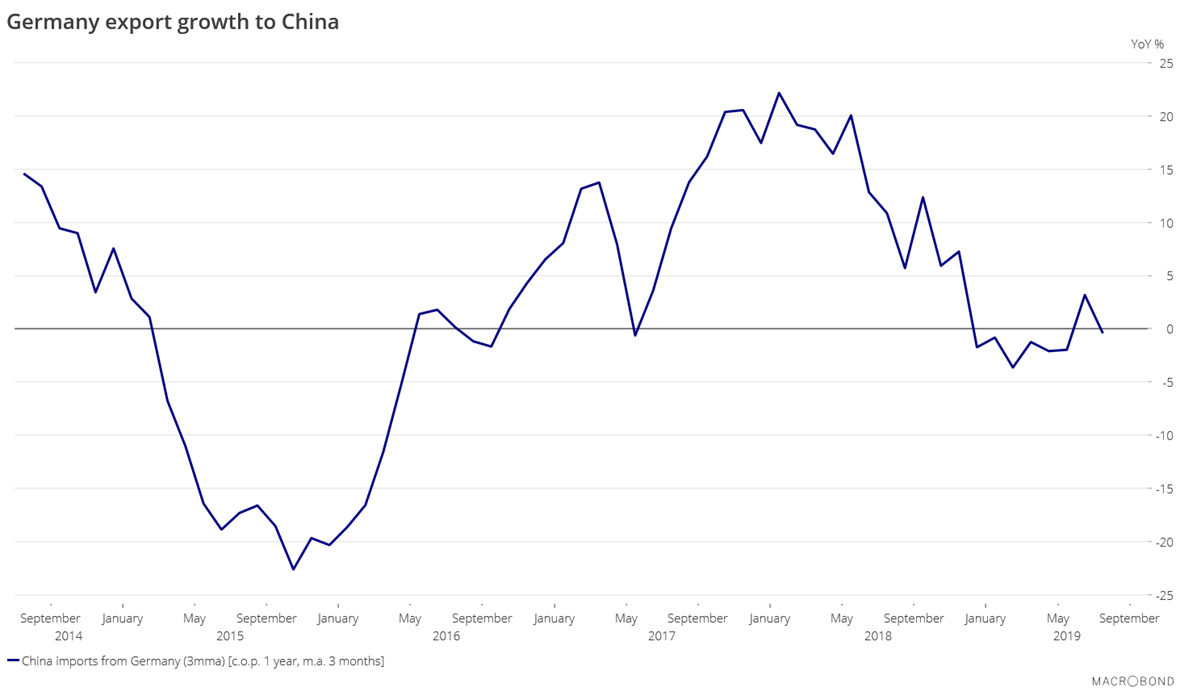

Today, we show you another ugly chart about the German economy. Last week, Destatis confirmed that the economy shrank by 0.1% QoQ in the second quarter and, as Saxobank’s Christopher Cembik points out, based on the very weak start to Q3, especially the latest ZEW, the risk of falling into recession is quite elevated this year.

On the export front, since Q3 2018, Germany has faced the combination of three negative waves:

-

credit crunch in Turkey,

-

risks related to Brexit and,

-

more importantly, slowdown in China that affects directly the key local car market.

After a short-lived rebound in June, China’s imports from Germany has again entered in negative territory in July.

Source: Saxobank

We use the 3-month moving average to track imports in order to avoid too much short-term volatility. China’s imports from Germany are down 0.4% YoY last month.

Given the most up-to-date data about the car sector, China’s economy and global trade, there is no reason at that point to expect a rebound that could help the German economy. What is even more worrying is that Germany’s domestic demand, which has been quite resilient over the past quarters, starts to be negatively impacted by the industrial slump.

We expect in coming weeks a very heated debate over fiscal stimulus in Germany.

Financial conditions are very accommodative – Germany’s yield curve is at the flattest level since the financial crisis – but solutions to restart growth engine will be trickier to find than in 2008 as the country’s slowdown is also deeply linked to structural challenges.

Thus, a typical Keynesian stimulus package, based on temporary VAT reduction along with other tax exemptions, will only be able to bring short-term relief. It won’t be enough to tackle lack of digitization, infrastructure and increase in the long-run growth potential. A long-term strategy that may include green investments is needed for the German economic model to revive.

via ZeroHedge News https://ift.tt/2Z1O0FD Tyler Durden