Despite a headline beat (juiced by huge and volatile surges in defense and non-defense aircraft orders), core durable goods orders disappointed and capital goods shipments (ex-Air) slumped by the most since Oct 2016.

Durable Goods Orders rose 2.1% MoM (well above the 1.2% rise expected) and YoY, durable goods rebounded into the positive…

Source: Bloomberg

Much of the surprise was driven by gains in aircraft orders:

-

nondefense aircraft and parts new orders +47.8%

-

defense aircraft and parts new orders +34.4%

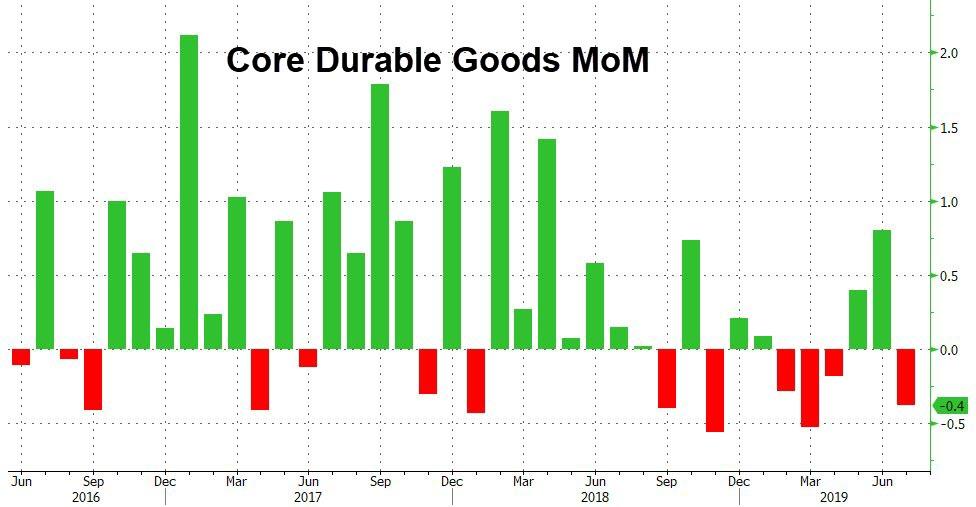

But core durable goods orders disappointed (falling 0.4% MoM against expectations of no change)…

Source: Bloomberg

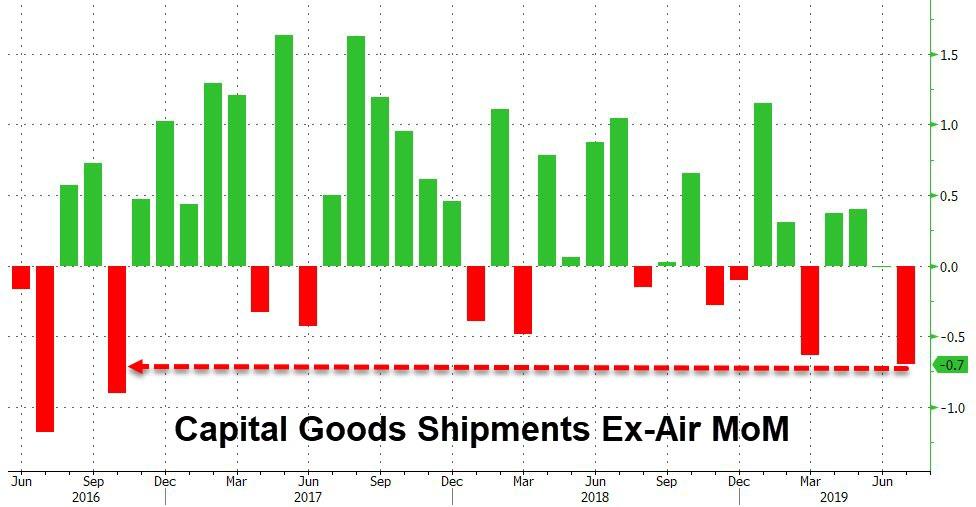

And moreover, shipments (ex-Air) fell by 0.7% MoM – the biggest drop since Oct 2016…

Source: Bloomberg

The slump in sales of equipment suggests American businesses remained cautious about capital spending ahead of this month’s escalation of the U.S.-China trade war.

The report compares with recent data that signal further cracks in the manufacturing sector. Markit’s PMI posted its first contraction since 2009, and the Kansas City Fed’s factory gauge shrank.

via ZeroHedge News https://ift.tt/2ZsdLOB Tyler Durden